Join Our Telegram channel to stay up to date on breaking news coverage

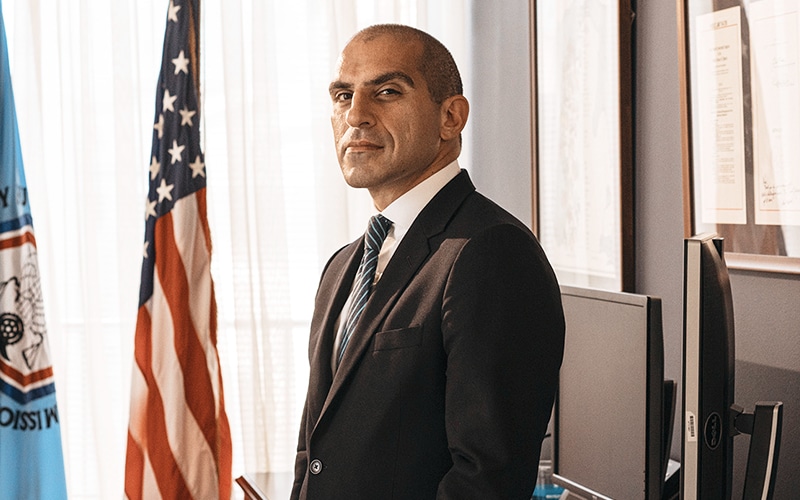

The US regulators continue to claim the rights to control the crypto industry, as the country has not yet decided which of them can claim the digital asset sector as part of their own jurisdiction, nor has it created a new regulatory body specifically for crypto. In the latest attempts to make his claim, the CFTC Chair, Rostin Behnam, used the new Senate Agricultural hearing to say that Ether and stablecoins are commodities.

CFTC chair repeats his claims of Ether being a commodity

The hearing, which took place yesterday, March 8th, saw one of the Senators, Kirsten Gillibrand, inquiring about the different views held by the different regulatory bodies on the matter of crypto. Specifically, the Senator wanted to know what was different between the SEC’s view and CFTC’s view on the matter. The question came after CFTC’s 2021 settlement with Tether, the crypto world’s leading stablecoin issuer.

The CFTC chair replied that,

Notwithstanding a regulatory framework around stablecoins, they’re going to be commodities in my view.

He further noted that the CFTC’s enforcement team found it rather clear that Tether (USDT) was a commodity. The CFTC has been making similar claims for years for specific assets, primarily Bitcoin, Ether, and Tether. One example came back in mid-December 2022, in the regulator’s lawsuit against Sam Bankman-Fried, the founder of FTX, in light of its collapse one month earlier.

According to the CFTC, as per their filing today, ETH is a commodity. This really should put any security designation to rest. pic.twitter.com/PkHWredNK4

— Hal Press (@NorthRockLP) December 13, 2022

Many who strongly oppose the SEC’s stance that “everything apart from Bitcoin is a security” have expressed interest in the CFTC chairman’s claim.

This is a pretty stark (almost impassioned?) rebuke of the ‘everything except BTC is a security’ and ‘stablecoins are securities’ positions. Would be great if the CFTC released the legal analysis on these issues Chairman Behnam says it did. https://t.co/RIeTgUxTFd pic.twitter.com/LGtuEPs4X3

— Lawtoshi (@lawtoshi) March 8, 2023

CFTC is risking too much to allow itself to be wrong

After he was asked to provide evidence that would support the CFTC’s claim, Behnam stated that the very fact that Ether futures products are allowed on CFTC exchanges supports the regulator’s claim. He insisted that the CFTC strongly feels that ETH is a commodity asset, adding that there are things like litigation risks, agency credibility risk, and more — all of which is on the line. The regulator would not have taken these risks without serious legal defenses that are supporting its argument.

Interestingly, Behnam left out Ether during the invite-only event at Princeton University in November, when he spoke on the topic, claiming that Bitcoin is the only crypto that can be viewed as a commodity. However, a month before that, he said that Ethereum could be considered a commodity as well. Now, several months after leaving out ETH, he once again claims strongly that it is a commodity, leading to the conclusion that the CFTC chair’s opinion on the asset’s classification is somewhat wavering.

His recent comments also completely oppose the SEC Chair, Gary Gensler. Gensler is sticking to his statement that everything except for BTC is a security — a claim that has led many crypto lawyers to rebuff it time and time again. But, for the time being, the conflict between the regulators remains unresolved.

Related

- CFTC chair advocates for restructuring for better regulations

- CFTC files a lawsuit on fraud involving $1.7 billion Bitcoin

- CFTC sues Ohio man over crypto Ponzi scheme

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage