Join Our Telegram channel to stay up to date on breaking news coverage

During a discussion at Bitcoin 2023, Jameson Lopp, co-founder and chief technology officer at Casa, a Bitcoin wallet provider, shared insights into the rising desire among individuals to have complete autonomy over their Ethereum assets.

Lopp emphasized Casa’s obligation to accommodate Ethereum support in response to the expanding community of users seeking such solutions.

Casa Explores Ethereum Support and Secure Self-Custody Solutions

Events like the collapse of FTX in 2022 have brought attention to the importance of securely storing Ethereum and its associated tokens, including stablecoins. Lopp shared that Casa had encountered clients who suffered losses because they lacked a distributed cold-storage setup, resulting in the disappearance of stablecoins and other assets.

1) Today @CasaHODL is excited to announce an expansion in our self-sovereignty as a service offering. We’re bringing our best-in-class user experience to cold storage for ETH holders.

— Jameson Lopp (@lopp) November 30, 2022

In response to this challenge, Casa made the decision to announce Ethereum support in December. Despite facing criticism from Bitcoin enthusiasts on social media, the company proceeded with the plan to meet the demands of its clients.

Lopp recognized that numerous individuals perceive self-custody as daunting due to the perceived intricacy of the security protocols involved. Although the initial steps of creating a wallet and initiating cryptocurrency transfers are relatively uncomplicated, the adoption and implementation of adequate security measures can present difficulties for individuals.

He reassured users that Casa’s software incorporates best practices directly into the product, enabling users to follow clear instructions and minimizing the risk of catastrophic losses resulting from human error.

Lopp characterized Casa’s offering as a “rigorous cold-storage system with distributed keys,” originally intended for affluent individuals who were prepared to invest $10,000 per year for custody services. Nevertheless, Casa has broadened its product lineup to encompass a free version that provides limited functionalities, with the objective of appealing to a wider spectrum of users.

The concept of self-custody in the cryptocurrency space traces its roots back to the first Bitcoin wallet, BitcoinQT, developed by Satoshi Nakamoto. Despite the growth of the crypto user base, many individuals still opt to store their assets on centralized exchanges, disregarding warnings from experts about the associated risks.

To address this situation, wallet providers are actively exploring new technologies that simplify the process of self-custody. By offering user-friendly solutions, they hope to encourage more individuals to take control of their cryptocurrency assets and reduce their reliance on centralized platforms.

Ethereum Staking Trends – Shapella Success, Growing Staked Assets, and Yield Potential

The recent Shapella upgrade of Ethereum has sparked considerable interest among both institutional and retail investors due to its groundbreaking feature allowing the withdrawal of staked ETH tokens.

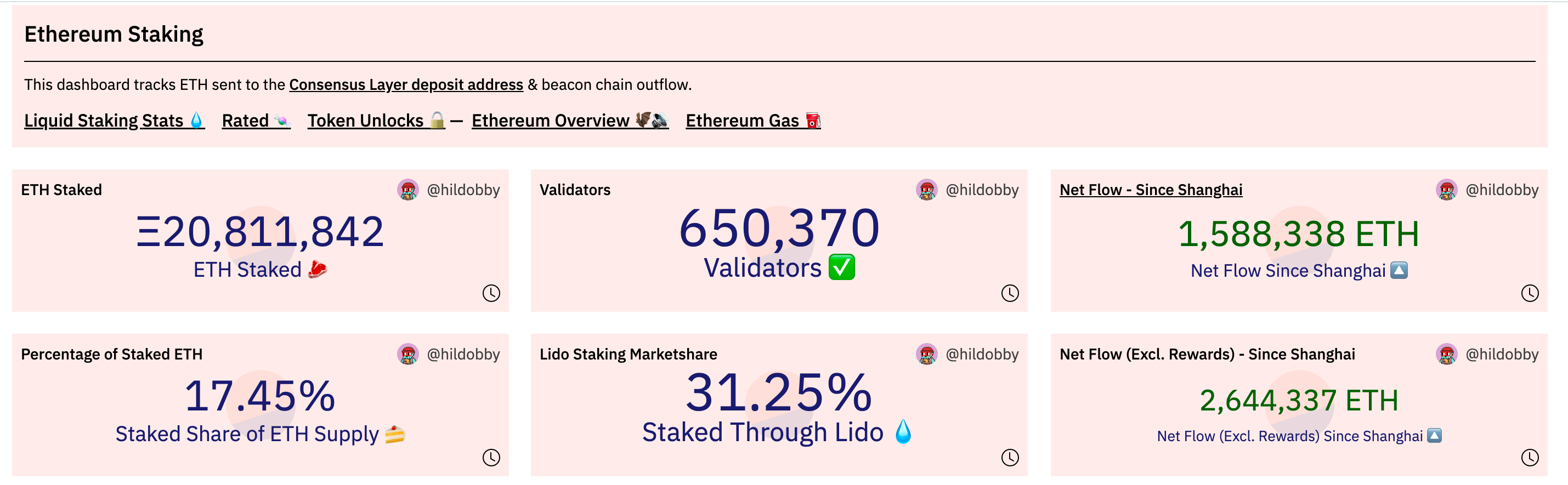

Despite initial concerns of a potential sell-off, the impact on price was relatively subdued, and the network experienced a gradual decrease in exit activity within a few weeks. Notably, the total amount of staked ETH has now surged to an unprecedented level of 20.8 million tokens, with Lido Protocol emerging as the leading contributor with a substantial deposit of 6.2 million tokens.

When it comes to staking, Ethereum’s current ratio stands at 17.45%, indicating the proportion of eligible supply that is staked. However, in comparison to certain competing proof-of-stake (PoS) chains boasting staking ratios surpassing 60%, Ethereum’s ratio appears relatively modest. This observation signals the untapped potential for significant growth in staking participation within the Ethereum network.

In the next year, the staking ratio could potentially double, driven by the strong inflow of capital into liquid staking projects such as Lido and Rocket Pool. Moreover, centralized exchanges, including Giottus, now offer staking services with attractive annual percentage yields (APY) ranging from 5% to 7%, which may attract retail investors.

In addition to the potential for capital appreciation, staked ETH provides an attractive yield compared to traditional bank deposits. As interest rates are expected to decline in the near term, Ethereum staking emerges as a viable alternative for earning attractive rewards while benefiting from the growth potential of the asset itself.

Ethereum shares its earnings with validators, and recent phenomena like the memecoin frenzy resulted in validators gaining over 20,000 ETH in the last week alone.

The success of Ethereum staking platforms has not gone unnoticed, as evidenced by the significant gains in the tokens of top platforms like Lido DAO (LDO) and Rocket Pool (RPL), even in a sideways market. The growing interest in the market is further illustrated by Asymmetry Finance’s recent $3 million raise to expand its market share.

However, concerns linger regarding potential regulatory crackdowns. The US Securities and Exchange Commission (SEC) recently penalized Kraken with a $30 million fine for offering staking services without proper registration.

Coinbase, another major player, has temporarily paused withdrawals of staked ETH, leading to apprehension among investors. It is important to consider these regulatory risks alongside short-term macroeconomic risks when deciding to stake ETH.

For those who believe in Ethereum and its ecosystem, investing in the asset or building an ETH-heavy portfolio may be a consideration. Staking ETH can provide stable rewards while waiting for the asset to appreciate in value over the coming years. Nonetheless, it is essential to stay mindful of both short-term economic factors and regulatory developments, which have become a frequent occurrence in the crypto landscape.

As the Ethereum network continues to evolve and attract more participants, monitoring these trends and understanding the potential implications will be crucial for investors and enthusiasts alike.

Ethereum Struggles with Crucial Resistance at $1,840 Level – What Should Investors Expect?

Currently, Ethereum is encountering multiple hurdles near the crucial $1,840 resistance level against the US Dollar. The price remains below $1,810 and the 100-hourly Simple Moving Average, indicating a challenging situation.

On the hourly chart of ETH/USD, a significant bearish trend line is taking shape, with resistance near $1,805. To regain bullish momentum, Ethereum needs to surpass the barriers at $1,825 and $1,840.

Despite struggling to break through resistance levels at $1,840 and $1,850, Ethereum remains in a consolidation phase, similar to Bitcoin. It has managed to stay above the $1,785 support level, with a recent low of $1,791.

Currently, Ethereum is gradually recovering and moving upward, surpassing the 23.6% Fibonacci retracement level. Immediate resistance is expected near the trend line zone, followed by $1,810 and the 100-hourly Simple Moving Average.

If these barriers are overcome, Ethereum may experience a potential rise towards $1,920 and $2,000. However, failure to breach the $1,810 resistance could result in a further downward movement towards support levels at $1,785, $1,770, and possibly $1,720 and $1,700.

Read More:

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage