Join Our Telegram channel to stay up to date on breaking news coverage

Bitcoin (BTC) Price Prediction – January 29

Bitcoin (BTC) is seen struggling to beat $34,000, currently down with 3.28% as the coin got rejected once again.

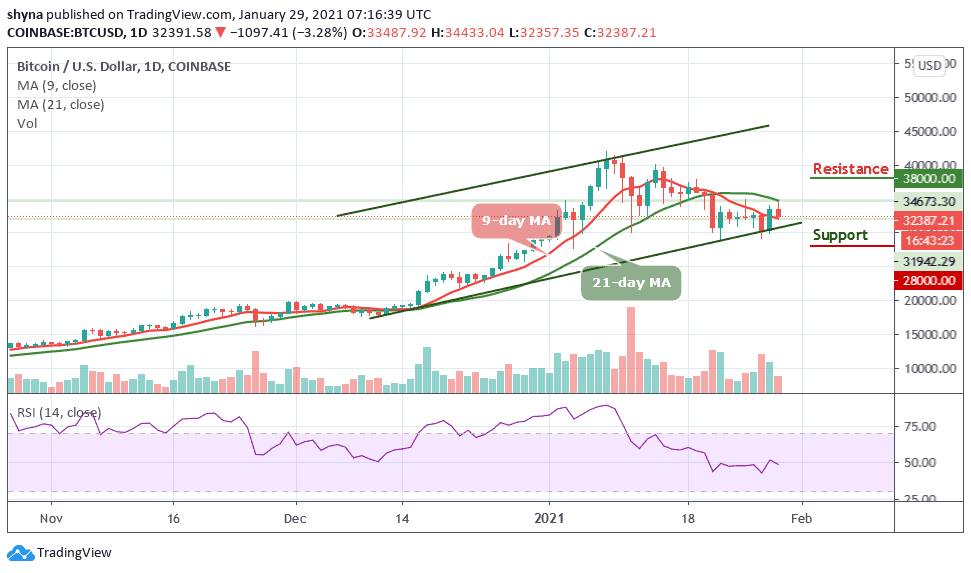

BTC/USD Long-term Trend: Bullish (Daily Chart)

Key levels:

Resistance Levels: $38,000, $40,000, $42,000

Support Levels: $28,000, $26,000, $24,000

It is very important for BTC/USD to reclaim the ground above $34,000 as soon as possible, the reason being that more action is expected above this level. However, the longer Bitcoin (BTC) stays under $32,000, the stronger the bears get. Therefore, the support at $31,000 may not be enough to hold the intense pressure. In this case, BTC could refresh lows towards $30,000.

Would Bitcoin Cash Go up or Down?

In the meantime, consolidation is likely to take precedence with support at $29,000, holding well. The technical indicator RSI (14) also puts emphasis on the possible downtrend action as the signal lines below 50-level. More so, the same situation is reflected in the moving averages as the green-line of 21-day MA is still above the red-line of 9-MA.

However, the next few days could be extremely crucial for Bitcoin. If BTC price fails to break above the moving averages in the next five days, the market price may move back below the $35,000 mark or it may just sit between the $33,000 – $35,000 price range. However, the resistance levels to keep eye on are $38,000, $40,000, and $42,000 while the supports are located at $28,000, $26,000, and $24,000 respectively

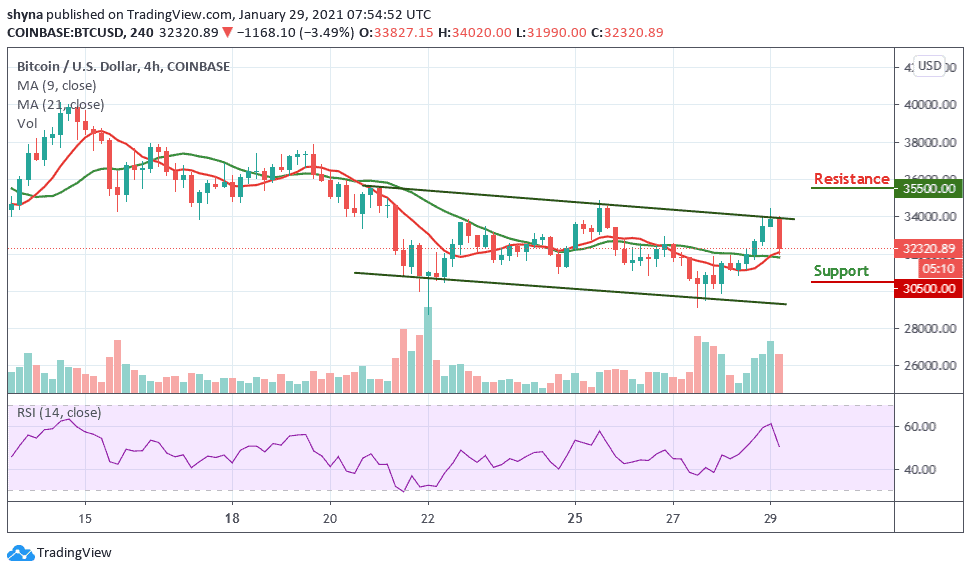

BTC/USD Medium – Term Trend: Bearish (4H Chart)

According to the 4-hour chart, BTC/USD is seen on a downward move and the coin may continue to depreciate if the $32,000 support is broken. The 9-day MA is seen crossing above the 21-day MA, if this fails, BTC/USD may likely fall and reach the critical supports at $30,500, $29,500, and $28,500 respectively. Meanwhile, the technical indicator RSI (14) is likely to move below the 50-level, which may cause more downtrends in the market.

Meanwhile, if the bulls can hold the current price tight, BTC/USD may continue to trade above the moving averages, crossing above the upper boundary of the channel may push the market price towards the potential resistance at $35,500, $36,500, and $37,500 levels.

Join Our Telegram channel to stay up to date on breaking news coverage