Join Our Telegram channel to stay up to date on breaking news coverage

Bitcoin Price Prediction (BTC) – September 23

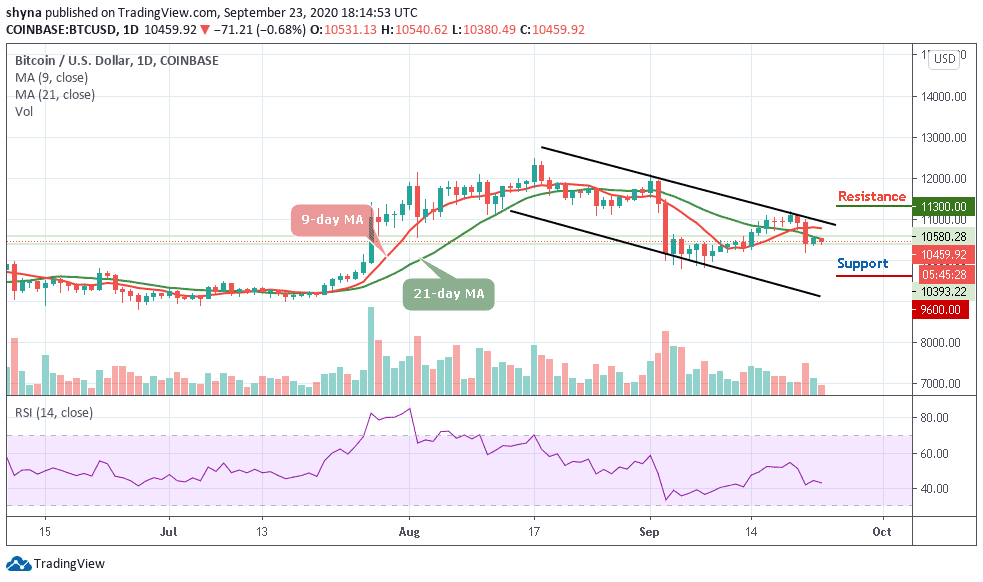

The price of Bitcoin is currently hovering at $10,459, right below a crucial support level at $10,500.

BTC/USD Long-term Trend: Bearish (Daily Chart)

Key levels:

Resistance Levels: $11,300, $11,500 $11,700

Support Levels: $9,600, $9,400, $9,200

BTC/USD may continue to face a setback for now; although this may not be a permanent one as the coin is likely to have a bullish run in the short-term. Currently, Bitcoin (BTC) is trading around $10,274 level after a free fall from $10,540. The coin remains below the 9-day and 21-day moving averages for a couple of days ago.

What is the Next Direction for Bitcoin?

As of now, BTC/USD may continue to fall again as the key support is becoming a threat to the bears. There are quite a number of technical levels clustered above the current price which means that the coin may be vulnerable to further losses at least as long as it stays below the critical $10,500. BTC/USD pair may drop to $9,600, $9,400, and $9,200 supports if the $10,000 support fails to hold.

In the opposite direction, if the critical support continues to provide support for the market, the Bitcoin price may come back to a resistance level of $10,700 before it experiences a rise above the moving averages and the channel formation to reach the potential resistance levels at $11,300, $11,500, and $11,700 respectively. Presently, BTC is down and there is a high chance for a break than a bounce. The RSI (14) is likely to cross below 40-level, a further drop may cause the Bitcoin price to fall more.

BTC/USD Medium-Term Trend: Bearish (4H Chart)

According to the 4-hour chart, the bears have dominated the market and the price is dropping below the 9-day moving average heading towards the south. However, if the price breaks below the lower boundary of the channel, the support levels of $10,000 and below may come into play.

However, as RSI (14) moves into the oversold zone, BTC/USD may remain at the downside but if it finds its way back to the top, the buyers could have gathered enough momentum to fuel the market and they may likely push the price above the moving average where it could hit the targeted resistance level of $10,735 and above.

Join Our Telegram channel to stay up to date on breaking news coverage