Join Our Telegram channel to stay up to date on breaking news coverage

There are now 116 publicly traded firms with Bitcoin in their treasuries, with corporate holdings approaching $85 billion. This increase results from rising institutional acceptance and trust in Bitcoin as a tactical asset.

Are you trying to find the most promising altcoins to watch on June 8th? Knowing which cryptocurrency projects are gaining traction can give you a competitive advantage, regardless of your experience level. Understanding the intersection of innovation, solid fundamentals, and long-term potential is crucial, given how quickly the industry changes.

6 Best Altcoins to Watch Today

This article examines the six best altcoins to watch today, exhibiting new growth, relevance, and technological significance: Uniswap, Qtum, Helium, and Bittensor. Can these coins transform industries like DeFi, AI, and decentralized wireless infrastructure? Could these be hidden jewels that are underappreciated?

1. Uniswap (UNI)

In November 2018, Uniswap emerged as a groundbreaking Ethereum-based decentralized exchange (DEX), eschewing conventional order books in favor of an automated market maker (AMM) approach powered by smart contracts.

The fundamental issue UNI addresses is straightforward yet effective: it removes intermediaries, such as centralized exchanges, by allowing users to trade tokens straight from their wallets, while liquidity providers profit by making contributions to on-chain pools.

By issuing about 30 million new UNI annually and allowing for 4.97 percent annual inflation, it strikes a compromise between encouraging ongoing governance engagement and avoiding a significant diluting effect on value. However, if token demand doesn’t increase simultaneously, any rise in issues could negatively impact pricing.

Speed matters

Almost all swaps with UniswapX fill in 1 block 🫣 pic.twitter.com/UhTJg9x8MS

— Uniswap Labs 🦄 (@Uniswap) June 5, 2025

Developed to provide lightning-fast, inexpensive cross-chain swaps, it has the support of more than 80 key DeFi players, including Circle, Coinbase, Lido, and Morpho, in addition to Flashbots’ expertise. The technology offers faster user experiences and 200–250 ms block times.

2. Qtum (QTUM)

Qtum initially surfaced in March 2017 as a link between Ethereum’s smart contracts and Bitcoin’s safe UTXO mechanism. By combining Ethereum’s programmable flexibility with Bitcoin’s tried-and-true stability, it aimed to create a lightweight, portable blockchain that could be used in mobile and business settings.

Qtum just released an improved mobile wallet that streamlines DeFi access while increasing security and transaction speeds. Although performance can occasionally be slowed by excessive network usage, early assessments recommend the interface.

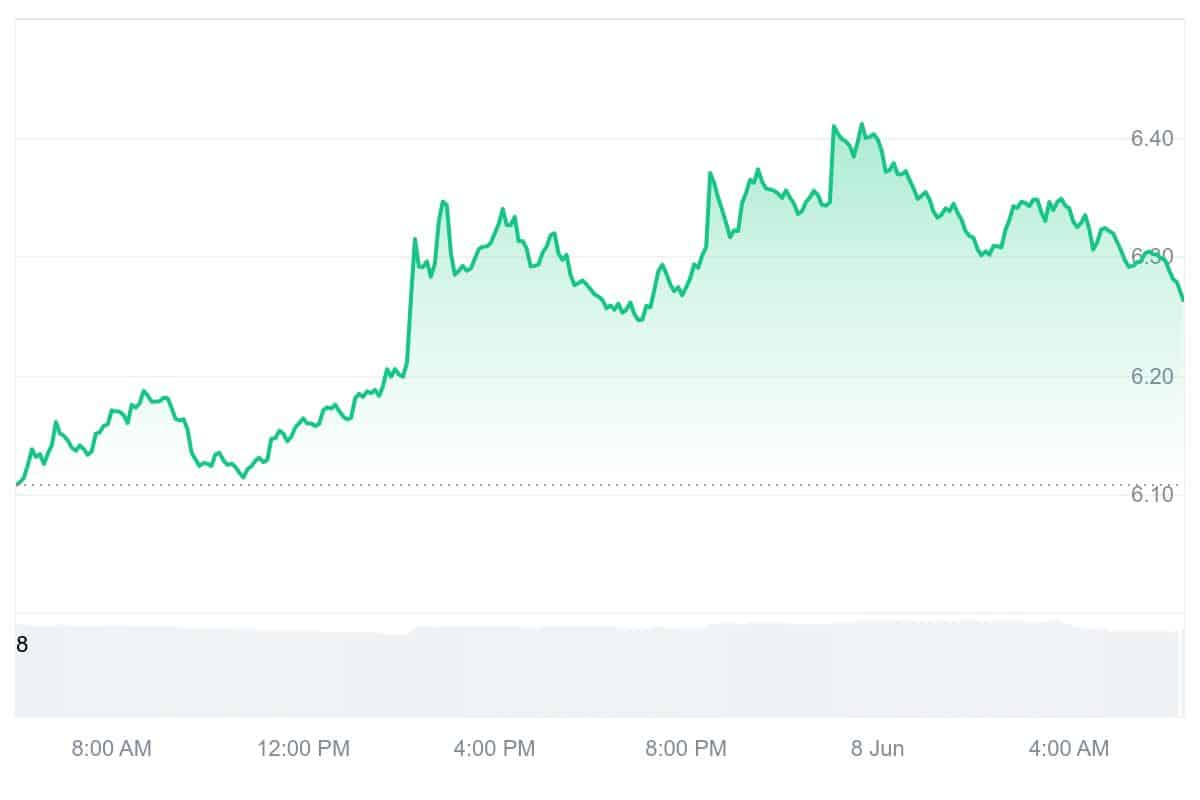

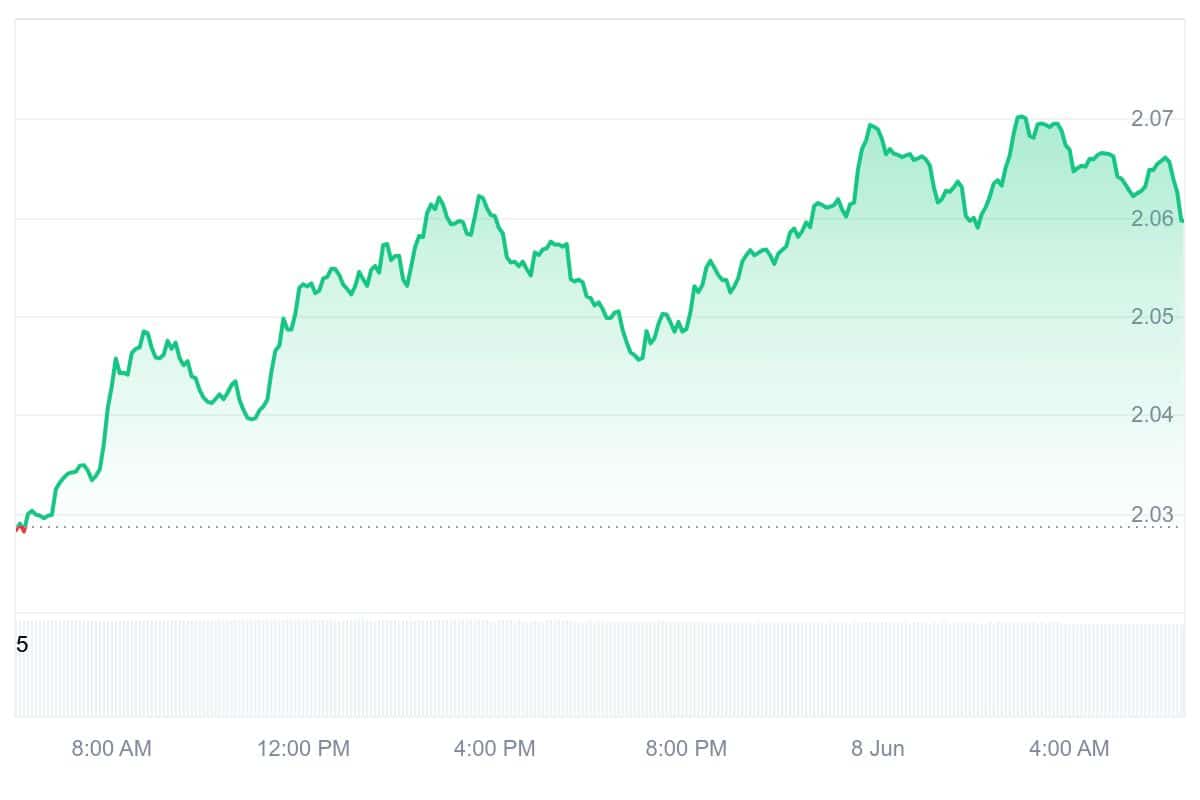

With the Fear & Greed Index lingering around 52, the present emotion is neutral to bearish; however, slight recovery indicators, such as a ~3% increase in the last day and a rise of more than 3.5 percent in the previous week, point to underlying stability. Mid-May historical highs around $2.71 subtly suggest resistance and recent consolidation around $2.00–2.10 could provide a new base.

Ready to dive into the world of Qtum? Qtum has been leading the charge since 2017, and is accessible on a multitude of exchanges and wallets. Empower your projects with our trusted technology! Visit our site and get started! pic.twitter.com/a46Eyn0yo6

— Qtum (@qtum) May 30, 2025

It has just begun investigating partnerships in the payment and blockchain integration domains. The wallet overhaul hinted at deeper connections with DeFi systems, and the payment alliance indicates that practical use cases might soon be realized.

3. Helium (HNT)

Helium is a daring answer to a practical technological problem: linking smart devices without the need for costly infrastructure or invasive, centralized networks. With the help of ordinary folks who install solar-powered hotspots in their homes or places of business, Helium seeks to create “The People’s Network,” a global, community-driven wireless network.

Token dynamics were made simpler by governance in March 2025, when HNT consolidation replaced sub-tokens. In April 2025, Helium (now known as Nova Labs) reached a favorable, no-admit settlement with the SEC for $200k, resolving issues related to unregistered securities.

From community-built to Capitol Hill.@SarahAberg1 proud to rep @helium at the first DePIN fly-in, showing policymakers what the future of infrastructure really looks like.

Powered by @solana. 🎈 https://t.co/S0SkAOV2Ah pic.twitter.com/03FLAa1K5n

— Helium🎈 (@helium) June 5, 2025

Given a market value of about $540 million, HNT suggests a thriving community and actual infrastructure, with more than half a million hotspots worldwide being incentivized through HNT mining. Nonetheless, the bearish attitude, which is shown by a comparatively high Fear & Greed index of 62 (“Greed”), implies that investors perceive opportunity but exercise caution.

With the support of Andreessen Horowitz and Tiger Global, they raised $200 million (Series D) at a $1.2 billion valuation in 2022, demonstrating that institutional confidence views Helium as a future-of-networking play and one of the six best altcoins to watch today.

4. Bittensor (TAO)

Today, tech giants like OpenAI, Google, and Microsoft control a large portion of the centralized AI development process. These companies house influential models behind closed doors, limiting access and eliminating innovation. By developing a peer-to-peer marketplace where anybody may contribute compute power or AI models and be compensated for their value, Bittensor completely upends that paradigm. This is known as “decentralized AI.”

It uses YUMA, a consensus technique that rewards miners and validators proportionately based on how well AI results are evaluated. Consider a science fair where users (miners) submit models to solve subnetwork challenges, and judges (validators) select the best solutions. TAO is awarded to the victors, establishing competitive incentives for further development.

Wrapped TAO (wTAO) Airdrop is LIVE

$1,498,378 in wTAO tokens for our community.

2 years of bridging Bittensor's neural network to Ethereum – proven, tested, secure.

Claim your wTAO: https://t.co/fHKi1b4iQ9

Join the established decentralized AI ecosystem#TAO #ETH… pic.twitter.com/se5p5sGWeW

— Bittensor (@bittensor_) June 3, 2025

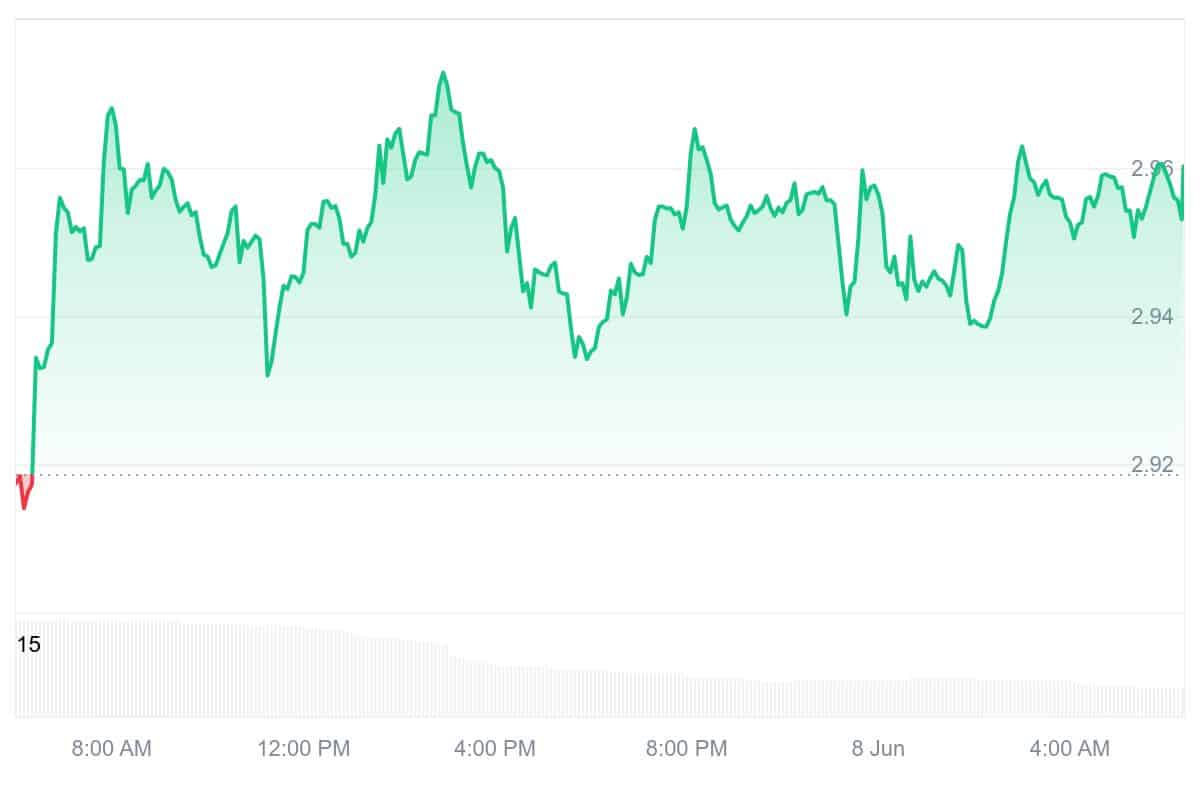

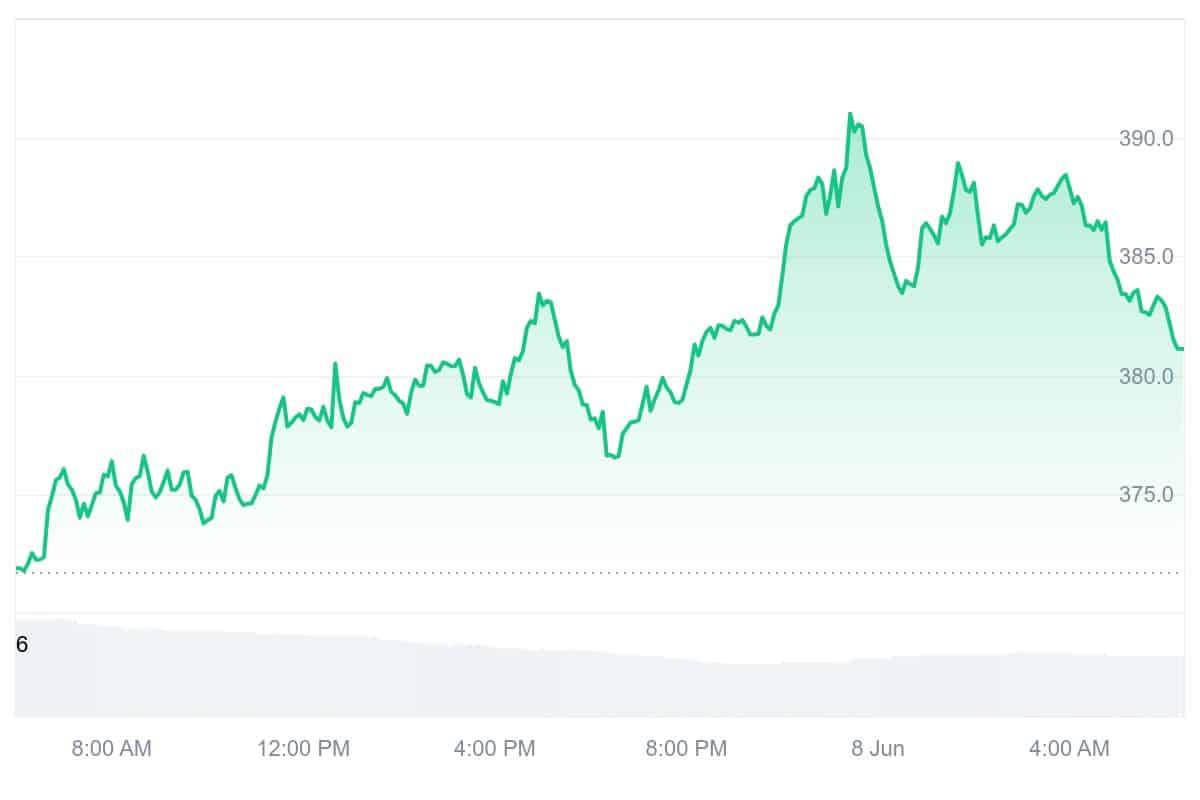

Analysts are observing resistance around $400 and support zones close to $350 as TAO continues to trade solidly between $350 and $400. A slight decline to about $272 is anticipated in early June, followed by a possible recovery, indicating short-term volatility.

Large investors supporting the coin include Coinbase Ventures, Pantera, NGC Ventures, DCG, and Polychain Capital; these companies operate fund subnets or validators. This isn’t just a grassroots initiative; major infrastructure and financial companies support the project as it creates decentralized artificial intelligence networks.

5. Snorter Token (SNORT)

Snorter Token is a wild-card memecoin on the Base network that generates a lot of buzz, and it’s no wonder, given its humorous branding and early-stage enthusiasm. With its special entrance pricing, Snorter is currently enthralling investors in its presale and appealing to FOMO, the fear of missing out on the next big cryptocurrency craze.

Investors are mostly drawn to SNORT because of its defiant mascot appeal and potential for virality. Due to their widespread appeal rather than technical complexity, projects adopting memetic culture frequently outperform traditional tokens.

SNORT asserts its position in this frantic period of cryptocurrency hysteria with audacious humor, an engaging presale structure, and the ability to ignite a viral firestorm. If you’re looking for that thrilling early-stage rush, prepare yourself for an exciting ride. SNORT is a story worth seeing.

6. StarkNet (STRK)

Based on STARK cryptography, StarkNet is essentially a zero-knowledge (ZK) rollup that condenses thousands of transactions into a single proof sent to Ethereum. This approach maintains Ethereum’s trust guarantees while offering significantly reduced gas costs, faster throughput, and resistance against quantum assaults.

According to Ethereum co-founder Vitalik Buterin, StarkNet recently achieved the crucial Stage 1 decentralization milestone. By removing numerous “training wheels,” this change makes it possible to implement censorship resistance, a multi-sig security council, and sequencer delay protections, all of which are essential components of trustless infrastructure.

USDC on Bitcoin.

Available right now via @XverseApp and @dot_swap.

Powered by Starknet.pic.twitter.com/ZO984ALiKA

— Starknet 🐺🐱 (@Starknet) June 5, 2025

With little under $630 million in total value locked (TVL), it now surpasses competitors such as zkSync in this criteria, leading all ZK rollups. StarkWare’s plan calls for complete Stage 2 decentralization by early 2026 and the eventual integration of Bitcoin execution, an aspiring cross-chain trajectory.

The StarkNet Foundation conducted one of the biggest cryptocurrency airdrops earlier this year, distributing 700 million STRK across over 1.3 million wallets. This led to a spike in staking, governance activity, and new dApp deployments.

Learn More

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage