Join Our Telegram channel to stay up to date on breaking news coverage

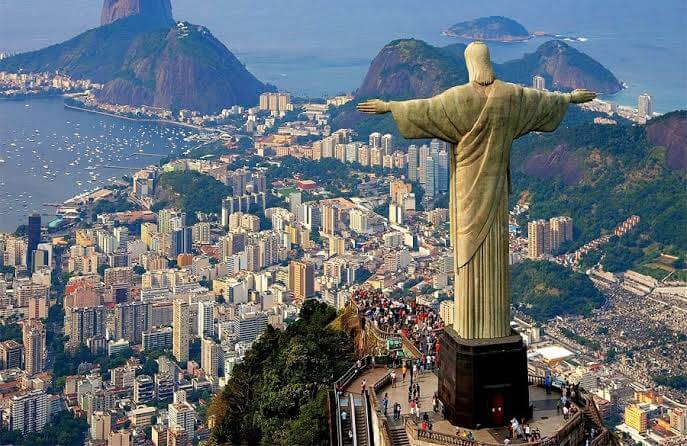

The craze for Central Bank Digital Currencies (CBDCs) is currently at fever-pitch, with more countries leaning into the idea of launching state-backed digital assets. Brazil is the latest in the line of countries to show a propensity for digitizing its currency. Facing an economic downturn, the government is now turning towards the possibility of a CBDC.

Save Money by Not Printing It

This week, Banco Central do Brasil announced the creation of a dedicated group to study the crypto industry and the possibilities of a state-backed asset. Per a formal statement, the team will consist of 12 members, all exploring a potential CBDC and its impact on both the country’s digital payments system and its economy.

Brazil’s CBDC focus appears to have been born out of a need to save money. According to data, the country spends about 90 billion reals ($16 billion) annually to generate a supply of paper money. Essentially, it spends 1 to 2 percent of its Gross Domestic Product on printing and circulating cash alone.

This new intergovernmental group will examine how CNDCs can help save money, as well as some other benefits that it could bring to the Brazilian economy.

“The subject of digital currencies addressed by central banks has been on the research agenda of many central banks for some time. However, this year, there was a greater focus on a more practical approach,” said Rafael Sarres de Almeida, an official from the central bank’s Information Technology Department.

The Fear of China

Sarres also added that the central bank had seen progress from several other countries on the CBDC front. Thus, Brazil will need to join the fold and not get left behind. The IT official specifically pointed out China, the global leader as far as CBDC research is concerned.

China’s work towards a digital yuan has been one of the crypto industry’s most closely-watched stories in 2020. Ever since President Xi Jinping announced that the country would embrace blockchain, several progress reports have been made to digitize its currency.

Two weeks ago, the Wall Street Journal reported that the Peoples’ Bank of China had expanded tests for the digital yuan to Hong Kong’s Greater Bay Area. The region, which includes locations like Shenzhen and Macau, has a GDP of $1.5 trillion and is a financial hotspot. Along with China’s mainland, the Bay Area’s inclusion could give China’s digital asset a significant capital base.

Sun Guofeng, the head of the monetary policy department at the Peoples’ Bank, also told Reuters this week that the government was working towards launching the asset in the next two years.

So far, China’s digital asset efforts have been the most significant catalyst for other countries to explore CBDCs. Currently, Jamaica, Japan, England, and France all have tests running on potential CBDC efforts. Most of them have done so to mount some defense against the digital yuan and its potential to overrun the global financial system.

While the United States is yet to take definitive action on the topic, the fear of China has been reason enough for others to take CBDCs seriously.

Join Our Telegram channel to stay up to date on breaking news coverage