Join Our Telegram channel to stay up to date on breaking news coverage

BlackRock’s spot Bitcoin exchange-traded fund (ETF) was listed on the Depository Trust & Clearing Corporation (DTCC), moving it a step closer to regulatory approval and sending Bitcoin into orbit.

“Hard not to view this as them getting the signal that approval is certain/imminent,” tweeted Bloomberg Intelligence analysts Eric Balchunas. “Def notable BlackRock is leading charge on these logistics (seeding, ticker, DTCC) that tend to happen just prior to launch.”

BlackRock’s iShares Bitcoin Trust is the first ETF to feature on DTCC, which Balchunas said is a strong indicator of BlackRock’s confidence in the ETF’s imminent approval.

The iShares Bitcoin Trust has been listed on the DTCC (Depository Trust & Clearing Corporation, which clears NASDAQ trades). And the ticker will be $IBTC. Again all part of the process of bringing ETF to market.. h/t @martypartymusic pic.twitter.com/8PQP3h2yW0

— Eric Balchunas (@EricBalchunas) October 23, 2023

The ETF analyst also speculated that BlackRock may already have received the Securities and Exchange Commission’s (SEC) green light or is preparing for it.

BlackRock’s application for the ETF, submitted in June, gives the SEC until January 10 to reach a final decision on its approval or denial. Should it gain approval, it could pave the way for a queue of other spot crypto ETFs currently under SEC review.

Other asset managers with pending applications include Grayscale Investments, Fidelity, and WisdomTree.

To date, the SEC has not approved a spot Bitcoin or Ether application. The watchdog recently delayed the review process for these funds, adding at least another month to the evaluation period.

🔥🔥ARK Investor – Cathie Wood – "SEC is engaging with us for #BitcoinETF Application. It shows change in SEC's behavior. Bitcoin ETFs will come for sure and a number of ETFs will get approved at the same time. The court is going to mandate the SEC" !! pic.twitter.com/grkjMHlxUo

— Flip The Chain (@flipthechain) October 18, 2023

Markets Optimistic About Spot Bitcoin ETF Approvals

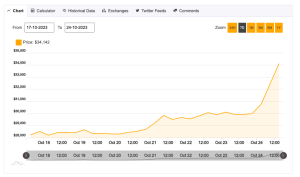

The appearance of BlackRock’s iShares Bitcoin Trust on the DTCC listing further fueled market optimism for potential ETF approvald, driving a 13% increase in Bitcoin’s price over the past 24 hours, to the highest level in 18 months.

Related Articles

- BlackRock CEO Larry Fink Says Bitcoin Rally About “Flight To Quality” And “Pent Up Interest”

- Former SEC Chair Says BlackRock Bitcoin ETF “Incredible Development,’’ Outlines Approval Criteria

- Analyst Gives 3 Reasons Why Blackrock’s Bitcoin ETF Filing Is A Boost For BTC

- Bitcoin Minetrix Price Prediction – BTCMTX Price Potential In 2023

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage