Join Our Telegram channel to stay up to date on breaking news coverage

Former BlackRock director Steven Schoenfield says US regulators may approve spot Bitcoin exchange-traded funds (ETFs) as early as January and that it may be a $200 billion windfall for Bitcoin investment products.

Schoenfield, now CEO of MarketVector Indexes, is optimistic about an early approval from the Securities and Exchange Commission (SEC) because it hasn’t outright declined applications and instead has opted to postpone decisions while seeking comment, he said at a conference in London this week.

He now expects approval of all applications together, so no one firm has first-moved advantage, within “three to six months.”

That would be a windfall for managers of Bitcoin assets with new funds of $150 billion to $200 billion flowing into the industry in the short term, potentially doubling or even tripling the current assets managed in Bitcoin products, he said.

Former BlackRock managing director Steven Schoenfield gives the U.S. SEC “three to six months” before it approves a Bitcoin spot ETF and believes spot ETF approval may result in a “$150 to $200 billion inflow” into Bitcoin investment products over three years. Decrypt reported.…

— Wu Blockchain (@WuBlockchain) October 4, 2023

BlackRock Faces Tough Competition For Spot Bitcoin ETF Assets

Because Schoenfield expects the SEC to approve all the applications together, he sees a tough battle for market share for his old firm

“As much as BlackRock will try to crush the competition, there’s a good half dozen, maybe eight or nine, other firms deeply committed to tradable digital assets,” Schoenfield said. “So I think BlackRock will be in for quite a fight.”

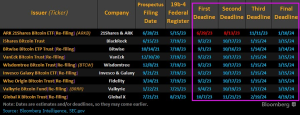

The SEC on Sept. 29 again pushed back the deadline to approve or deny spot Bitcoin ETFs made by Blackrock and a raft of other fund managers.

In the next 5 years, the capital in crypto funds may increase from $50 billion to $650 billion according to Bernstein analysts.

Are you bullish yet?

— WhaleFUD (@WhaleFUD) September 26, 2023

Pressure on the SEC to approve spot Bitcoin ETFs intensified after Grayscale Investments won a landmark court victory over the SEC, when a judge called the regulator’s decision to approve Bitcoin Futures ETFs, but not spot Bitcoin ETFs, ”arbitrary and capricious.”

Four House Financial Services Committee members also have urged the agency to approve the listing of spot Bitcoin ETFs “immediately.”

Research firm Bernstein says approval of spot crypto ETFS will help crypto assets under management surge as much as 13-fold in the next five years to $650 billion. The crypto fund management industry is on the cusp of a transformation from a “cottage industry’’ into a sector with $50 billion in revenues over the period, it said.

Related Articles

- SEC Delays Approval of Spot Bitcoin ETFs Even As Lawmakers Pile On Pressure for Green Light ”Immediately”

- Spot Bitcoin ETF Approval To Trigger ‘Enormous Inflows,’ Reckless Not To `Aggressively Accumulate BTC,’ Report Says

- Valkyrie Wins Approval To Add Ethereum Futures To Bitcoin Strategy ETF

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage