Join Our Telegram channel to stay up to date on breaking news coverage

“Insanity is doing the same thing over and over again and expecting different results.”

Albert Einstein is generally credited with that quote, though many doubt he actually said it. Another famous quote of dubious origin that I could have started this article with is “Those who forget history are doomed to repeat it” No less than five different people have had some version of that quote attributed to them.

Once again, people trusted their money to a centralized exchange. Once again, another major Bitcoin exchange is claiming to have been hacked. This time, the bill is over $75 million worth of bitcoin. It is one of the largest single losses since the Mt.Gox Fiasco put Bitcoin on the mainstream media’s radar for all the wrong reasons.

There were several exchange failures in the interim, but only the Cryptsy failure compares to this newest one. No doubt, many will wonder if Bitfinex was an inside job, like many suspect Mt. Gox and Cryptsy before it were. A healthy dose of patience, while we wait for the facts to come out, is urged, but neither should we discount the idea.

What is worth speculating about is what it will do to the Bitcoin Price and more important, its long term health.

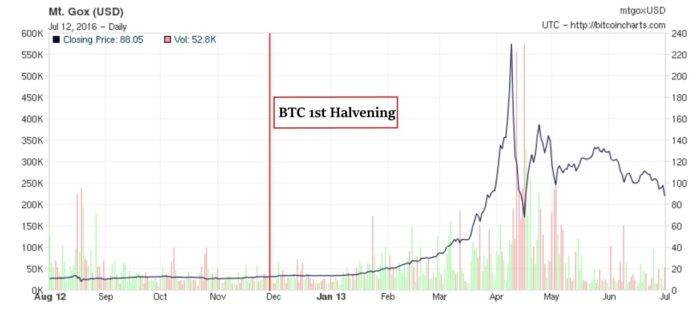

The last bitcoin halvening, which you can read about in our article comparing halvening events, seemed to mirror our current experience in many ways.

The last Bitcoin halvening happened months before the first major price spike.

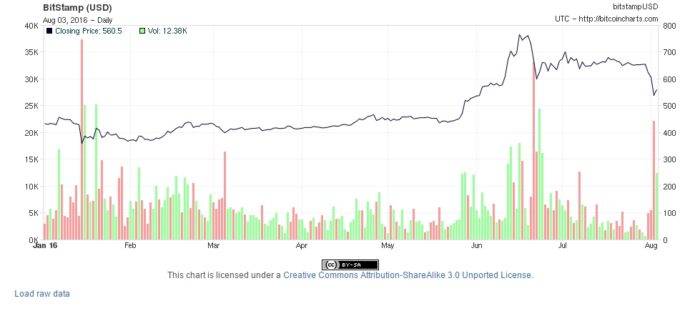

This year’s halvening happened a month before the Bitfinex failure and before it, Bitcoin was seemingly in a stable period, possibly building up to something similar.

Looking a little closer, you can see that there was a large price increase in the months leading up to the first halvening. In April 2012, the price of Bitcoin hovered just above $4, by August, a few months before the halvening, it peaked at nearly $14.

This year’s halvening looks similar, before the Bitfinex failure.

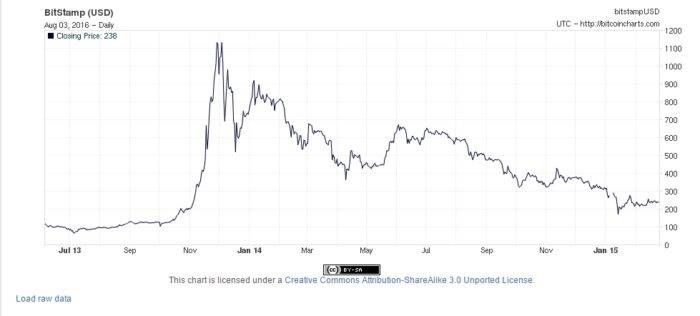

There was another price spike, the most famous on in late 2013. It is interminably linked to the Mt. Gox failure.

The Mt.Gox failure was unlike the Bitfinex event in many ways. Mt.Gox had issues for nearly a year before its eventual collapse. First, withdraws slowed, then they dried up completely, and only have several months of excruciating purgatory, did Mt. Gox finally collapse.

By comparison, the Bitfinex failure was quick. There was some offline time about a week ago, and a known hack earlier in the year, but things were progressing relatively smoothly. One day everything if fine and then the next, more than $75 million was missing. Few expect Bitfinex to survive. Also, as large as $75 Million seems, the Mt. Gox loss was on order of magnitude larger, costing customers an estimated $300 million.

Still, on a marco level, the two failures have similarities, and the Mt. Gox fiasco can teach us a few things. Bitcoin was in the middle of its largest price increase.

Part of this was undoubtedly due to artificial price inflation caused by Mt. Gox’s bots, but not all of it. It isn’t 100% clear what caused the 2013 price jump, other than it was simply “bitcoin’s time”. The Mt. Gox failure, undoubtedly, depressed it greatly.

But if Bitcoin was set to follow the same pattern, the Bitfinex failure may have interrupted that. While the Mt. Gox failure was undoubtedly worse, it was also slow and by the time it finally collapsed, the price had already increased.

Mt.Gox’s issues became public in late 2013, but it didn’t collapse until early 2014 and after it did, Bitcoin’s previous gains were wiped out. There is no telling what would have happened if Bitcoin didn’t have to deal with controversy at such a critical time. Would the price have continued to rise? Or was its deflation an inevitable part of its growth? We will never know.

Bitcoin was seemingly humming along, until Bitfinex fell on its head like an Anvil. If bitcoin was following the same path it did during the first halvening, we could have gotten to see a great price increase without the handicap of a major exchange failure. If a rise was inevitable, how much will this event depress it?

The markets are unpredictable, so judging the past is the only way we have to go forward. The immediate reaction was a predictable tumble for the price, but will people remember this in two months? four months? That will determine its long term impact.

Price jumps happen quickly, but a lot happens under the surface before one occurs. That applies to everything with a fluctuating price, not just bitcoin. A perfect storm of FOMO investors, positive press, an increase in utility and a decrease in supply all have to come together to cause the price to skyrocket towards the moon.

Now, bitcoin has this Bitfinex story hanging from its ankles like a ball and chain, dragging it back towards the earth. And right as it seemed to be preparing itself for a moon shot. Everyone is asking how do we fix it, how do we get the money back? All I want to know is how do we cut it off as quickly as possible and move on?

Perhaps there is nothing we can do, but actually try to learn from our mistake this time. We need to stop putting our trust, and our money, into the hands of centralized exchanges. There isn’t one that is special, there isn’t one that is safe. They are not special, you are not special. The hackers will come and take your coins and it will hurt all of us.

Guard them yourself and let no one handle them for you.

Join Our Telegram channel to stay up to date on breaking news coverage

Comments are closed.