Join Our Telegram channel to stay up to date on breaking news coverage

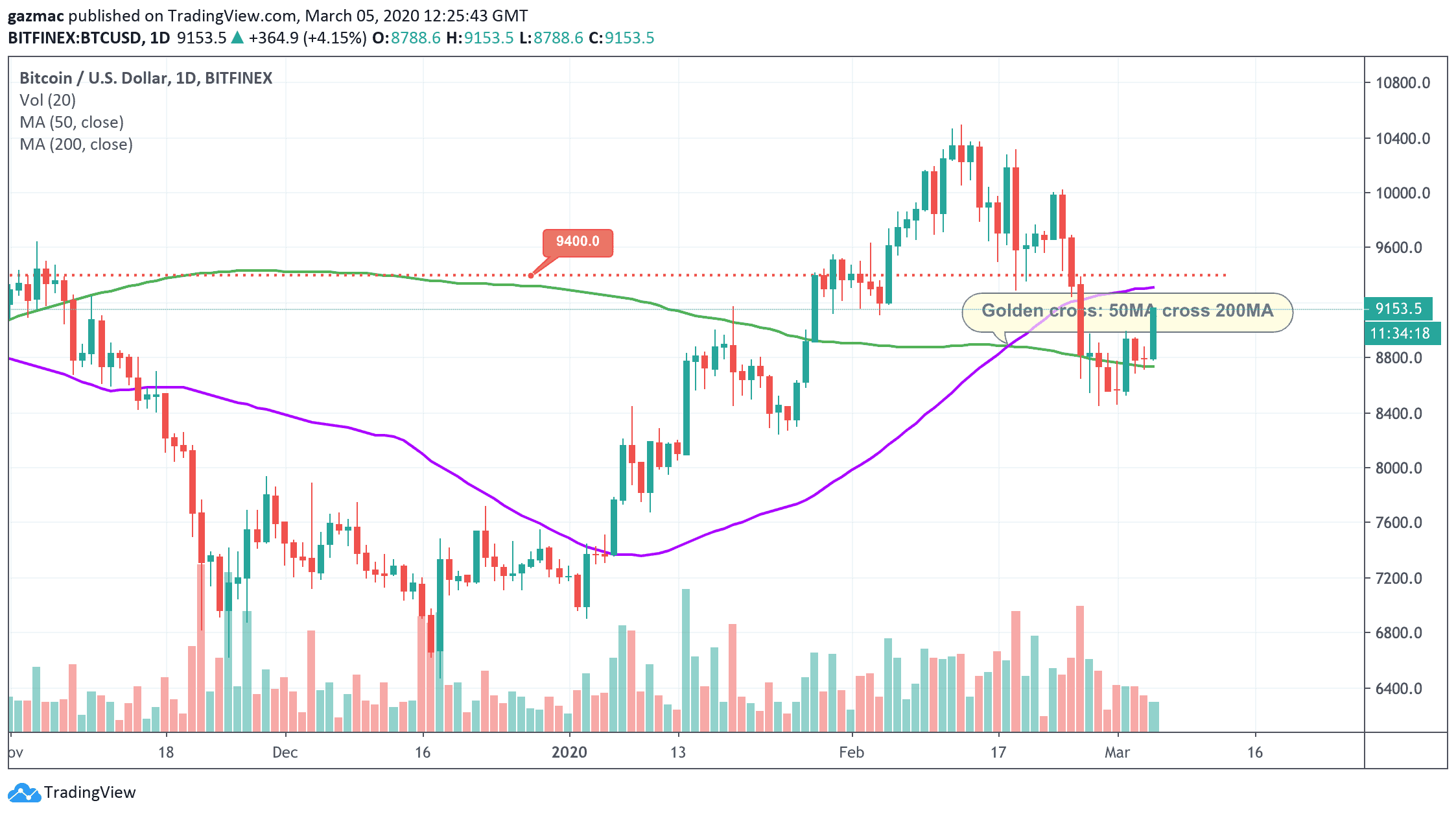

Bitcoin has broken through resistance at $9,000 in what bulls will hope is a decisive move.

Today’s 4% ($360) move follows the 5% ($450) improvement on 2 March.

The golden cross on the 1-day chart put in on 18 February may yet tell the tale of a rally to come.

It’s too early on a technical view to be sure of renewed bullish vigour for a charge to $10,000, but it does bring a challenge to resistance at $9,400 into play.

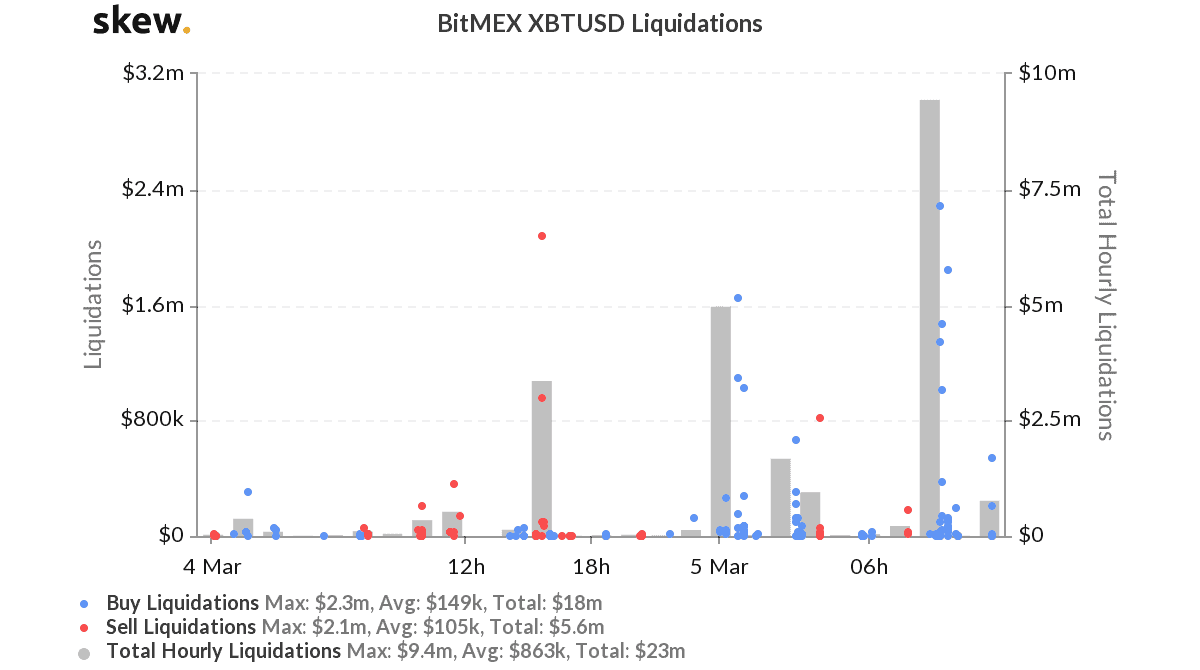

Certainly, on the derivatives front, the long positions have been building up again, with the hourly liquidations gap between buyers and sellers widening in the bulls favour (see Skew below).

Zooming out from the technical, may provide a surer footing to explain recent firmness in the bitcoin price and the wider market.

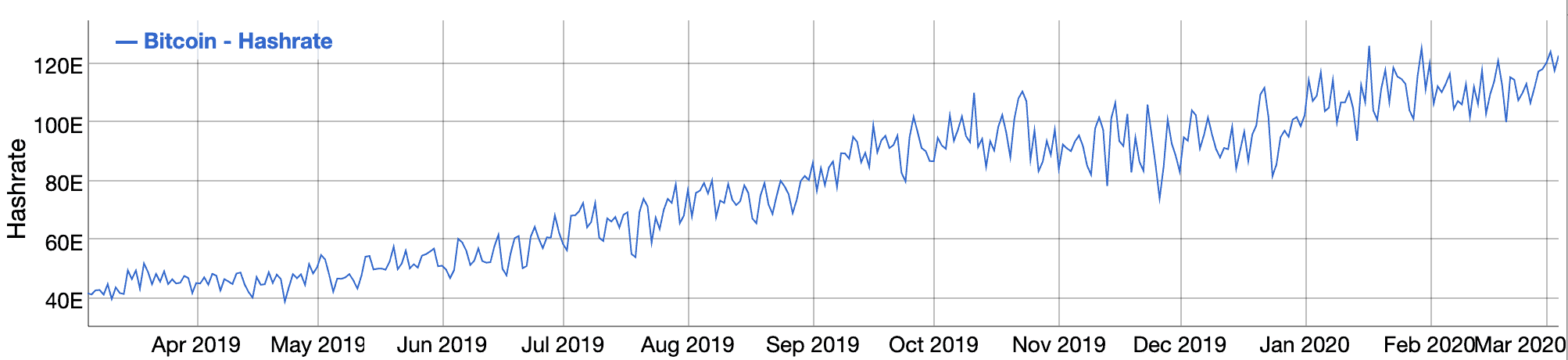

The network is in good health as the hashrate shows.

But sentiment is probably being helped by a number of other factors.

Let’s talk about Libra and bitcoin (BTC) again

Insiders may well have been buoyed by the news, which broke on 3 March (the day after the first spurt higher), that Facebook has not given up on Libra.

The Information broke the news and it has since been spun by many news outlets as a step back by the Libra Association, and by inference Facebook.

However, the pivot towards “digital versions” of the dollar and other fiat currencies alongside Libra is a smart move.

As far as the regulators are concerned the inclusion of a dollar stablecoin weakens the worry that Facebook was in some way trying to supplant the US currency’s preeminent place in the financial world.

But Libra is still there. And its Calibra wallet that will hold all the various stablecoins… and more.

It is admittedly not clear whether the Libra token will still be backed by a basket of currencies and near-cash equivalents.

However, the head of the Swiss-based Libra Association Dante Disparte, head of Policy and Communications, said: “The Libra Association has not altered its goal of building a regulatory compliant global payment network, and the basic design principles that support that goal have not been changed nor has the potential for this network to foster future innovation.”

So, the market may be taking Disparte at his word.

Even if the launch is delayed by a “few months” according to sources, that’s not really a delay at all as no one was really expecting it to a launch imminently anyway.

The important thing about the news is the affirmation that Facebook is committed to Libra.

Let’s remind ourselves that Calibra is a digital wallet and as such it will be open to bitcoin. Even if it you won’t be able to buy bitcoin directly, forks of the wallet will provide the necessary bridging.

All told then, the latest Libra news is bullish for the crypto sector and for bitcoin in particular.

The coronavirus effect bullish for bitcoin after all?

And of course we can’t report on the bitcoin price without mentioning the coronavirus.

Although the World Health Organisation is reticent to make the call, we all know we are in the midst of a pandemic, right?

Here in London, HSBC has just shut down its trading floor; in the US California is the latest to declare a state of emergency and Italy has shut all its schools and universities.

The equity markets have fallen into correction territory (or near it) but not without gigantic bounces to lure market participants into a false sense of security.

That supposed security was enhanced by “Jomentum” in the Democratic primaries, where pundits now have Joe Biden as the frontrunner and not the market-unfriendly socialist Bernie Sanders.

Bitcoin’s claims to safe-haven status have admittedly taken a battering.

But was the poor performance more to do with a conspiring of factors going into the equity meltdown, such as IOTA going off line (and staying offline), and the damage to DeFi caused by the bZx hack?

India crypto trading to explode

One last point to consider is the likely bullish impact of the Indian Supreme Court’s decision to rebuff the central bank’s banning of financial institutions from providing services to digital asset firms.

A surge in crypto trading is expected to follow.

Sumit Gupta, co-founder and chief executive of CoinDCX, the first exchange in the country to integrate bank transfers, said of the news: “Banking integration will open up large markets for us. Integration of banking channels makes the whole process of crypto adoption simpler.

“Through DCX Insta, customers were able to purchase crypto instantly, however now that the banking integration that has gone live the process will be much smoother for customers accessing cryptocurrency through our platform.

“With renewed accessibility and convenience in purchasing cryptocurrencies, we believe that this change will have a dramatic effect in accelerating crypto adoption in India.”

Image courtesy Pixabay

Join Our Telegram channel to stay up to date on breaking news coverage