Join Our Telegram channel to stay up to date on breaking news coverage

Bitcoin price is up 7.17% in the last 24 hours to trade for $45,160 as of 1:05 a.m. EST time, with a 58% surge in trading volume.

It comes after a Reuters report indicated that while analysts from Bloomberg Intelligence, James Seyffart, and Eric Balchunas, indicated that the window for approval of spot Bitcoin exchange-traded funds (ETFs) is between January 5 and 10, the decision could come by January 2 or 3.

$BTC #BTC Bitcoin @ 45k on headlines of SEC informing spot Bitcoin ETF applicants of approval in the coming days (Reuters) https://t.co/iY9jNzN3yr pic.twitter.com/WHMeuKrSvw

— CheddaFreeze (@CheddaFreeze) January 2, 2024

Speculation for approval and subsequent launch has reinvigorated the fear of missing out (FOMO) as traders position for a possible rally.

VanEck Advisor Says BTC ETFs To Creat ”Trillions In Value”

Meanwhile, an advisor to global investment manager VanEck says people are underestimating the impact of spot Bitcoin ETFs in the long run.

Gabor Gurbacs says the approval may ”create $ Trillions in value” and likens the situation to the 2004 launch of the SPDR Gold ETF launched by State Street.

“In the subsequent 8 years gold’s price quadrupled+ from $400 to $1,800 adding ~$8 Trillion in market cap going from ~$2 Trillion to ~$10 Trillion,” he said. “Bitcoin’s market cap is ~$750 Billion today, less than 1/3rd of what gold was in 2004. In my view, upon the approval of a U.S. spot Bitcoin ETF, Bitcoin’s price trajectory could follow gold’s blueprint from 2004 and the years after just much faster.

In my view, people tend to overestimate the initial impact of U.S. Bitcoin ETFs. I think maybe a few $100mm flows (mostly recycled) money.

Long term, people tend to underestimate the impact of spot Bitcoin ETFs. If history is any guide, gold is worth studying as a parallel. https://t.co/6vvkA9aC09

— Gabor Gurbacs (@gaborgurbacs) December 31, 2023

Gurbac’s prediction comes only days after the fund manager published an ad for its expected spot BTC ETF with the headline “Born to Bitcoin.”

Born to Bitcoin. 🧡 pic.twitter.com/qYI3bmZDvC

— VanEck (@vaneck_us) December 29, 2023

Elsewhere, journalist Charles Gasparino said that spot BTC ETF announcements could come later in the week, citing the need for the financial regulator to go through paperwork, likely referring to the filings.

JUST IN: SEC still needs to go through paper work for spot #Bitcoin ETFs so "the announcement likely toward week’s end," reports FOX Business Charles Gasparino.

— Bitcoin Magazine (@BitcoinMagazine) January 1, 2024

In another interesting development, Mike Novogratz, CEO of spot BTC ETF race participant, Galaxy, has said “Big things coming.” The announcement on X hinted at a possible collaboration with leading global asset management firm, Invesco.

Happy New Year! Big Things Coming. #BlockYourCalendar pic.twitter.com/0nI3xPL6K3

— Mike Novogratz (@novogratz) January 1, 2024

Galaxy is a leading financial services innovator in the digital asset, cryptocurrency, and blockchain technology sectors.

Bitcoin Price Prognosis Ahead Of Expected Spot BTC ETF Approvals

While Bitcoin price remains within the weekly supply zone between $40,387 and $46,999, it has broken above the midline of this order block at $43,860, although not decisively. Investors or futures traders looking to take new long positions on BTC should wait for confirmation of this breakout above the $46,999 or more clearly, above the $47,000 psychological level.

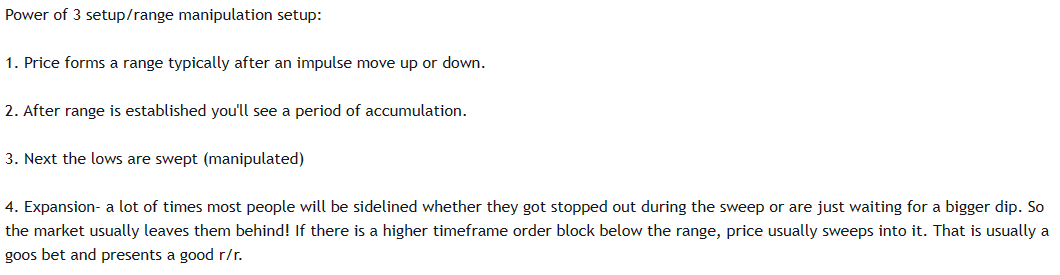

For the meantime, this breakout could very well be manipulation after a period of accumulation. This is based on the Power of 3 (PO3) setup.

Both the MACD and the AO are also still in the positive territory, adding credence to the bullish thesis. Increased buying pressure among the bulls could see Bitcoin price flip the weekly supply zone into a bullish breaker, confirmed by a move above the $48,000 psychological level. In a highly bullish case the gains could extend higher, for BTC market value to extend past the $50,000 level and reach the $60,000 range, levels last tested in November 2021.

Converse Case

On the flip side, if profit taking increases or smart money acts in a manipulative attempt to catch longs off guard, Bitcoin price could pull south, falling back below the $43,860 mean threshold and losing the support due to the ascending trendline.

The ensuing selling pressure could see Bitcoin price drop below $40,000, and in a dire case, extend the fall below the $37,800 range.

While Bitcoin price remains on an uptrend today, savvy investors have turned to BTCMTX as a leveraged way to play its next bull run.

Promising Alternative To Bitcoin

BTXMTX is the native crypto for the Bitcoin Minetrix ecosystem, a cloud mining project that makes Bitcoin ownership a reality even for the ordinary folk.

It has decentralized and tokenized BTC mining, lowering the barriers to make ownership achievable. This explains why it features among analysts’ top picks for the upcoming cryptocurrencies to invest in.

Recognizing the Simplicity of #BitcoinMinetrix 🔄#BTCMTX: Protecting assets, granting users tradeable tokens.

Conventional Cloud Mining: Complex agreements and restrictions. 📄🔒 pic.twitter.com/ud8AJY69Pq

— Bitcoinminetrix (@bitcoinminetrix) December 31, 2023

The project’s BTCMTX token sells for only $0.0126. Investors looking to buy BTCMTX at this price should head over to the website now before the price changes in less than four days.

#BitcoinMinetrix Stage 17 has started!

What technological advancements in cloud mining are you most excited about? 🔍 pic.twitter.com/HEIOHE0kEX

— Bitcoinminetrix (@bitcoinminetrix) January 1, 2024

The success of the presale is best expressed in the sales, now boasting upwards of $7.2 million, with the $7.998 target objective within reach. Another metric for determining project success is the number of followers on social media, with X alone commanding over 15.5K.

Visit Bitcoin Minetrix to buy BTCMTX here.

Also Read:

- How To Buy Bitcoin Minetrix On Presale – Alessandro De Crypto Video Review

- Bitcoin Minetrix Presale Has Just Hours Left: Last Chance to Buy Before Price Rise

- Bitcoin Price Prediction: BTC Enters 2024 Steady At $42k But This Bitcoin Mining Token Might 10X Next Month

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage