Join Our Telegram channel to stay up to date on breaking news coverage

Bitcoin price is down 0.01% in the last 24 hours to trade for $42,273 as of 12:50 a.m. EST time, but trading volume is up 5%.

It enters 2024 holding steady above the $42,000 psychological level, and the fact that it continuously remains above the $40,000 mark shows the market is not selling.

The steady hand displayed by BTC holders comes as the new year sets the stage for the spot Bitcoin exchange-traded funds window, opening on January 5.

A look at the current market situation shows that the Bitcoin price has started the market still within a range, consolidating under the critical barrier at $43,860. It remains within the weekly supply zone, a bearish order block that extends between $40,387 and $46,999.

More concerning, even while moving within the bearish order block, it has broken below the support offered by the ascending trendline after filling up the pattern with indications of an extended downtrend, at least for the short term before the expected ETF-inspired move north. With this, the cloud-mining project Bitcoin Minetrix has become the center of attention among forward-looking investors.

Happy New Year! 🎉

What are your thoughts on how cloud mining will advance in 2024? 🤔💭 pic.twitter.com/Oz0ko8fMX5

— Bitcoinminetrix (@bitcoinminetrix) January 1, 2024

Possibility That Bitcoin Spot ETF Approval Is Already Priced In

Despite expectations that the spot BTC ETF approval will be a bullish catalyst for Bitcoin price, data from the options market suggests the opposite. It shows that the impact may already be priced in, indicated by little implied volatility seen in the January 12 BTC options.

According to experts from Greek Live, the January 12 BTC options are highly correlated with Bitcoin spot ETF, with the first deadline for approval of the Ark 21 Shares application being January 10. The result of this event could therefore be reflected in the January 12 options data.

There is news in the market that the SEC will pass the Bitcoin Spot ETF application as early as next Tuesday, but there was little volatility across the major term IVs and the price.

Looking at the options data, Jan12 options IV, which is strongly correlated to the ETF, fell… pic.twitter.com/f1B4ZPC05d— Greeks.live (@GreeksLive) December 31, 2023

Bitcoin Price Outlook For The Week

After breaking below the support offered by the ascending trendline, Bitcoin price looks poised for an extended move south, potentially testing the $40,000 psychological level. The Relative Strength Index (RSI) appears subdued, moving horizontally and teasing with an inclination south. This points to waning momentum among BTC buyers.

If the trajectory continues, the RSI could cross below the signal line (yellow band), with the crossover typically interpreted as a sell signal.

Increased weakness among the bulls could see the bears take over, with the ensuing seller momentum sending Bitcoin price out of the supply zone. Such a move could see BTC price test the $40,000 psychological level, or in a dire case, extend the fall south to tag the $37,800 level. This would denote a 10% slump below the current price.

However, for the prevailing bullish outlook to be invalidated, Bitcoin price must record a decisive candlestick close below the $30,000 psychological level. Such a move would constitute a 30% drop below current levels.

Converse Case

On the flip side, the histogram bars of the Awesome Oscillator(AO) and those of the Moving Average Convergence Divergence (MACD) are flashing green and moving within the positive territory. This shows the bulls maintain a presence in the BTC market.

Also, with the RSI still above the 70 level, prospects for a move north remain alive as the momentum indicator has not indicated that BTC is ripe for selling. Until such a time when the RSI crosses below the 70 level, the upside potential remains alive for the Bitcoin price.

If the buyers act now, the ensuing buyer momentum could see Bitcoin price push north, restoring above the ascending trendline. Enhanced buying pressure could see BTC break out from above the confines of the weekly supply zone, flipping the $46,999 ceiling into support. Confirmation of the move north will occur after the Bitcoin price flips the $48,000 psychological level into support.

In highly bullish cases, Bitcoin price could shatter past $50,000 or, in the very ambitious case, extend to tag the $60,000 psychological level.

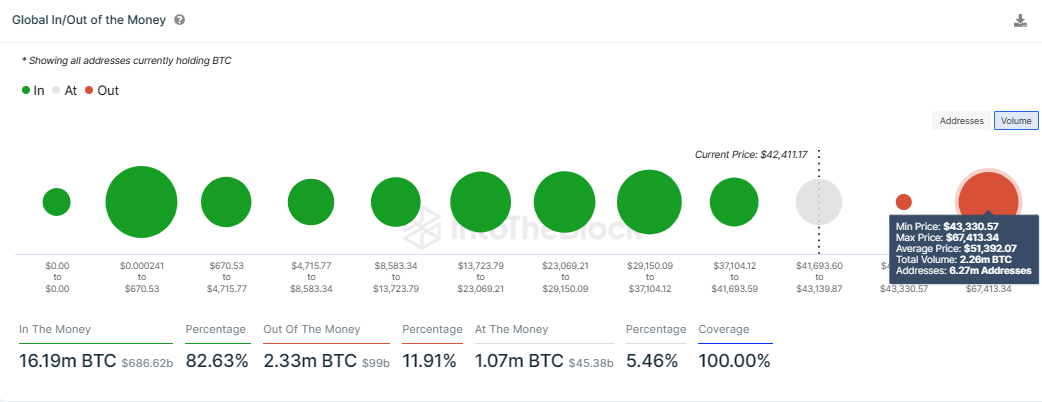

On-chain Metric: GIOM

Meanwhile, data according to IntoTheBlock’s Global In/Out of The Money (GIOM) metric shows that while Bitcoin price has stronger support downward, it faces stiff resistance between the $43,330 and $67,413 zone. Here, roughly 6.27 million addresses are holding $2.26 million BTC tokens purchased at an average price of $41,392.

The data also shows that at current rates, 82.63% of BTC holders are sitting on unrealized profits, while only 11.91% are sitting on unrealized losses. With more holders in the profit, as well as anticipation for a rally, the effective seller momentum is bound to be lower compared to buying pressure.

With the odds favoring approval of spot BTC ETF, enlightened investors looking to benefit from its expected pump effect on Bitcoin price, enlightened investors are buying BTCMTX. It is a stake-to-mine project with the token featuring among analysts’ top picks for the next 100X crypto to invest in with the potential for massive gains.

Promising Alternative To Bitcoin

Ahead of the expected spot BTCETF approval, BTCMTX presents itself as the most promising alternative to Bitcoin. It is the powering token for the Bitcoin Minetrix ecosystem, a cloud-mining project making Bitcoin ownership achievable even for the ordinary folk.

Recognizing the Simplicity of #BitcoinMinetrix 🔄#BTCMTX: Protecting assets, granting users tradeable tokens.

Conventional Cloud Mining: Complex agreements and restrictions. 📄🔒 pic.twitter.com/ud8AJY69Pq

— Bitcoinminetrix (@bitcoinminetrix) December 31, 2023

Bitcoin Minetrix is in the presale stage, allowing interested investors to buy BTCMTX for rates as low as $0.0125 as stage 16 ends.

Just one day until #BitcoinMinetrix Stage 16 wraps up! ⏱️

What common misconceptions about #Bitcoin mining have you encountered? 🤔 pic.twitter.com/7dzGrEFVxW

— Bitcoinminetrix (@bitcoinminetrix) December 31, 2023

So far, presale sales have reached $7.096 million out of a target objective of $7.182 million.

Watch a review of the BTCMTX purchase process here or visit the website to buy the token here.

Also Read:

- How To Buy Bitcoin Minetrix On Presale – Alessandro De Crypto Video Review

- Bitcoin Minetrix Presale Has Just Hours Left: Last Chance to Buy Before Price Rise

- Official Oboypapi Shares a New Way to Earn Bitcoin with the Bitcoin Minetrix Stake-to-Mine Approach

- Filipino YouTuber ALROCK Reviews the New Stake-to-Mine Crypto – Bitcoin Minetrix

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage