Join Our Telegram channel to stay up to date on breaking news coverage

The Bitcoin price is up 2% in the last 24 hours to trade for $43,016 as of 4:50 a.m. EST time on trading volume that plunged 25%.

It comes as the market continues to digest the disappointment of no rate cuts this March, a development exacerbated by selling of Grayscale Bitcoin Trust (GBTC) shares.

Slight uptick in $GBTC outflows in the 200m range

Not that this alone will bring large sell offs to the market

Expected range bound moves headed into FOMC https://t.co/rTbbs1bg5d pic.twitter.com/GspUZkzVYf

— Cam – Crypto DeGen (@CryptoNews_eth) January 31, 2024

Meanwhile, reports indicate that Valkyrie Funds has become first Bitcoin ETF issuer to diversify custody for its fund. The move looks to be a marketing strategy to inspire confidence among investors as it points to reduced custodial risk as two entities will handle safekeeping.

Very interesting move — @ValkyrieFunds moving to use @BitGo for custody of their #Bitcoin in $BRRR via filing today. https://t.co/XWH3hCuQT9 pic.twitter.com/gWsT6lO2cO

— James Seyffart (@JSeyff) February 1, 2024

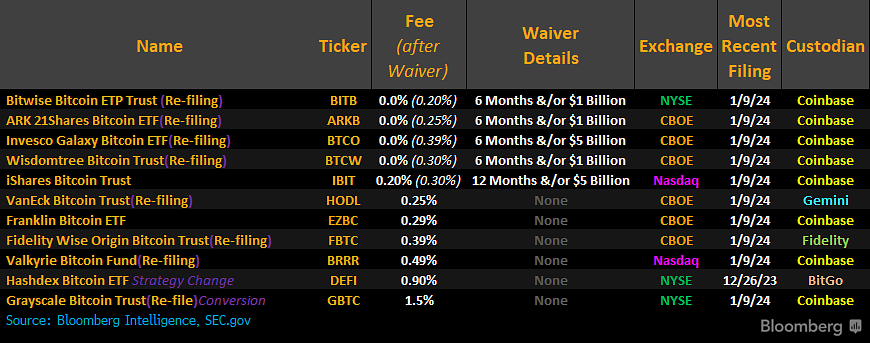

According to the filing, Valkyrie Bitcoin Fund (BRRR) will be custodied by both BitGo and Coinbase from now on. This is a paradigm shift considering its peers in the spot BTC ETF market only have custody with single entities.

Spot BTC ETF issuers and custodians

Meanwhile, Coinbase remains the predominant custody provider, serving eight out of the 11 (8/11) applications. VanEck, Fidelity, and Hashdex are the only issuers who do not get custody services from Coinbase. The helm of Coinbase as the largest US-based exchange is probably why it is so popular among ETF issuers.

According to Nate Geraci, the founder of ETFStore, more issuers could bring in more custodians soon. “I would be surprised if most of them do not have multiple custodians over the next quarter,” said Geraci, adding that this could help reduce custody fees.

“I would be surprised if most of them do not have multiple custodians over the next quarter.”

ETF issuers talking to BitGo, Gemini, Kraken, etc to serve as secondary custodian for spot btc ETFs.

Diversifies risk & can pressure down custody fees.

via @olgakharif @Yueqi_Yang pic.twitter.com/rCRQwhtp4b

— Nate Geraci (@NateGeraci) February 1, 2024

Meanwhile, recent developments indicate that BlackRock (IBIT), Fidelity (FBTC), Ark/21Shares (ARKB), and Bitwise (BITB) are the best-performing ETFs, with BlackRock in the lead.

All of the new ETFs are doing well but these 4 are doing really well. $IBIT, $FBTC, $ARKB, $BITB. https://t.co/pvnmU6U3DQ

— James Seyffart (@JSeyff) February 1, 2024

Bitcoin Price Outlook With BTC Stuck Below A Critical Support

The Bitcoin price remains below the ascending trendline, with the Relative Strength Index (RSI) still subdued and moving horizontally. While its position at 53 and above signal line is encouraging, bulls must increase their buying power if they are to recover the market.

The Moving Average Convergence Divergence (MACD) and the Awesome Oscillator (AO) are in positive territory, increasing the odds for a restored upside potential. The histogram bars of both indicators are also flashing green, adding credence to the bullish supposition.

If the bulls increase buying momentum, the Bitcoin price could extend north, flipping the ascending trendline into support above $43,750.

Enhanced buyer momentum could see the Bitcoin price climb higher to the $48,000 resistance level, or in highly bullish cases, reach for the $50,000 psychological level. This would constitute a 16% ascent above current levels.

TradingView: BTC/USDT 1-day chart

Converse Case

On the other hand, if the bulls show weakness, the bears could take over the market. This could send the Bitcoin price to the $40,726 support level. A break below this buyer congestion level could see the fall extend to the 100-day Simple Moving Average (SMA) at $40,293.

If both these levels fail to hold as support, the Bitcoin price could roll over into the demand zone between $38,496 and $39,895. A breach of the midline of this order block at $39,196 could confirm the continuation of the fall for the Bitcoin price, sending it to the critical support at $37,800. Beyond here, the cliff could send BTC to $30,000. A break and close below this level would invalidate the big-picture bullish outlook.

Large Holders Reducing Profit Booking Could Bode Well For Bitcoin Price

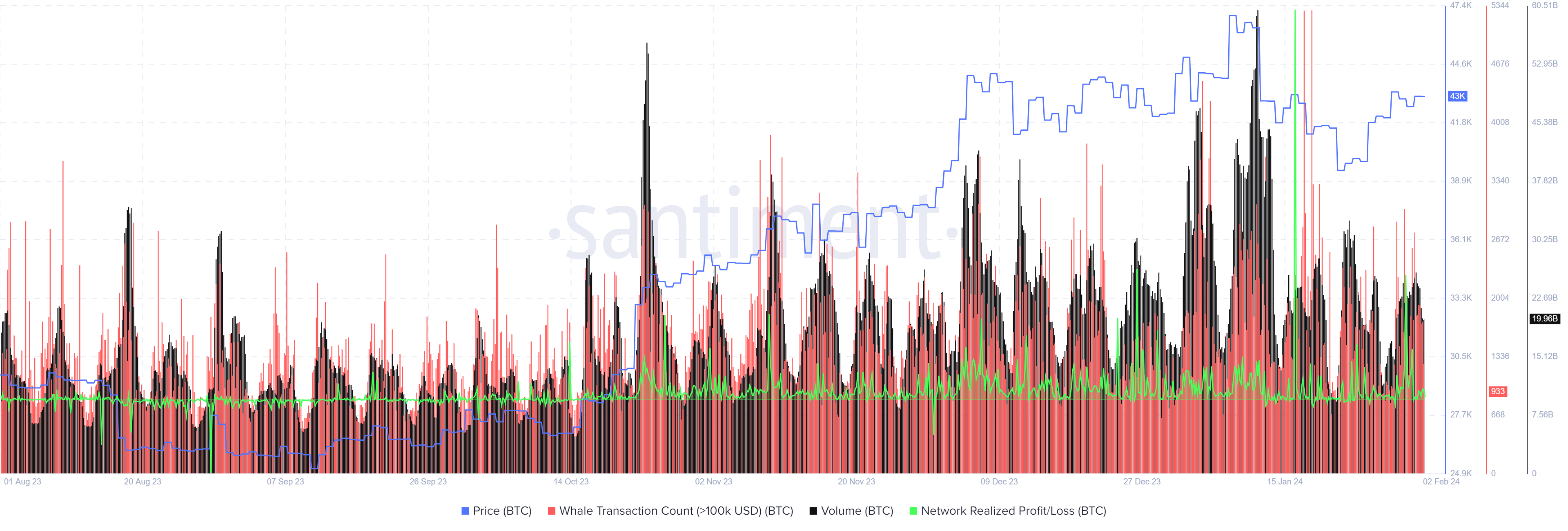

On-chain metrics from Santiment show that large holders have reduced their profit-taking. This is seen in the decline in whale transactions valued at $100,000 and higher between January 17 and February 1. The same goes for the Network Realized Profit/Loss and are accentuated by the recent decline in transaction volumes.

BTC Santiment: Whale transaction count and Network Realized Profit/Loss

Elsewhere, investors are rushing to the 10X opportunity that analysts see in BTCMTX, the revolutionary Bitcoin cloud-mining project. It is one of analysts’ top choices for the best Web3 projects to buy into in 2024.

Promising Alternative To Bitcoin

BTCMTX is arguably the most promising alternative to Bitcoin. It powers the Bitcoin Minetrix ecosystem, a cloud-mining project that makes BTC ownership a reality for everyone. It sidesteps all the hassles that come with traditional Bitcoin mining, ensuring community members enjoy a safe and convenient mining experience.

Identifying the distinctions between #BitcoinMinetrix and Conventional Cloud Mining! 🌐

Safety and Security: 🛡️#BTCMTX: Empowering users with decentralized, tradable #Tokens.

Conventional Cloud Mining: Mandates cash deposits. pic.twitter.com/hCkOD1UViF

— Bitcoinminetrix (@bitcoinminetrix) February 1, 2024

The project is in the presale, boasting upwards of $10.1 million in sales so far. Investors can buy BTCMTX now for rates as low as $0.0132 before the price increases in less than three days.

Big Announcement! 🎉#BitcoinMinetrix has hit a phenomenal milestone, raising over $10,000,000! 🪙 pic.twitter.com/toEsT1NvWv

— Bitcoinminetrix (@bitcoinminetrix) January 31, 2024

Keep abreast of all news and developments about the Bitcoin Minetrix project by joining its social media community. This will also give voice to your ideas and give you a first-mover advantage for all value-added developments in the project.

Discover the #BTCMTX Community on #Telegram for updates on #Bitcoin mining. 🛠️

Stay in the loop with up-to-the-minute details, participate in discussions, and tap into the knowledge of experienced #BTC mining experts. 📈

Join us at 🌐 https://t.co/jjqYaqOtyv pic.twitter.com/SwvUuZgvdZ

— Bitcoinminetrix (@bitcoinminetrix) February 2, 2024

Visit Bitcoin Minetrix to buy BTCMTX here.

Also Read:

- How To Buy Bitcoin Minetrix On Presale – Alessandro De Crypto Video Review

- Bitcoin Minetrix Presale Has Just Hours Left: Last Chance to Buy Before Price Rise

- Best Meme Coins to Buy Now – Keep an Eye on These 100X Potential Cryptos

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage