Join Our Telegram channel to stay up to date on breaking news coverage

Bitcoin Rebounds but Challenges the 22K Resistance Zone – September 10, 2022

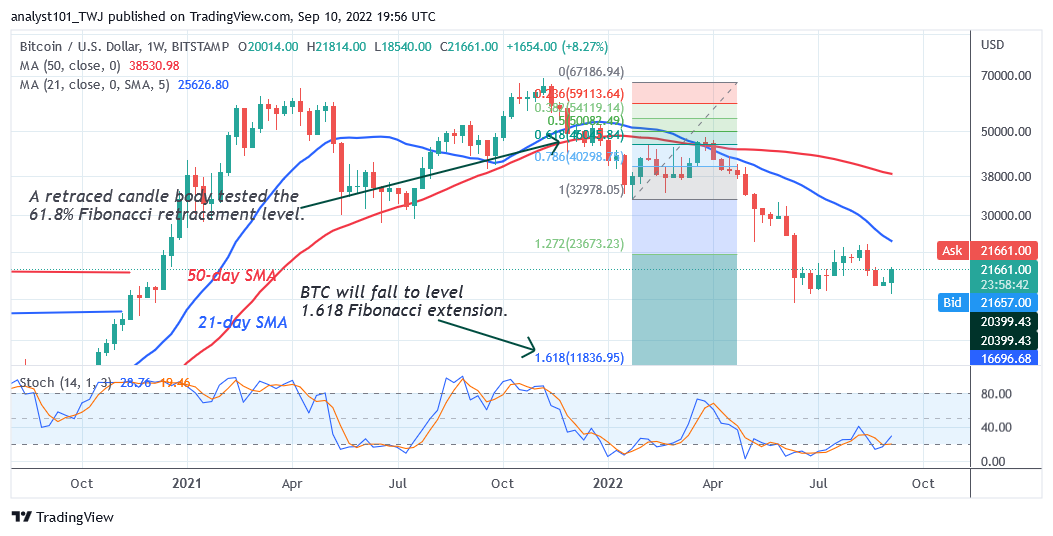

Bitcoin (BTC ) rebounds above the $18,500 support but challenges the 22K resistance zone. The largest cryptocurrency will revisit the $24,000 overhead resistance if price breaks above the 50-day line SMA and the bullish momentum is sustained.

Bitcoin Price Statistics Data:

•Bitcoin price now – $21,548.50

•Bitcoin market cap – $412,655,350,207

•Bitcoin circulating supply – 19,147,168.00 BTC

•Bitcoin total supply – $452,251,435,151

•Bitcoin Coinmarketcap ranking – # 1

Resistance Levels: $50,000, $55, 000, $60,000

Support Levels: $25,000, $20,000, $15,000

Your capital is at risk.

Following its decline to the low of $18,675, Bitcoin bulls buy the dips as the cryptocurrency resumes its uptrend. However, the downtrend could have continued if the $18,675 support is breached. Bitcoin could have declined to the previous low at $17,605. Today, Bitcoin has reclaimed the $20,000 psychological price level. Buyers also pushed the crypto above the 21-day line SMA but were yet to break above the 50-day line SMA. On the upside, Bitcoin will be compelled to a range-bound move between the moving average lines if the 50-day line SMA remains unbroken. In the same vein, Bitcoin will rally and revisit the $24,000 overhead resistance where the moving average lines are breached.

Microstrategy Intends to Reinvest $500 M Stock Sales Into Bitcoin: SEC Filing

MicroStrategy is the largest institutional Bitcoin (BTC) buyer as the firm intends to increase its Bitcoin holdings by buying the dips. According to a report, buying the dip is essential for MicroStrategy as the company’s reserve of nearly 129,699 BTC currently suffers an aggregated value loss of over $1 billion. Because of this, the company has entered an agreement with two agents — Cowen and Company and BTIG — to sell its aggregated class A common stock worth $500,000,000.

This has been revealed by the Securities and Exchange Commission (SEC) filing. The business analytics software firm continues to pursue its goal of acquiring more BTC by selling company stocks. The filing confirmed: “We intend to use the net proceeds from the sale of any class A common stock offered under this prospectus for general corporate purposes, including the acquisition of bitcoin, unless otherwise indicated in the applicable prospectus supplement.”

Meanwhile, the BTC price has risen to $21,556 but challenges the 22K resistance zone. The bottom line is that Bitcoin will be compelled to a range-bound move for a few more days if the 50-day line SMA remains unbroken. The crypto is at level 55 of the Relative Strength Index for period 14. It indicates that Bitcoin will further rise to the upside.

Related:

• How to buy Tamagoge

• Visit Tamadoge Website

Join Our Telegram channel to stay up to date on breaking news coverage