Join Our Telegram channel to stay up to date on breaking news coverage

Bitcoin price is up almost 2% in the last 24 hours to trade for $39,450 as of 5:00 AM EST with trading volume down almost 10%.

The drop in trading volume is characteristic of weekends when the retail market tends to take a back seat. This leaves the market to the large holders, increasing volatility because a small number of large trades can influence the market.

Bitcoin Price Eyes $40,000 As Whale Buys $187 Million Worth Of Crypto

With eyes peeled to the $40,000 mark, a whale has shown bullishness, buying about $187 million worth of assets in three days from Binance exchange. Blockchain-tracking service Lookonchain reported that from the $187 million, $90.64 million accounted for BTC purchases.

It seems that a whale has accumulated ~$187M assets from #Binance in the past 3 days, including:

2,380 $BTC($90.64M)

172K $BNB($39.19M)

16,300 $ETH($33.61M)

200K $SOL($12.2M)

530B $SHIB($4.4M)

460M $IOST($4.2M)

1.6M $MATIC($1.22M)

16M $CHZ($1.16M)

… pic.twitter.com/3q1kjifU8B— Lookonchain (@lookonchain) December 1, 2023

Other tokens in the bucket comprised, Binance Coin (BNB), Ethereum (ETH), Solana (SOL), Shiba Inu (SHIB), Polygon (MATIC), and IOST (IOST). It is also worth mentioning the purchasing wallets were created on June 8 and withdrew assets from Binance at the same time.

As whales continue shopping, investors anticipate an extended move for Bitcoin price, with the next level to watch being the $40,000 psychological level.

Bitcoin Price Outlook

With prospects for more gains, Bitcoin price eyes the $40,000 psychological level next, before a potential correction. The correction comes as there remains a lot of uncollected liquidity residing underneath after the uptrend.

Meanwhile, the odds continue to favor the upside, considering the Relative Strength Index (RSI) is northbound, pointing to rising momentum. Its position at 68 shows there is still more room to the north before BTC can be considered overbought.

Also, the Awesome Oscillator (AO) histogram bars are taking to the green feel, again, after a steady streak of red. It suggests that more bulls are coming into the BTC market.

Increased buying pressure above current levels could see Bitcoin price extend to the forecast $40,000 psychological level. Past this level, the gains could extrapolate further towards the $42,000 psychological level.

On the flip side, if selling pressure increases, Bitcoin price could pull south, retesting the 78.6% Fibonacci retracement level which provides support at $34,533. In the dire case, the slump could extend for BTC to test the 30,474 support, marked by the important Fibonacci level of 61.8%. A break and close below this level would invalidate the current bullish outlook.

In the worst-case scenario where the $30,000 range fails to provide support, Bitcoin price could descend further, retracing the 50% Fibonacci at $27,623.

Bitcoin Price: On-Chain Metrics To Support Bullish Outlook

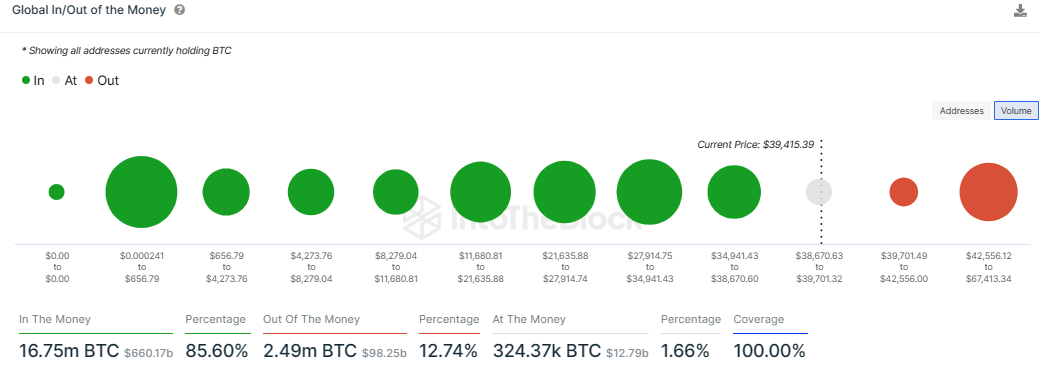

On-chain aggregator IntoTheBlock’s Global In/Out of the Money (GIOM) shows that Bitcoin price has more robust support downward compared to overhead pressure. The model reveals there is no supply barrier that will prevent the largest cryptocurrency by market capitalization from achieving its upside potential at $40,000.

The on-chain metric also shows that one major area of interest between $42,556 and $67,413 could present as the major obstacle. A high number of investors that had previously purchased BTC around this price level populate the zone. Here, roughly 5.64 million BTC addresses are holding nearly 2.11 million BTC tokens.

Also, at the current price, 85.6% of BTC holders are sitting on unrealized profit (in the money), while only 12.74% are sitting on unrealized losses (out of the money). Meanwhile, a negligible 1.66% are breaking even (at the money).

For as long as more holders are in profit, the overall sell pressure on Bitcoin price is expected to be low. This is especially true as the broader market is currently bullish, with three key narratives driving the market:

- Imminent approval of spot Bitcoin exchange-traded funds (ETFs), which experts put between January 5 and 10

- The history of the fourth quarter being the best month for Bitcoin on metrics of returns.

- Anticipation for the Bitcoin halving, expected to kick off the next bull market cycle.

Adding to the bullish thesis for Bitcoin price, exchange inflows are dwindling, suggesting investors are not moving towards selling. Notably, whenever investors are looking to sell, they move their holdings from their wallets to exchanges.

Meanwhile, amid the Bitcoin hype, attention has shifted to BTCETF, a presale token that continues to front-run the Bitcoin ETF narrative. With experts placing the odds at 90% in favor of approvals by January, now is the time buy BTCETF.

Promising Alternative To Bitcoin

BTCETF is the native crypto for the Bitcoin ETF Token project, marketed as the only ecosystem where token holders are rewarded for ownership.

The #BTCETF #Token stands as more than a typical #DigitalCurrency; it's a forward-thinking initiative shaping the future of #Bitcoin ETFs. 🌟

Leveraging #Ethereum, #BitcoinETF foresees and embraces this forthcoming evolution, presenting exclusive advantages to its user base. pic.twitter.com/inReCyJ3Ax

— BTCETF_Token (@BTCETF_Token) November 28, 2023

BTCETF is now selling for $0.0062, a price tag that will only stand for the next two days before yet another price hike. That means now is the time to take advantage of the low entry.

#BitcoinETF Stage 7 has started! 🎊 pic.twitter.com/dval4GuSME

— BTCETF_Token (@BTCETF_Token) December 2, 2023

So far, presale sales have reached $2.365 million, out of a target objective of $2.876 million. The tokens are selling fast, with investors using ETH, USDT, and their bank cards to buy the token.

Visit Bitcoin ETF Token website to buy BTCETF here.

Also Read:

- How To Buy Bitcoin ETF Token On Presale – Alessandro De Crypto Video Review

- Cilinix Crypto Provides Update on New Bitcoin ETF-Inspired Crypto ICO – Should You Still Buy $BTCETF?

- Grayscale Bitcoin Trust Discount Shrinking And Investors Back New Bitcoin ETF Token With $2M As Sellout Nears And SEC Approval Bets Mount

- Bitcoin Price Prediction: BTC Pumps 3% After Michael Saylor Boosts Bitcoin Holdings By $593 Million, But Time Is Running Out To Buy This Coin Primed To Explode On Bitcoin ETF Approvals

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage