Join Our Telegram channel to stay up to date on breaking news coverage

Bitcoin (BTC) Price Prediction – May 9

Today, BTC/USD faced a pullback as the price slid below $9,800 and tested support near $9,500 price area.

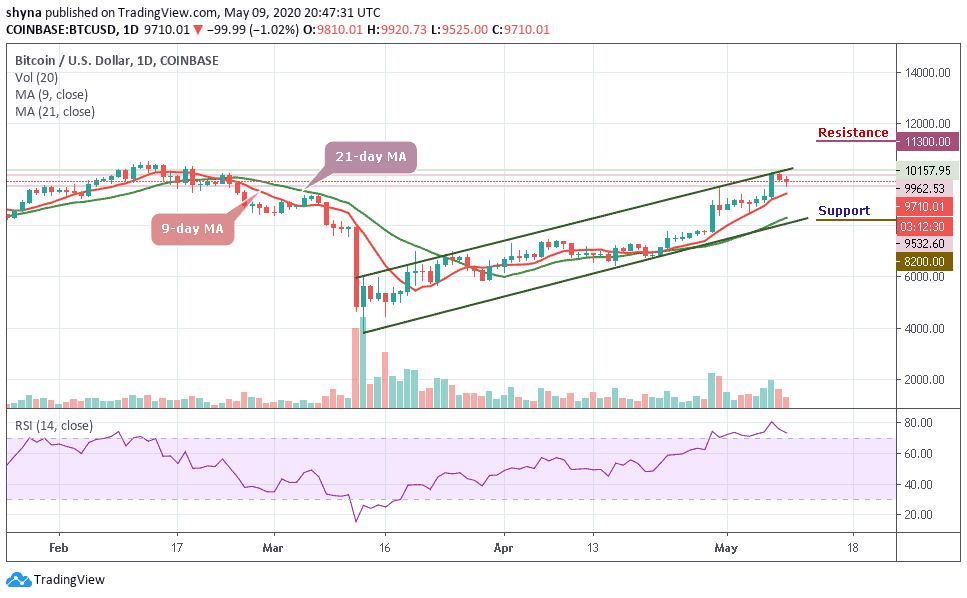

BTC/USD Long-term Trend: Bullish (Daily Chart)

Key levels:

Resistance Levels: $11,300, $11,500, $11,700

Support Levels: $8,200, $8,000, $7,800

BTC/USD has not been able to breach the key $10,000 level following a recent rejection at $10,157. On the downside, support has been established at $9,532. BTC/USD is trading at $9,710 at the time of writing. The prevailing trend is having a bearish bias but the bullish interest has not left the market in spite of the resistance at $10,000.

In addition, the market is still deciding above the 9-day and 21-day moving averages, where the buyers are anticipating a clear breakout above the channel. Meanwhile, the $10,500 and $10,700 levels may further surface as potential resistances should the $10,400 level holds. However, a strong bullish spike might take the price to $11,300, $11,500, and $11,700 levels.

Moreover, if the market continues to follow the downward trend, Bitcoin’s price may drop to $9,000, and should this support fails to contain sell-off, we may see a further roll back to $8,200, $8,000, and $7,800 support levels. Meanwhile, the technical indicator RSI (14) suggests an extremely overbought market and facing down, the market may fall to immediate supports.

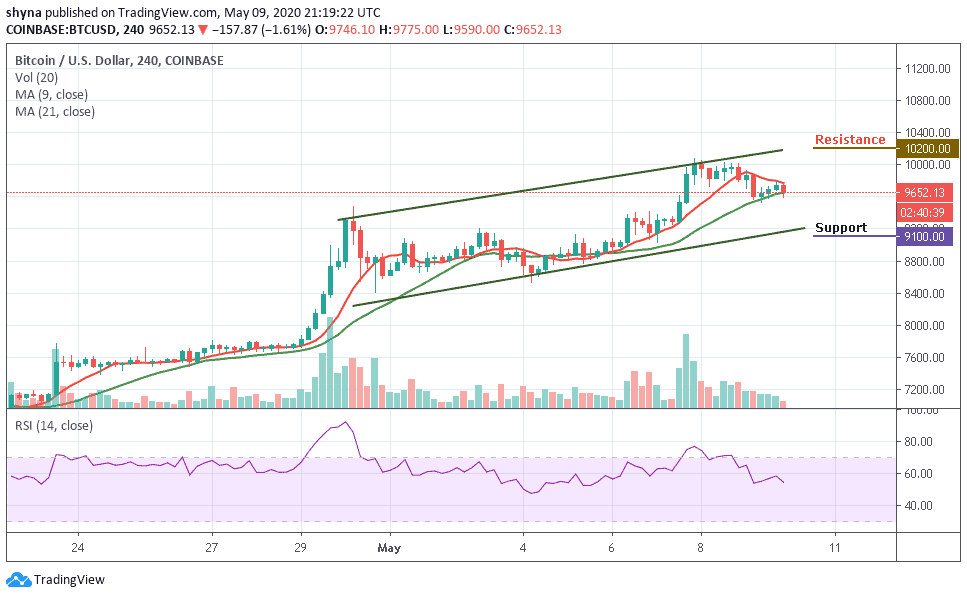

BTC/USD Medium – Term Trend: Bullish (4H Chart)

On the 4-hour chat, Bitcoin bears have now stepped back into the market pushing the BTC price below its previous support level that existed around $9,590. Although the Bitcoin price has not yet slipped below $9,500, it’s still in the loop of making a bounce back. Its price hovers around $9,652 and may take time to persistently trade above $10,000.

At the moment, BTC/USD is currently moving below the 9-day moving average but yet to cross below the 21-day moving average. In as much the technical indicator RSI (14) moves below the 55-level, the downward movement may likely push the price to the nearest supports at $9,100, $8,900 and $8,700 while the potential resistance lies at $10,200, $10,400 and $10,600.

Please note: Insidebitcoins.com is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results.

Join Our Telegram channel to stay up to date on breaking news coverage