Join Our Telegram channel to stay up to date on breaking news coverage

Bitcoin (BTC) Price Prediction – August 8

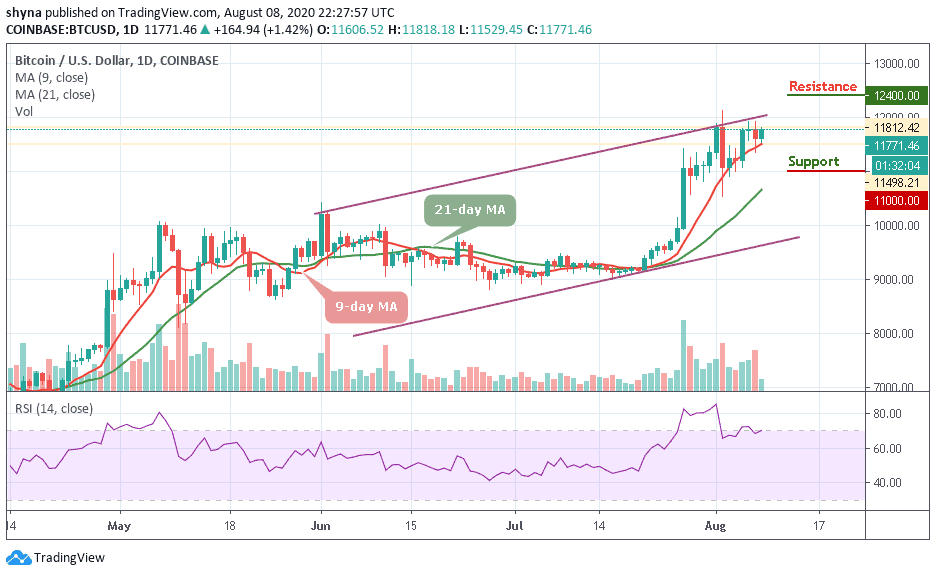

At the moment, the daily chart reveals that BTC/USD lacks strong resistance on the upside.

BTC/USD Long-term Trend: Bullish (Daily Chart)

Key levels:

Resistance Levels: $12,400, $12,600, $12,800

Support Levels: $11,000, $10,800, $10,600

BTC/USD touches the daily high at $11,812 to face a key resistance of $12,000 but was later rejected and is now trading sideways. However, if the first digital asset continued to consolidate in this way, traders could soon see it break through the above-mentioned level of key resistance and it could then be obvious to target the potential resistance of $12,500. In other words, traders may see a larger decline in the coming days if the coin breaks below the 9-day moving average.

Possible Next Direction for Bitcoin

BTC/USD has remained in the consolidation mode above the 9-day and 21-day moving averages, deciding on the next move. In addition, it can be expected that the market may continue to sell should in case the market price breaks below the 9-day MA. But, if the bulls show a strong commitment, BTC/USD could rise above the upper boundary of the channel and may reach the potential resistance levels of $12,400, $12,600, and $12,800 as the RSI (14) indicator, while on the positive side, may continue to give bullish signals.

Presently, the daily chart shows that the weak upward momentum may be affecting the Bitcoin bulls, although bears may likely bring the price to $11,200 which could lead the Bitcoin price to the supports of $11,000, $10,800, and $10,600 in the next negative moves.

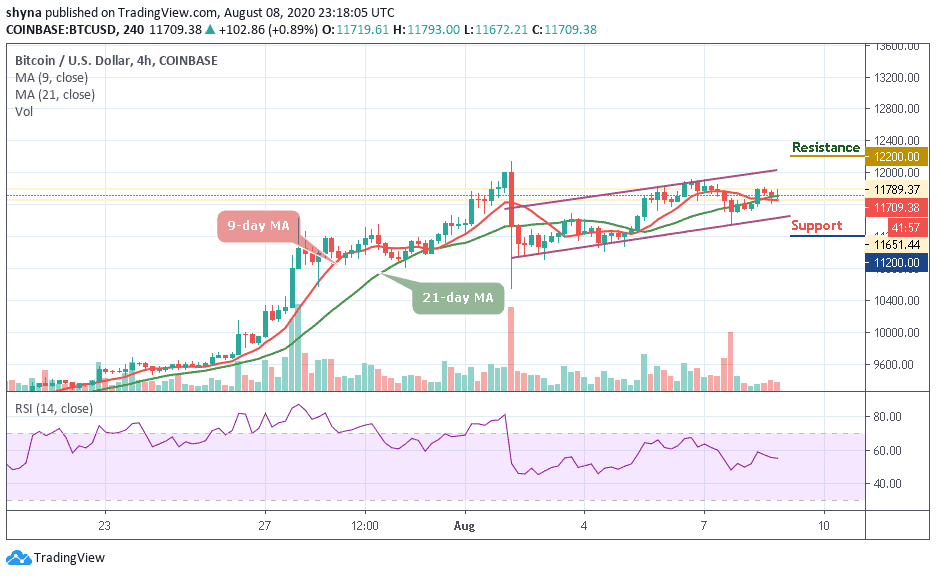

BTC/USD Medium-Term Trend: Bullish (4H Chart)

The 4-hour chart shows that the Bitcoin price touches the daily high at $11,814; this barrier may likely slow down the bulls as the coin may consolidate around the 9-day and 21-day moving averages before breaking above the channel to reach the important resistance at $12,200 and above.

On the downside, as the technical indicator (RSI (14) moves around 56-level, if the market price breaks below the moving averages and the technical indicator confirms it, the nearest support levels may come at $11,500 and $11,300 while the critical support is located at $11,200 and below.

Join Our Telegram channel to stay up to date on breaking news coverage