Join Our Telegram channel to stay up to date on breaking news coverage

The Bitcoin price is almost 3% up in the last 24 hours to auction for $36,738 as of November 9, 11:30 PM EST.

It followed a strong move past $36,000 and $37,000 during the early hours of the New York session on Thursday, exploding almost 10% to record an intra-day high past the $38,400 level.

The move north corrected just as fast, with almost $1 billion in open interest (the sum of all open long and short orders) wipe out the market. In the move north, Bitcoin price liquidated almost $1.6 million in short positions. The correction on the other hand saw around $17 million long positions wiped out.

For clarity, it is worth detailing that the move north followed a short squeeze among traders while the move south was a long squeeze. With more longs than shorts wiped out, it was an effective long squeeze.

The strong move-up and effective correction came as the crypto market, specifically Bitcoin holders, tried to get ahead of spot Bitcoin exchange-traded funds (ETFs) approvals. A statement by ETF specialist with Bloomberg Intelligence, James Seyffart, provoked this. He highlighted:

A ‘brief window’ opens tomorrow for SEC to potentially approve all 12 spot BTC ETF applicants, including Grayscale GBTC. It will be open for at least 8 days.

JUST IN: 🇺🇸 Bloomberg analysts say a "brief window" opens tomorrow for SEC to potentially approve spot #Bitcoin ETFs, and it will be open for at least 8 days. pic.twitter.com/CfDXylvd8v

— Bitcoin Magazine (@BitcoinMagazine) November 8, 2023

Bitcoin Price On Parabolic Expansion

Nevertheless, some analysts hold that it is more about price than news, noting that Bitcoin price has reached a place where it is setting up for parabolic expansion. This means that even without news, the king of cryptocurrency will keep rising, with onlookers inaccurately attributing the pump to news or speculation.

#BTC Weekly

Contrary to popular belief “price” will dictate the “news” and we’ve entered the phase of the market where price is setting up for parabolic expansion pic.twitter.com/mJDpCOASDN

— “Coosh” Alemzadeh (@AlemzadehC) November 9, 2023

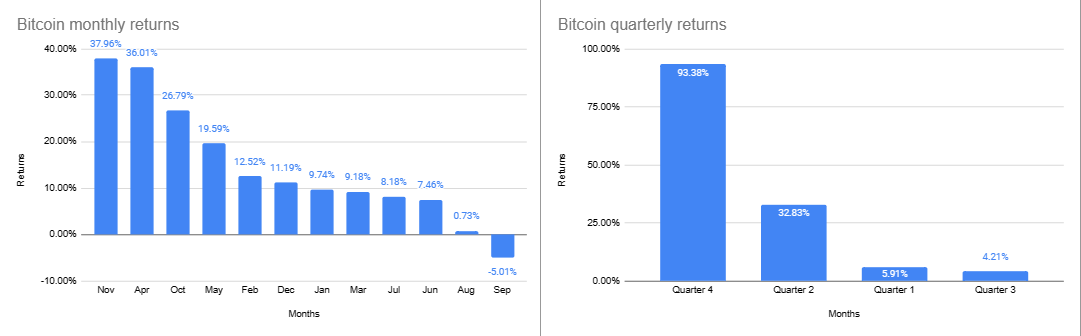

There could be some truth to this assumption, considering November has historically proven to be the best-performing month for Bitcoin in terms of returns. Refer to our previous article here for details.

This could mean that Bitcoin price is unstoppable from here on out, ahead of the BTC halving expected in April 2024.

Bitcoin Price Prognosis As Late Investors Find Themselves Sidelined

After breaking above the upper boundary of a rising parallel channel, Bitcoin price has brought the $40,000 psychological level within sight. Interestingly, the price managed to close above the upper boundary, though not decisively, to exchange hands for $36,738 at press time.

Prospects for more gains remain open, with the Relative Strength Index (RSI) still northbound to show momentum is still rising. However, its position at $82 shows that BTC is massively overbought, meaning it may not be prudent to open new positions, particularly for conservative traders. Rather, they should not close their current open positions. This is because the price could still rise as momentum continues.

The Awesome Oscillator (AO) is also positive, with the histogram bars turning green from red. It shows more bulls are still coming into play.

Conversely, profit-taking remains a threat to the upside potential of Bitcoin price and could trigger a correction, especially because BTC is already overbought. A break below the $35,500 support level would clear the way for an extended drop toward the $32,500 and $31,190 support levels in a downtrend.

A break and close below the aforementioned level would clear the path for a prolonged slump, potentially going as low as the $30,000 psychological level.

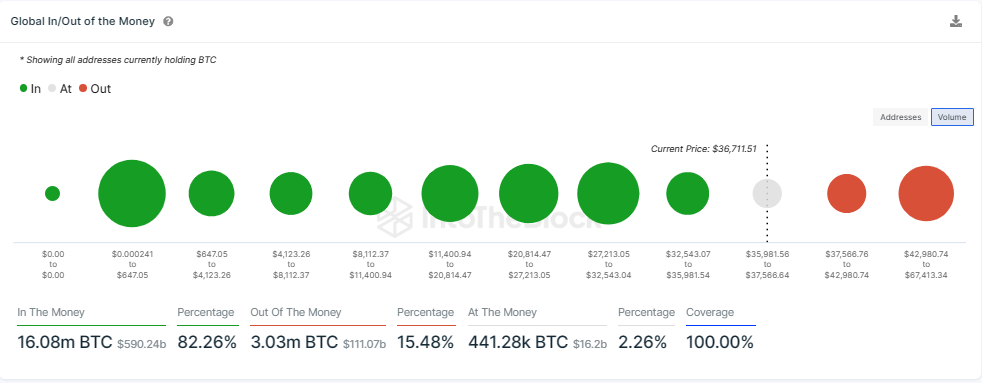

Bitcoin GIOM

The “Global In/Out of the Money” (GIOM) metric for on-chain aggregator IntoTheBlock supports the bullish outlook. It shows that at the current price, 82.26% of BTC holders are sitting on unrealized profit (in the money). This is relative to the 15.48% of token holders sitting on unrealized losses (out of the money). Only about 2.26% are breaking even (at the money).

The above difference reduces the effective volume of traders looking to sell as more holders look to ride the rally.

Bitcoin Alternative

As the hype around spot Bitcoin ETFs continues to brew, forward-looking investors have shifted their gaze to BTCETF.

Investors can buy BTCETF for just $0.005 using Ethereum (ETH) or Tether (USDT) stablecoin, or a bank card. With a target objective of $420,000 in stage one, the latest updates show that $251,000 is already in the bag.

#BitcoinETF has reached its first major milestone! 🎉

Raising more than $100K! pic.twitter.com/od7N5lhaM2

— BTCETF_Token (@BTCETF_Token) November 9, 2023

BTCETF powers the Bitcoin ETF Token ecosystem, front-running the spot BTC ETF narrative that Bloomberg’s Seyffart referred to. Now that Bitcoin price has breached the $36,000 level, and with $40K in sight, it is the best time to get in on the Bitcoin ETF Token bandwagon before it is too late.

#Bitcoin continues to soar as SEC's potential approval of multiple spot #BitcoinETFs fuels market optimism.

With $BTC crossing $36,700, all eyes are on the SEC's decision within the upcoming window.

Exciting times are ahead for the entire #Crypto world! 🚀#ETF #CryptoNews

— BTCETF_Token (@BTCETF_Token) November 9, 2023

Buy BTCETF here to witness first hand the groundbreaking initiative that will transform the crypto sphere with its forward-thinking approach toward upcoming Bitcoin ETFs. Notably, Bitcoin ETF Token is among the five best crypto presales to buy now. Do not miss out.

Also Read:

- How To Buy Bitcoin ETF Token – BTCETF Presale Review

- 3 Reasons Bitcoin Price Can Surge To $40,000 This Month, While Investors Shift $20,000 into Bitcoin ETF Token ICO

- Bitcoin Climbs to $37,000 While Bitcoin ETF Token Accrues $140,000, Emerging As A Top BTC Contender

- Bitcoin Price Prediction: As BTC Soars Past $36K, This Spot Bitcoin ETF Play Blasts Past $100K In Presale As Bulls Run Wild

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage