Join Our Telegram channel to stay up to date on breaking news coverage

The Bitcoin price soared 4% in the last 24 hours to trade for $46,717 as of 6:30 a.m. EST time, with trading volume surging 20%.

It comes as BTC bulls show strength, breaking a multi-week consolidation as BTC traded horizontally between January 27 and February 6. The show of strength seen in the Bitcoin price comes on the back of the BTC ETFs (exchange-traded funds) proving more attractive compared to alternatives in China, Europe, and Canada.

“[The] next wave of US ETF bulls coming from abroad as global funds lag – It isn’t just China investors, but Europe and Canada locals are also rushing to buy US-focused ETFs,” said Bloomberg Intelligence ETF analyst Eric Balchunas. “Flow percentages [are] way higher than aum [assets under management] percentages for most regions.”

Next Wave of US ETF Bulls Coming From Abroad as Global Funds Lag – It isn't just China investors, but Europe and Canada locals are also rushing to buy US-focused ETFs as flow % way higher than aum % for most regions.. awesome note today from @psarofagis & @RebeccaSin_SK pic.twitter.com/fsP1tfGTBI

— Eric Balchunas (@EricBalchunas) February 8, 2024

For China, it comes amid a constrained economy, causing investors to flock out of the country’s local market.

China so beat up and US at record highs and then you add on the premium, it becomes selling low and buying high on steroids, feels like it could end in tears for the local China investors.

— Eric Balchunas (@EricBalchunas) February 6, 2024

The same is seen in Europe and Canada, where lagging global funds have caused a flurry of investments into US-focused ETFs. This caused spikes in the total volume of ETFs traded in these regions.

Meanwhile, Bernstein and InvestAnswers forecast a massive rally for the Bitcoin price

Bitcoin Price Targets According To Bernstein and InvestAnswers

InvestAnswers, a renowned cryptocurrency analyst, says the Bitcoin price could soar 190% in 165 days. The analyst attributes this ambitious target to history.

“By my estimates… We are 165 days away from either an $80,000 Bitcoin or $130,000 Bitcoin, somewhere in between, by July 16th 2024,” InvestAnswers says. “Assuming history, assuming math, assuming supply, assuming money flows.”

The analyst also highlights that all the action for the Bitcoin price happens 90 days before the halving. In their opinion, this is the zone we are in now. After that, the analysts say the outlook could be relatively flat.

Elsewhere, a Bernstein report indicates that the Bitcoin price will explode to new all-time highs on ETF-fueled rallies. Analysts Gautam Chhugani and Mahika Sapra at the Wall Street brokerage giant say BTC will surge into the $70,000 range by the end of 2024.

#BitcoinUpdate 🚀 Analysts at Bernstein project Bitcoin's price to hit $70,000 this year, citing no significant obstacles. With positive macroeconomic conditions, growing ETF demand, and a potential SEC leadership change, they anticipate a 65% surge.

— BlockVoyager (@BlockVoyagerAIO) February 6, 2024

The analysts accredit this forecast to the impact of the recently approved spot BTC ETFs. In a separate analysis, 10X Research’s Markus Thielen says the Bitcoin price could hit $48,000 soon on the back of the Chinese New Year and extrapolate the gains to $52,000 by mid-March, before topping out in 2025.

#Bitcoin Could Hit $48K in Days, Propelled by Historic Chinese New Year Gains: 10X Research

The largest crypto rallied every time in the last 9 years by 11% on average around the Chinese New Year festivity, says 10X's Markus Thielen.#bitcoin #cryptocurrency #Blockchain

— block_chain news (@chain55058) February 9, 2024

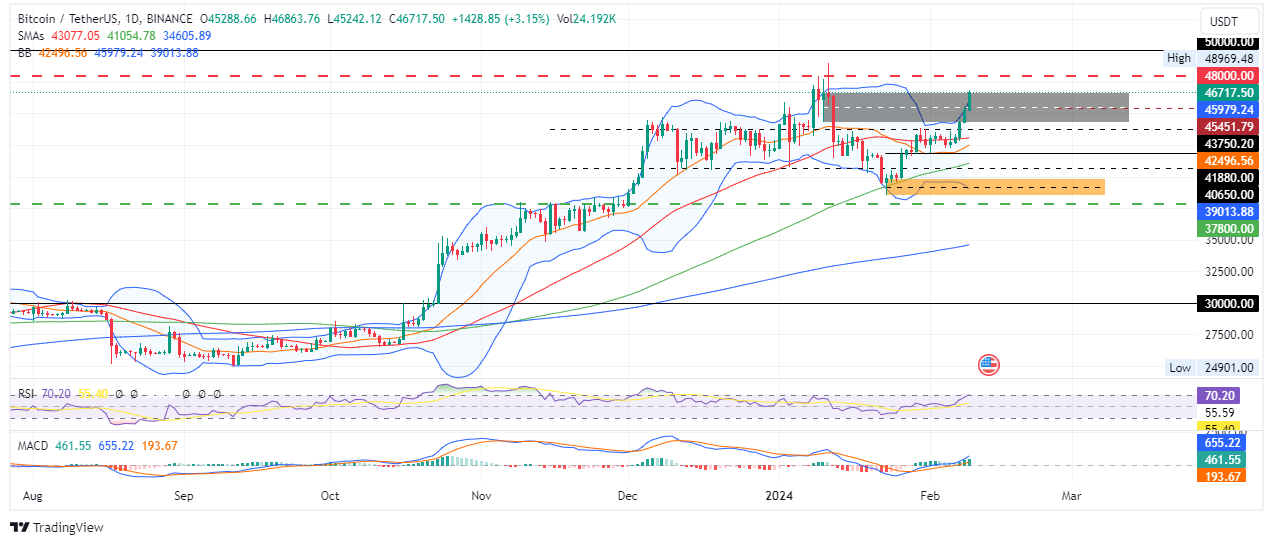

Meanwhile, the Bitcoin price continues to trade within a supply zone between $44,235 and $46,715. For a confirmed move north, it must record a candlestick close above the midline of this order block at $45,451.

This could pave the way for an extension to Thielen’s $48,000 target, or in a highly bullish case, reach the $50,000 psychological level. This would denote a 6% climb above current levels.

The Relative Strength Index (RSI) is northbound, pointing to rising momentum. This coupled with the green histogram bars of the Moving Average Convergence Divergence (MACD), adds credence to the bullish thesis.

TradingView: BTC/USDT 1-day chart

Converse Case

If profit booking kicks in, the uptrend could be cut short for the Bitcoin price. Also, noting the position of the RSI at 70, BTC is already overbought and caution is advised. This is particularly for investors looking to take new long positions for BTC. Those with current longs should leave them open as the upside potential remains alive.

In a southbound directional bias, traders should only be worried if the Bitcoin price records a candlestick close below the midline of the supply zone. Such a move could suggest the supply zone will hold as resistance, increasing the odds for a fall.

A correction could see BTC test the $37,800 level. For the bullish outlook to be invalidated, however, Bitcoin price must break below $30,000.

For investors eager to capitialize on other Bitcoin-related opportunities, consider BTCMTX, a booming ICO that analysts say is poised for exponential gains in 2024.

Promising Alternative To Bitcoin

BTCMTX, featured among the top five cryptos to invest in this year, is the powering token for the cloud-mining ecosystem, Bitcoin Minetrix. Here, community members can mine BTC in a decentralized fashion.

#BitcoinMinetrix is a cutting-edge cloud mining platform, empowering users to participate in decentralized $BTC mining.

By eradicating the risks associated with third-party cloud mining scams, it provides users with full command over their mining activities. 🔒 pic.twitter.com/MWZnuafYih

— Bitcoinminetrix (@bitcoinminetrix) January 18, 2024

The project changes the narrative from the traditional BTC mining approaches. In so doing, it spares investors the hassle of expensive hardware costs and massive space requirements. It also spares investors the high cost of buying BTC.

Mining #Bitcoin vs Buying $BTC? 🤔

💡 Contribute significantly to network expansion.

🔐 Gain greater control over the acquisition journey.

🛠️ Deepen understanding of the technological complexities. pic.twitter.com/O0asQryARd

— Bitcoinminetrix (@bitcoinminetrix) February 5, 2024

Investors looking to buy BTCMTX can do so on the official website for $0.0133. The price tag will hold for just about 19 hours before another price hike. So far, presale sales have reached $10.564 million, out of a target objective of $11.211 million.

#BitcoinMinetrix attains another remarkable milestone!

Surpassing $10,400,000. 💰 pic.twitter.com/6WaHtJCB4m

— Bitcoinminetrix (@bitcoinminetrix) February 9, 2024

Visit Bitcoin Minetrix to buy BTCMTX here.

Also Read:

- How To Buy Bitcoin Minetrix On Presale – Alessandro De Crypto Video Review

- Bitcoin Minetrix Presale Has Just Hours Left: Last Chance to Buy Before Price Rise

- Bitcoin Price Prediction: MicroStrategy Bolsters BTC Holdings With $37 Million Purchase As Experts Say This Bitcoin Derivative Might 10X

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage