Join Our Telegram channel to stay up to date on breaking news coverage

The Bitcoin price is down a fraction to trade for $42,157 as of 1:10 a.m. EST time, with trading volume surging nearly 15%.

It comes after BTC found an inflection point, marking a turnaround point from the 10% drop to the $38,555 intra-day after a break below the ascending channel.

With a new demand zone in place, the Bitcoin price is staging a recovery rally, steered by the hype of the possibility of BTC exchange-traded funds (ETFs) advertisements appearing on Google starting Monday, January 29.

🇺🇸 Google to start allowing #Bitcoin ETF ads in 4 days — effective from 29th of January. pic.twitter.com/milikbK3mz

— Bitcoin Archive (@BTC_Archive) January 25, 2024

Bitcoin ETF Ads Likely To Appear On Google Starting Monday

The US Securities and Exchange Commission (SEC) approved multiple spot BTC ETFs on January 10. With this landmark development, Bitcoin is now available via some of Wall Street’s biggest fund managers, including BlackRock and Fidelity.

With such products expected to meet updated criteria for ads on Google , Bitcoin ETF ads are soon likely to feature on the search engine’s advertisement board.

Considering Google is the biggest advertising network globally, boasting nearly 100,000 searches per second and representing approximately 90% of the global population, such an expansive reach looks poised to be a big boost for both BTC ETFs and Bitcoin itself.

OFFICIAL:

Google now allows advertising for #Bitcoin ETFs.

— BTC Proxy (@BTC_proxy) January 29, 2024

In the meantime, a marketing war is ongoing with Blackrock, Hashdex, and Bitwise, among others, already having run commercials for their spot Bitcoin ETFs.

BlackRock Rolls Out 'Boomer-Friendly' #BitcoinETF Ad #BlackRock chooses a mature, boomer-appealing strategy. 📈👴🏼💼 #BTCETF

1⃣ BlackRock new ad for its #Bitcoin ETF, $IBIT, is uniquely subdued, aiming at the wealthy boomer demographic. $BTC

2⃣ The ad features a calm, clear… pic.twitter.com/PzZiKroRxK— RichQuack (@RichQuack) January 15, 2024

Bitcoin Price Outlook: Week Ahead As BTC ETF Ads Go Live On Google

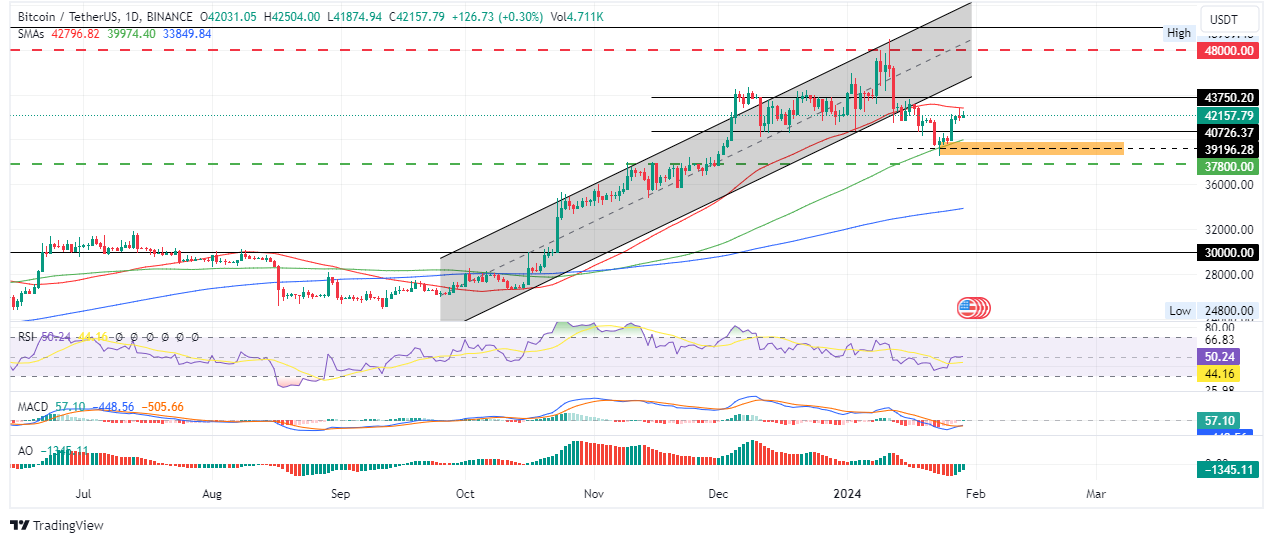

The Bitcoin price faces opposition from the 50-day Simple Moving Average (SMA) at $42,796. Nevertheless, the odds favor the upside and the recovery rally could extend north. To begin with, the Relative Strength Index (RSI) has restored above the 50 midline, pointing to the bulls regaining control of the price strength.

The histogram bars of the Awesome Oscillator (AO) have also recovered the green shade, steadily edging towards positive territory above the indicator’s midline. In addition, a close look at the Moving Average Convergence Divergence (MACD) indicator reveals a bullish crossover, executed when the MACD crossed above its signal line (orange band). These indicators favor the upside potential for the Bitcoin price.

If the bulls show fortitude, the Bitcoin price could shatter the resistance due to the 50-day SMA, flipping it into support before confronting the critical supplier congestion level, $43,750.

An extended push north could send the Bitcoin price to the $48,000 psychological level, or higher, reclaiming the $48,969 range high last tested on January 11. Clearing this local top would bring the $50,000 psychological level into focus, nearly 20% above current levels.

TradingView: BTC/USDT 1-day chart

Converse Case

However, if traders book profits now for the 10% gains made since the January 23 low of $38,555, the Bitcoin price could lose all the ground covered. This could see BTC rejected from the 50-day SMA to retract back to the $40,726 support.

An extended fall could see the Bitcoin price seek support due to the 100-day SMA at $39,974. If this buyer congestion level fails to hold as support, BTC could drop into the demand zone extending from $38,496 to $39,895. A break and close below the midline of this order block at $39,196 would confirm the extension of the fall, with BTC likely to revisit the critical support at $37,800, last tested on December 1.

Nevertheless, for the big-picture bullish outlook seen on the BTC/USDT daily chart to be invalidated, the price must record a daily candlestick close below the $30,000 psychological level.

On-Chain Metric To Support Short-Term Bullish Outlook For the Bitcoin Price

Among the on-chain metrics supporting the bullish thesis for the Bitcoin price in the short term is the BTC exchange flow balance. As shown in the chart below, this metric is on a steady downtrend, suggesting reducing intention to sell. With dwindling selling pressure on the king of cryptocurrency, the Bitcoin price upside potential becomes even stronger.

BTC Santiment: Price, Exchange Flow Balance

As indicated, the exchange flow balance is -87, where the negative indicates more BTC flowed out of exchanges than what flowed in. If it were positive, it would suggest more BTC was flowing into exchanges than what came in. Notably, enhanced inflows into exchanges are interpreted as an intention to sell.

Meanwhile, the countdown to the BTC halving, which is expected on April 24, continues. The event is considered a catalyst for the asset, as the Bitcoin price hit a new all-time high after halving in the past. With this, Bitcoin ownership is coveted more than ever, and that’s boosting the BTCMTX presale.

Promising Alternative To Bitcoin

The BTCMTX presale is giving investors easy and convenient entry into the Bitcoin Minetrix ecosystem. This is a cloud-mining project, where BTCMTX token holders get to stake their holdings for credits.

These credits are redeemable for mining hash power. With the entire process tokenized and decentralized, it gives investors a better deal than the traditional Bitcoin mining approach.

Tapping into the possibilities of mining $BTC with #BitcoinMinetrix! ⚙️

Embarking into #Crypto mining with ease:

🌟 Simple initiation for beginners.

💰 Cost-effective without hardware expenses.

🌆 No worries about space, noise, or heat.

🔄 Effortless upgrades with no hassle. pic.twitter.com/uUbXWLCL2z— Bitcoinminetrix (@bitcoinminetrix) January 28, 2024

BTCMTX is also ranked among analysts’ top picks for the best penny cryptos to buy with potential for great returns. Investors looking to buy BTCMTX, the powering token for the Bitcoin Minetrix ecosystem, can do so on the official website.

Each token is selling for only $0.0131, with the presale already accumulating upwards of $9.7 million and the target of $10.326 million within sight. But a price hike is coming in less than two days, which means there’s no time to lose for interested investors.

What makes #Bitcoin mining preferable over purchasing #Bitcoin? 🤔

✨ Play a crucial role in growing the network.

🔒 Attain increased autonomy in the acquisition process.

🔨 Develop a profound comprehension of technological intricacies. pic.twitter.com/757fijSIBX

— Bitcoinminetrix (@bitcoinminetrix) January 27, 2024

Visit Bitcoin Minetrix to buy BTCMTX here.

Also Read:

- How To Buy Bitcoin Minetrix On Presale – Alessandro De Crypto Video Review

- Bitcoin Minetrix Presale Has Just Hours Left: Last Chance to Buy Before Price Rise

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage