Join Our Telegram channel to stay up to date on breaking news coverage

Bitcoin (BTC) Price Prediction – June 2, 2020

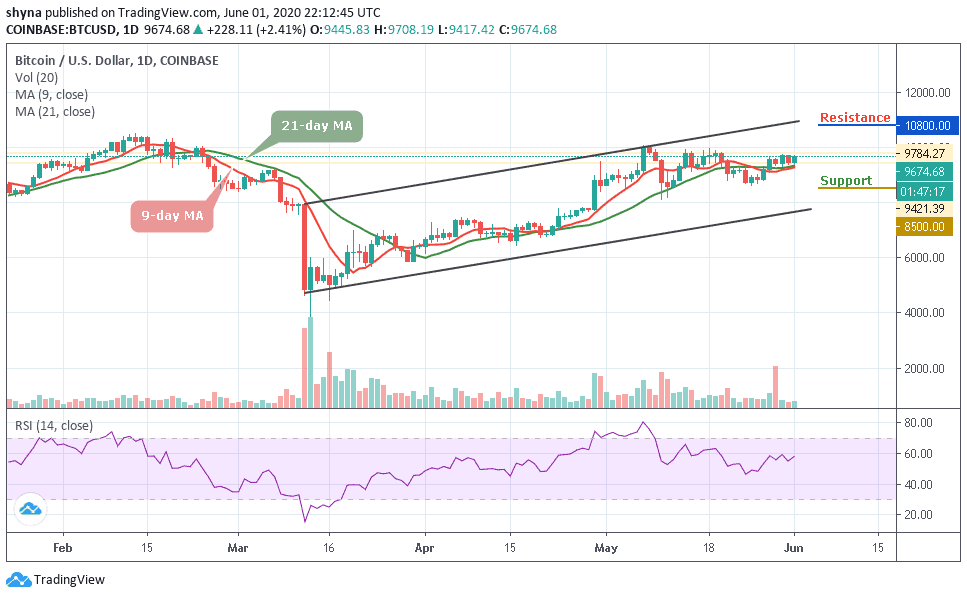

Yesterday, BTC/USD pair rebounded above the low of $9,600 as price broke through the resistances of $9,800, $9,950, and $10,000. It was a strong bounce that broke through these resistance levels. Besides that, the several retests at the overhead resistance have weakened the resistance zone. The question is can bulls sustain the upward momentum?

Key Levels:

Resistance Levels: $10,000, $11, 000, $12,000

Support Levels: $7,000, $6,000, $5,000

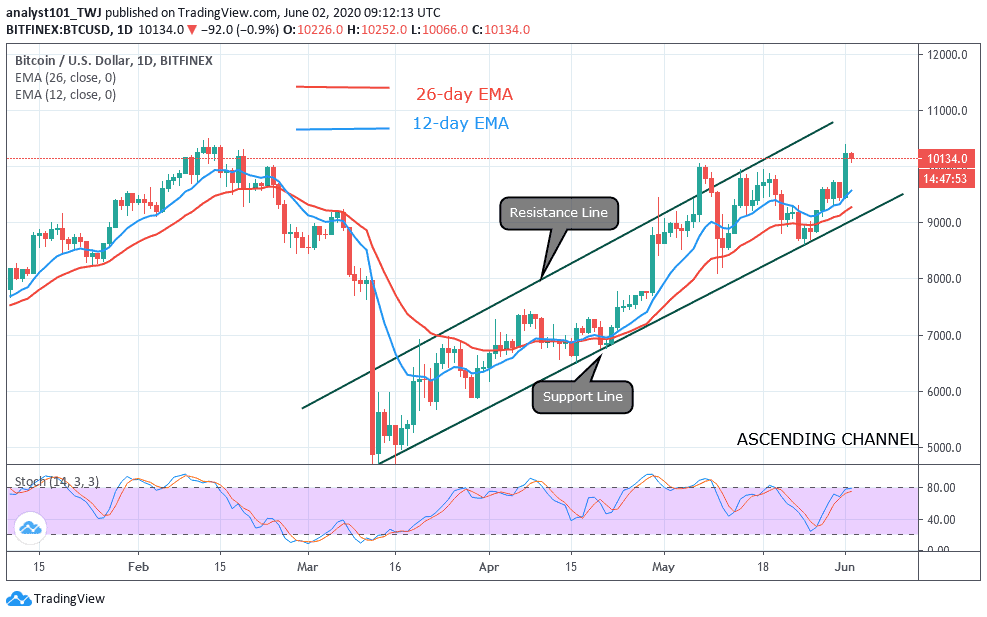

The upside range fluctuation has propelled Bitcoin to rebound. The bulls’ first attempt on May 30 was resisted at the $9,800 resistance and the market fell to the $9,400 support. The fluctuation continues upward to the high of $9,600 and BTC rebounded as price reached a high of $10,398. At the recent high, the market reached the overbought region. There is the possibility of the emergence of sellers at the overbought region to push prices down. In other words, BTC is likely to correct lower.

The market may retrace from the recent high to the support of either $10,000 or $9,950. Thereafter, a resumption of a fresh uptrend is likely. In the subsequent upward move, buyers will like to break the $10,398 resistance. A break above the current resistance will push price to $10,500. Nonetheless, Bitcoin has reached above 79 % range of the daily stochastic. This implies that the market is in a strong bullish momentum as price is overbought.

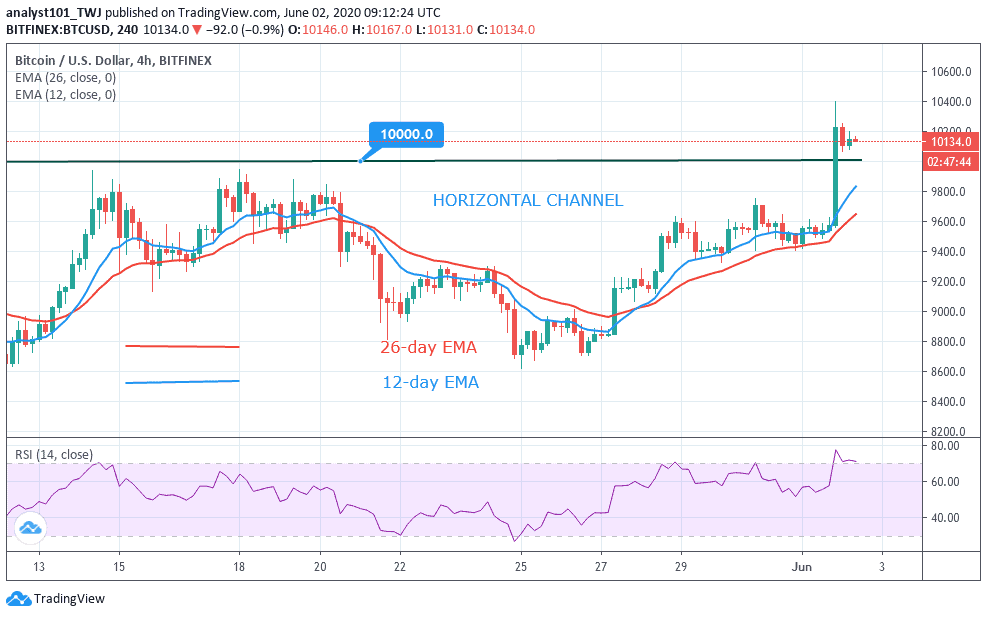

BTC/USD Medium-term Trend: Bullish (4-Hour Chart)

On the 4 hour chart, buyers have successfully broken the $10,000 overhead resistance. Presently, the market is retracing as it finds support above $10,000. BTC is fluctuating above $10,000 for a possible upward move. On the upside, if price breaks above $10,400, it will rally above $11,000. On the downside, if the bears break the $10,000 support, BTC will find support at either $9,950 or $9,875. Presently, BTC rose to level 77 before dropping to 71 of the Relative Strength Index.

Please note: Insidebitcoins.com is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results.

Join Our Telegram channel to stay up to date on breaking news coverage