Join Our Telegram channel to stay up to date on breaking news coverage

The Bitcoin price has dropped a fraction to trade for $68,585 as of 2:20 a.m. EST on trading volume that surged 40%.

It remains range-bound with all eyes on the $70,000 milestone after a peak of $69,990 recorded on March 8. The closest it came to retaking this new all-time high was on Sunday, when the BTC price recorded an intra-day high of $69,887.

This comes as BlackRock’s BTC holdings have surpassed those of Michael Saylor’s MicroStrategy.

NEW: BlackRock overtakes MicroStrategy in the competition for largest #Bitcoin stack 😮 pic.twitter.com/kBZoqvmFa7

— Bitcoin News (@BitcoinNewsCom) March 9, 2024

BlackRock Overtakes MicroStrategy In BTC Ownership As Bitcoin Eyes $70K

Based on BlackRock’s latest disclosure, its IBIT spot Bitcoin ETF has acquired up to 195,985 BTC since January 10. This saw IBIT surpass MicroStrategy’s BTC holdings of 193,000 Bitcoin tokens acquired since August 2020, as of February 26.

[1/4] Bitcoin ETF Flow – 08 March 2024

All data in. $223m positive net flow for thew day

The assets of the ETFs excluding GBTC are now over $28 billion, this is now larger than GBTC's assets for the first time pic.twitter.com/5BlBTu4WLn

— BitMEX Research (@BitMEXResearch) March 9, 2024

For MicroStrategy, the business intelligence firm’s interest in BTC is steered by its longstanding CEO, Michael Saylor. Under Saylor’s stewardship, the firm has been acquiring BTC since it became the first publicly listed company to do so in August 2020.

What started with a $250 million purchase, advertised as part of its “new capital allocation strategy” intended to maximize value for shareholders, has transcended into a series of purchases as BTC readies for its next bull cycle. For BlackRock, its holdings come on the back of institutional interest in BTC.

Meanwhile, proponents such as billionaire hedge fund investor Bill Ackman are drawn to BTC, saying he is considering buying the pioneer cryptocurrency as the Bitcoin price could “go to infinity” and “collapse the economy” if demand continues to rise.

Billionaire hedge fund investor Bill Ackman suggests #Bitcoin could "go to infinity" and "collapse the economy" if demand continues to rise.

"Maybe I should buy some Bitcoin." 👏 pic.twitter.com/FXfnjAJTaH

— Bitcoin Magazine (@BitcoinMagazine) March 10, 2024

Bitcoin Price Outlook As BlackRock And MicroStrategy Demonstrate Institutional Interest In BTC

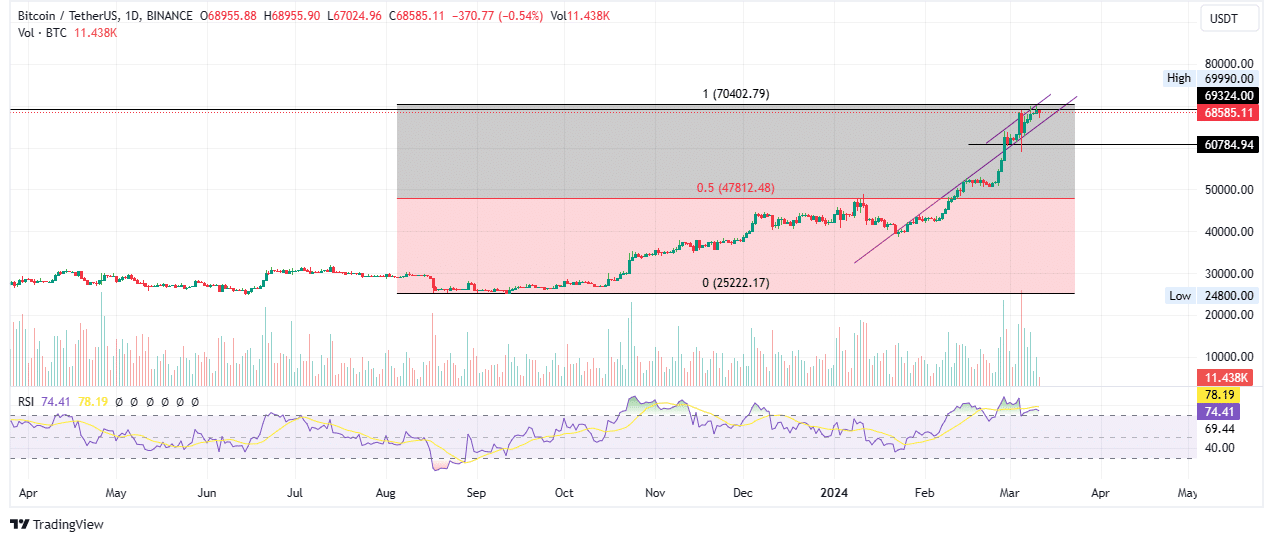

The Bitcoin price is trading within an ascending parallel channel, but the $69,324 threshold, the March 5 peak, caps the upside potential. The histograms of the volume indicator are reducing in volume, suggesting a weakening bullish trend.

However, the Relative Strength Index (RSI) is still northbound, suggesting rising momentum. This shows the bulls are still at play. More interestingly, the RSI is at the cusp of a bullish crossover, which could be executed once the RSI crosses above the yellow band of the signal indicator. If this buy signal is executed and the traders heed, the upside potential for BTC could froth.

If buying pressure increases, the Bitcoin price could extend north, shattering the $69,324 blockade before reclaiming the March 5 peak of $69,990. In a highly bullish case, the gains could extend to Coinbase Exchange’s peak price for BTC at $70,000, with prospects for extended gains.

TradingView: BTC/USDT 1-day chart

On the other hand, the RSI reading above 70 shows BTC is overbought. This coupled with the reducing volume indicator puts BTC at risk of a correction. If profit takers pull the trigger, the Bitcoin price could descend to the $60,000 threshold. Here, late traders and sidelined investors could find another buying opportunity.

Meanwhile, as the Bitcoin price eyes the $70,000 threshold but remains capped below $69,324, investors continue to buy GBTC as part of their portfolio diversification strategies.

Promising Alternative To Bitcoin

GBTC is the powering token for the Green Bitcoin ecosystem, a project that meets users at the place where the legacy of Bitcoin merges with the eco-friendly attributes of Ethereum. It is a predict-to-earn project that introduces the revolutionary Gamified Green Staking mechanism.

Green Bitcoin goes GLOBAL, with our campaign drawing thousands of supporters from every corner of our world.

We thank you. pic.twitter.com/dRUyegB7PQ

— GreenBitcoin (@GreenBTCtoken) March 7, 2024

That sustainable staking model allows users to earn passive income through staking rewards that are gamified. Under this gamified staking, holders predict the Bitcoin price in daily contests and earn rewards when they are right.

Green Bitcoin project participants enjoy up to 100% token bonuses for fresh gaming price challenges presented every week. You can participate in the daily and weekly BTC price prediction challenges, with the potential to earn attractive rewards.

Staking currently offers an annual return of about 156% with 3.7 million tokens already staked.

Buy Green Bitcoin’s GBTC tokens on the website at current presale rates. Hurry and take advantage of the low price to buy GBTC at pocket-friendly rates as the token will never be this affordable again.

Visit Green Bitcoin to buy GBTC here.

Also Read:

- How To Buy Green Bitcoin On Presale – Alessandro De Crypto Video Review

- Could Green Bitcoin (GBTC) Be a Better Investment for the Pre-Halving Bitcoin Rally?

- Prediction: Here’s Why Green Bitcoin Will Climb 10X on its Launch

- Should You Consider Adding Green Bitcoin To Your Investment Portfolio? Cilinix Crypto Presale Reviews

- Best Crypto to Buy Now (2024): Top Picks for Explosive Growth!

Join Our Telegram channel to stay up to date on breaking news coverage