Join Our Telegram channel to stay up to date on breaking news coverage

Bitcoin price is down 1% in the last 24 hours to trade for $45,788 as of 4:30 a.m. EST time, with trading volume dropping 15%.

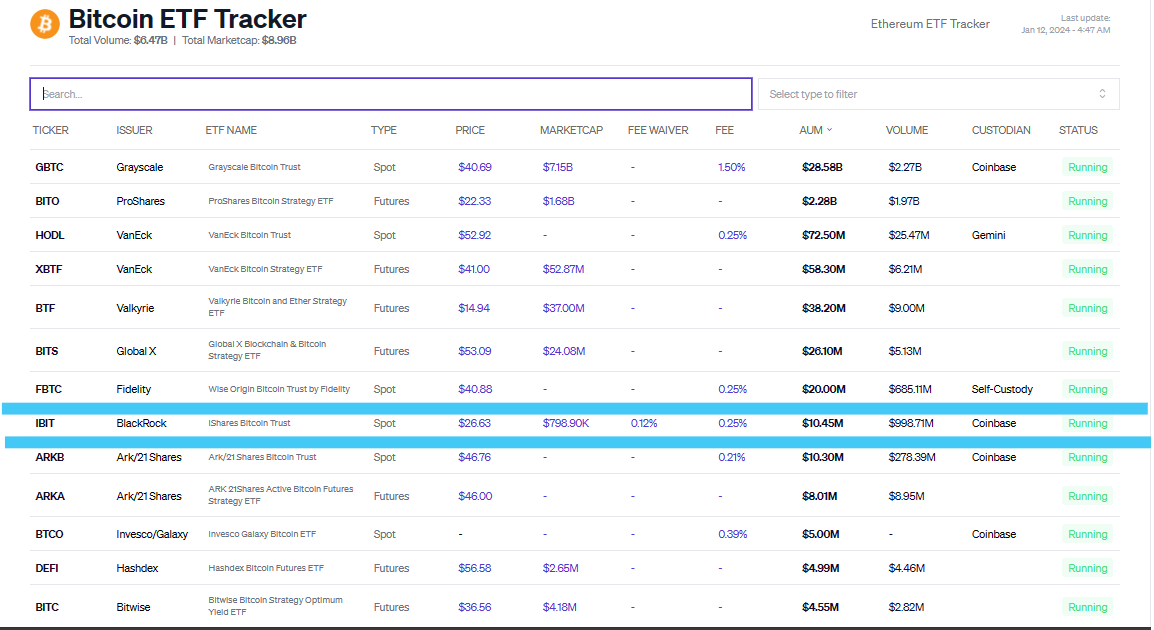

The muted price action came despite trading in spot BTC exchange-traded funds (ETFs) getting off to a roaring start on Jan. 11. ETF trading volumes hit millions of dollars minutes after trading commenced, and billions within the hour. By the close of business, trading volume had soared to $4.6 billion.

Here's the #Bitcoin ETF Cointucky Derby data via trading volume on day 1 (more volume will continue for a little while).

Total Volume was over $4.6 Billion with $GBTC about half of it. BlackRock & Fidelity went 1 & 2 absent GBTC. pic.twitter.com/t70MzyQfZW

— James Seyffart (@JSeyff) January 11, 2024

Bloomberg’s ETF expert Eric Balchunas revealed that the 11 approved ETFs saw 700,000 individual trades, which is double that of Invesco’s QQQ trust based on the Nasdaq index.

All told there were 700,000 individual trades today in and out of the 11 spot ETFs. For context, that is double the number of trades for $QQQ (altho it sees much bigger $ volume bc bigger fish use it) So a lot more grassroots action (vs big seed buys) than I expected which is… pic.twitter.com/syUGfjHQpr

— Eric Balchunas (@EricBalchunas) January 11, 2024

According to Blockworks live Bitcoin ETF Tracker, BlackRock trading volumes are nearing the $1 billion mark today, recording $996.7 million as of 4:55 a.m. EST time. This is after topping the $1 billion mark on Thursday.

Vanguard Blocks Clients From Buying Spot Bitcoin ETFs

Meanwhile, Vanguard, a $7.7 trillion asset manager, is blocking clients from buying spot BTC ETFs. The exclusion from its brokerage platform has raised concerns, prompting calls for a boycott.

JUST IN: $7 trillion Vanguard blocks clients from buying spot #Bitcoin ETFs on their platform. pic.twitter.com/sfh9uFTtUC

— Crypto Masters ME (@crypto__me) January 12, 2024

Vanguard said that “Spot Bitcoin ETFs will not be available for purchase on the Vanguard platform” because they “do not align” with the asset classes that “Vanguard views as the building blocks of a well-balanced, long-term investment portfolio.”

Some investors expressed frustration and a Wall Street Journal report noted that Vanguard’s decision amplifies the debate over the accessibility of crypto investments.

The Latest Breaking News 📣

— #BlackRock’s new Spot #BitcoinETF tops $1B in big first day of trading

— Vanguard blocks clients from buying #BitcoinETFs

— Robinhood lists all 11 Spot #Bitcoin ETFs on trading app

— Terra founder Do Kwon asks court to delay SEC trial for… pic.twitter.com/BG05PMjc2w

— CryptoRank.io (@CryptoRank_io) January 12, 2024

Some customers were so miffed that they said they closed their accounts.

Vanguard refuses to let customers buy #Bitcoin ETFs with their own money.

So customers are closing their accounts‼️ pic.twitter.com/11o1tOHR9S

— Bitcoin Archive (@BTC_Archive) January 11, 2024

Senior engineering manager at Coinbase Yuga Cohler declared intention to convert his Roth 401(k) savings at Vanguard to Fidelity, where he could gain exposure to spot Bitcoin ETF trading.

I have 8 years worth of 401K savings at @Vanguard_Group from my time as an employee at Google.

I will be rolling over these funds to @Fidelity.

Vanguard's paternalistic blocking of Bitcoin ETFs does not fit in with my investment philosophy. https://t.co/eKmgo0xK5h

— yuga.eth 🛡 (@yugacohler) January 11, 2024

Neil Jacobs, a Bitcoin commentator, said he would transfer funds out of Vanguard because of the “terrible business decision.”

I have a retirement account with Vanguard.

I called them and they said they will NOT be offering ANY of the Bitcoin ETFs.

I’m working on transferring assets out of there and then I will close my Vanguard account.

Terrible business decision by Vanguard.#Bitcoin pic.twitter.com/Q2OFcybqMQ

— Neil Jacobs (@NeilJacobs) January 11, 2024

Back to the skyrocketing trading volume, a lot remains to be said concerning its implication for the Bitcoin price. To begin with, the lackluster performance of BTC on the first trading day could quickly go the opposite way despite investors flocking to ETFs lured by enticing ETF inflow headlines.

https://twitter.com/HsakaTrades/status/1745315940235948049

Bitcoin Price Outlook As BTC Hits Two Year Peak

After crossing the $48,900 level on January 11, Bitcoin price hit a two-year peak. The last time BTC came this high was in December 2021.

Bitcoin price is trading within the weekly supply zone ranging from $40,467 to $46,999. A continuation of the primary trend will be confirmed once the supply order block is flipped to a bullish breaker, above the $48,000 psychological level.

Enhanced buyer momentum could see Bitcoin price extend north to clear the January 11 high of 48,969. In a highly bullish case, the gains could extend for BTC to complete an 8% climb to the $50,000 psychological level.

The Awesome Oscillator (AO) is in positive territory, flashing large volumes of green histogram bars. This suggests the bulls have established a strong presence in the BTC market. This favors the upside.

Conversely, with the Relative Strength Index (RSI) at 77, BTC is already overbought and a pullback could be underway. Increased seller momentum could see Bitcoin price could drop, testing the midline of the weekly supply zone at $43,916. An extended fall could see BTC find support due to the critical level of $37,800, or lower, the centerline of the Bollinger indicator at $34,959.

If the aforementioned buyer congestion levels fail to hold as support, Bitcoin price could nosedive to the $30,000 psychological level. A break and close below this level would invalidate the big picture bullish thesis.

Meanwhile, now that the spot BTC ETF campaign has concluded, the market is looking ahead for the BTC halving, slated for April, and the next big catalyst likely to boost Bitcoin’s price.

With this, forward-looking investors are flocking to BTCMTX, a token that grants them entry into an ecosystem where Bitcoin ownership is possible even for the ordinary folk. It features among the top 3 crypto presales to buy into and analysts’ top choices for cryptocurrencies to buy in 2024.

Promising Alternatives To Bitcoin

BTCMTX is the powering token for the Bitcoin Minetrix ecosystem, a stake-to-mine project that uses a cloud-mining mechanism. BTCMTX token holders stake their holdings for mining credits, and then redeem these credits for mining hash power.

Advantages of #BitcoinMinetrix:

Convenient accessibility.

Efficient cost structure. 💵

Abundant space and peaceful environment.

No concerns about resale value. 🔁 pic.twitter.com/slptHOIHNk

— Bitcoinminetrix (@bitcoinminetrix) January 11, 2024

The project is in the presale stage, recording upwards of $8.286 million of its $9.103 million target as investors look to get in on the action ahead of the halving.

The #PhoenixGroup secures a $187 million deal with @BITMAINtech for #Bitcoin mining machines, following their recent IPO and partnerships.

What's your take on their strategic moves?💡#BitcoinMinetrix also achieves another milestone and surpasses $8,200,000! 🎉 pic.twitter.com/zoLvO5vxw6

— Bitcoinminetrix (@bitcoinminetrix) January 11, 2024

Analysts say this penny crypto has potential for exponential growth. Investors looking to buy BTCMTX can do so on the website, where each token is selling for $0.0128.

To buy BTCMTX in the presale, visit the website here.

Also Read:

- How To Buy Bitcoin Minetrix On Presale – Alessandro De Crypto Video Review

- Bitcoin Minetrix Presale Has Just Hours Left: Last Chance to Buy Before Price Rise

- SEC Approves Bitcoin ETFs, But Gary Gensler Makes It Clear His War On Crypto Isn’t Over

- Bitcoin ETF Hype Helps Attract $151 Million In Inflows To Crypto Funds In The First Week Of 2024

- Bitcoin Price Prediction: As BTC ETFs Usher In A New Era For Crypto, This Bitcoin Derivative Looks Poised To Explode

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage