Join Our Telegram channel to stay up to date on breaking news coverage

Bitcoin currently appears to be heading back to $23k, after crossing the $24k level once on Thursday. Reports from experienced traders suggest that if Bitcoin fails to sustain the $23k level, it might be headed for a near bottom. How true is this? Let’s find out.

Bitcoin Back To $23k After $25k Not In Sight

The crypto market recently saw a mixed reaction in trading following Federal Reserve Chairman Jerome Powell’s announcement that inflation is starting to ease and the Federal Reserve’s 0.25% increase in interest rates.

While Bitcoin saw a decline of 0.82% to reach $23,450, Ethereum broke past the $1,600 barrier. With a 24-hour trading volume of $20.58 billion, which is close to where it was yesterday, Bitcoin continues to perform well.

Recently, Bitcoin exceeded even the most optimistic price predictions and reached new heights. After testing the $22,500 support on February 1st, it gained 6.5% in just five hours and hovered around the $24,000 level before dripping back below the price level. It’s worth noting that the 40-day correlation between Bitcoin and the S&P 500 is still above 75%.

On the other hand, Ethereum has been hovering around the $1,680 resistance level for well over a couple of weeks now. Despite the uncertainty in the market, the optimistic trend in Ethereum’s price chart and bullish investor outlook towards ETH derivatives give rise to the possibility of the price of Ethereum reaching $1,800 or even surpassing that by the end of next month.

Market Sentiment Shares A Bearish Outlook For Bitcoin

Bitcoin’s price has been steadily trending above the $23,000 level, reflecting the token’s bullish trend in recent weeks. The current trend is largely driven by the United States Federal Reserve’s recent adoption of a dovish monetary policy stance. However, not all investors are on board with this bullish trend, as many are expecting a decline in the price for digital assets.

Coinmarketcap’s Price Estimates provide insight into investor sentiment, and the latest round of predictions shows a bearish outlook for Bitcoin. This feature on the platform allows individual users to submit their price expectations and gives an estimate of all the predictions. The median estimation for February came out to a price of $20,000, a 14.69% drop from the current price. If this prediction proves accurate, it could result in a significant decline for Bitcoin.

The bearish sentiment extends beyond just the month of February, and investors are expecting a decline in price for the next five months. The median estimate for March came out to a price of $19,500. Out of the 34,000 votes collected, the average estimate was $20,203.57, while the median was much worse at $19,659.

It’s important to note that while Price Estimates are a useful tool to gauge investor sentiment, it is not a guarantee of future price movements. Market sentiment and investor sentiment are two separate things, and market conditions can change rapidly, leading to fluctuations in price.

While Bitcoin’s price continues to trend above $23,000, many investors are expecting a price decline. However, the cryptocurrency market is known for its volatility, and any number of factors could impact the price in the coming months. Investors should leverage their personal research on a token before making any investment decisions.

Technical Analysis Says Otherwise

There has been ongoing debate recently about whether the current upward trend of Bitcoin is sustainable. Despite this, the digital currency is still exhibiting signs that suggest its price may continue to climb. For instance, it is trading well above key moving averages.

Additionally, Bitcoin has now established support just above the $23,000 level, indicating that the bulls remain in control. Despite not reaching the $24,000 mark, the cryptocurrency still maintains enough momentum to possibly retest that level. With trading volumes of over $21 billion in the last 24 hours, as long as support remains above $23,000, the likelihood of a significant dip is low.

At the moment, Bitcoin is trading at around $23,470 and has seen a 0.02% drop in the last 24 hours, but a 2.08% increase over the past seven days. Recently, it fell for a third straight day after hitting a high of $24,262, its highest point since August of last year.

According to the 14-day relative strength index, Bitcoin’s recent decline has put the index at 68.41, slightly above the 68.00 support level that it maintained yesterday. Should this floor not hold, it could result in continued bearish sentiment and push the price below $23,000.

As discussed in the analysis for last month, the sideways movement was predicted for Bitcoin after its sharp rally in January, which is exactly what was observed this week between $21,800 and $23,800. A potential breakout above the $23,800 resistance could result in a positive week for traders, with the next resistance level at $25,400. With multiple failed attempts to break this resistance, the chances of a successful breakout have increased.

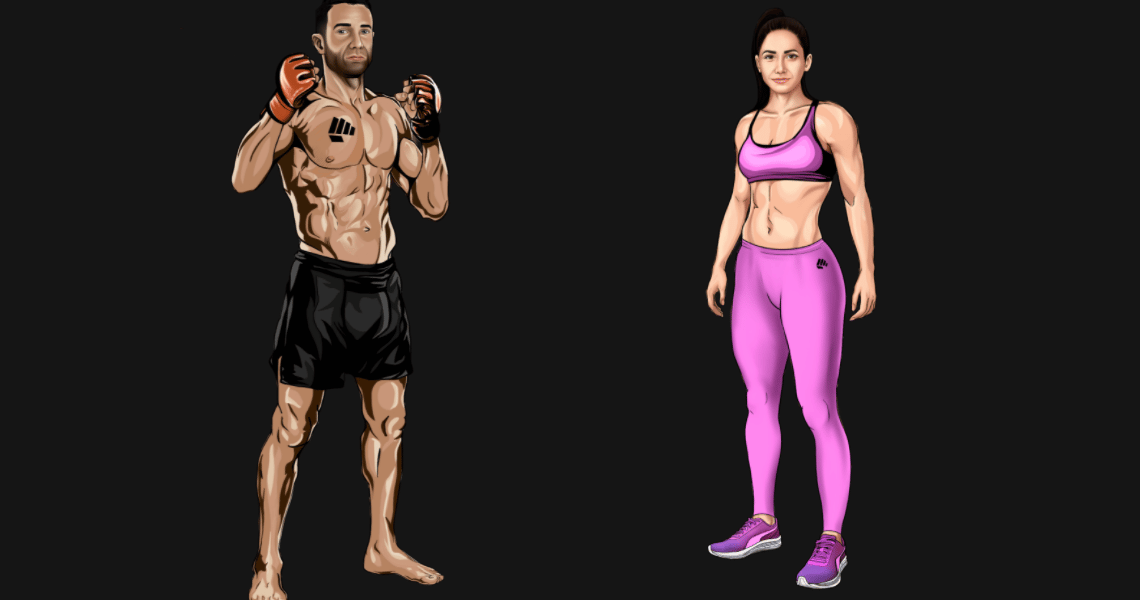

No More Excuses For A Healthy Lifestyle With Fight Out

Investors looking for a promising new cryptocurrency in the growing “move-to-earn” (M2E) niche may want to take a look at Fight Out. This unique project aims to gamify fitness and weight loss through an app. Once downloaded, users will be able to build a profile and receive custom workouts from top coaches, complete with HD videos demonstrating each exercise.

When a workout is finished, the app will track the user’s progress and reward them with REPS, FightOut’s off-chain currency. REPS can be used to purchase items from the Fight Out store, such as supplements and apparel. Additionally, Fight Out has its own ERC-20 token, FGHT, which can be used to buy more REPS and has exciting future plans, including serving as the transactional currency for the Fight Out Metaverse.

Fight Out is currently undergoing a presale of FGHT tokens, which are currently priced at $0.01949 and come with bonuses of up to 50% based on the investment amount and vesting period.

Fight Out sets itself apart from other M2E projects like STEPN, as it offers a more comprehensive approach to tracking and rewarding fitness without any expensive NFT buy-ins. The Fight Out app, set to launch in Q2 2023, will leverage smartphone and wearable technology to monitor physical performance and feature its own in-house tokenized economy.

The presale of the FGHT token has already raised $3.88 million and is expected to list on centralized exchanges in April at $0.033 per token. This could lead to potential paper gains of around 100% for early investors. With Fight Out’s ambitious goals to create an integrated web3 fitness experience and acquire gyms across the world’s major cities, it may be a smart investment opportunity.

Related Articles

Join Our Telegram channel to stay up to date on breaking news coverage