Join Our Telegram channel to stay up to date on breaking news coverage

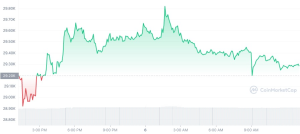

Bitcoin seems to be hitting its bullish strides one hundred dollars at a time. The largest crypto asset by market cap has recently touched the $29,300 price peg after scaling above the $29,100 resistance level yesterday.

Now, the foremost cryptocurrency is currently finding support at $29,200 with the potential to rally once more.

Could Bitcoin close the week above the $30,000 psychological threshold?

Bitcoin Building Momentum as Bullish Waves Gather

At press time, the Bitcoin price is standing at $29,272.64, reflecting a 0.61% increase in the last 24 hours.

In the past couple of weeks, Bitcoin has continued to consolidate its hold on the burgeoning crypto market and has since increased its share to 47.1%.

Despite the 23,000-odd altcoins vying for attention, Bitcoin is still the prize for many investors. This is in spite of a forgettable weekly performance of minus 0.26% in the last seven days.

Due to its deflationary framework, Bitcoin’s strength has largely been retained in its long-term potential to hedge against recurrent inflation.

Given its first mover advantage (FMA), the 14-year-old decentralized currency is still the top favorite for many.

The digital asset has added 3.78% in its price gain in the last 30 days, 25.32% in the last 90, and 39.84% in the last 180 days.

The token has also kept a strong green zone performance for its year-to-date (YTD) price gain with an impressive 76.73% despite an inclement regulatory climate for digital assets.

These metrics show the tenacity surrounding Bitcoin and the crypto market as a whole.

However, where the bulls are fixating their immediate target is if Bitcoin could surge above the $30,000 price peg.

This point has served as a strong resistance level, with the digital currency bouncing back several times.

With its strong technical indicators, crypto experts expect a change of guard soon enough.

Its 50-day smooth moving average (SMA) price of $28,549.42 shows that Bitcoin is on a hot streak in the middle of the trading park. In addition, its year-on 200-day SMA price of $21,825.37 displays how much growth the asset has experienced in the last couple of weeks.

However, if it capitulates under intense selling pressure, which is becoming highly unlikely given its continued rally, Bitcoin could comfortably find support around the $28,500 price peg.

For investors seeking even more clarity about potential entry points, Bitcoin’s relative strength index (RSI) oscillator figure of 54.48 shows that it is still underbought, making now a good time to buy Bitcoin and rise with the market.

The asset’s moving average convergence divergence (MACD) is still in its formative stage. However, the buy signal is slowly forming as the bulls increase their hodl positions on the famous blockchain asset.

Hard Line to Tow

Bitcoin’s emergence in the last decade and a half has been an eye-opener to many and a threat to several world governments.

With poor fiscal policies, more investors are turning to the crypto king to help store their value. However, the traditional financial landscape is not planning to go out with a punchline.

JUST IN: In response to receiving a loan from the IMF, 🇦🇷 Argentina is making good on their promise to go hard against crypto.

A new law goes against the constitution and prohibits payment service providers from offering their customers #Bitcoin 😱 pic.twitter.com/s5odOtgpnI

— Bitcoin News (@BitcoinNewsCom) May 5, 2023

In a recent law, the Argentina government has outlawed banks from enabling Bitcoin purchases through their payment infrastructure.

This decision was made following the recent financial aid it received from the International Monetary Fund (IMF) to prop up its economy.

Despite this external debt policy, the Argentinian economy is battling with a 104% inflation rate forcing many to criticize the government’s poor decision.

However, this recent measure has not dampened interest in the crypto asset. Instead, Bitcoin recently hit a new all-time high (ATH) in Argentina as their inflation continues to soar unmitigated.

Bitcoin recently hit a new ATH in 🇦🇷 Argentina as inflation soared to record highs.#Bitcoin is hope ✊#BuyTheNumbers powered by @HiveBlockchain pic.twitter.com/ceYqKcdwqB

— Wiser Miner | Bitcoin Mining Solutions (@WiserMiner) April 28, 2023

The data curated by HiveBlockchain shows that BTCARS price is over 118% YTD, meaning more Argentinians are turning to the decentralized asset as the most accessible means of protecting their wealth.

With record inflation rocking many economies, Bitcoin could ride on this wealth-sapping wave to regain its previous $69,000 ATH within this year.

Related News

- Bitcoin Price Climbs to $29,100 – Slow and Steady to the Top?

- Bitcoin Price Prediction for Today May 4: BTC/USD Retreats; Could it be a Recovery to $30,000 Resistance?

- Bitcoin Price Prediction for Today, May 5: BTC’s Rising Trend Comes to a Halt below $30K

Join Our Telegram channel to stay up to date on breaking news coverage