Join Our Telegram channel to stay up to date on breaking news coverage

The crypto market is back on the bullish track, and Bitcoin is leading the charge in its usual fashion.

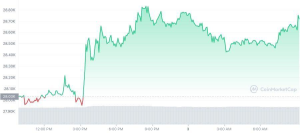

The foremost crypto asset is showing a positive increase of 2.45% in the last 24 hours as it climbs toward the $28,700 price peg.

Two days ago, Bitcoin reached a mid-term low of $27,746.85 but has since rebounded with a bullish trend.

On its current price trajectory, the bulls are targeting a psychological threshold of $30,000 in the coming days as the cryptocurrency market makes a long-awaited comeback.

This bullish sentiment is reinforced by the fact that the cryptocurrency currently trades above its short-term 50-day moving average (MA) price of $28,650.

While this might seem negligible, the 200-day MA price of $21,984.83 shows huge potential for a continued upward trend.

The resurgence of Bitcoin can be attributed to important macroeconomic events that have impacted the global financial space, particularly the U.S. economy.

Also, the expected release of a new interest rate by the U.S. Federal Reserve today is a much-needed boost for the price performance of the famous proof-of-work (PoW) digital currency.

Feds’ Expected Interest Rate Hike and PCEI Index Pointing to Swerving Investor Climate

The U.S. Federal Reserve is expected to place a new benchmark rate for its federal funds rate today in its ongoing Federal Open Committee Meeting (FOMC).

According to market experts, the Feds are expected to raise the interest rate by 25 basis points (bps) in the next round of hikes.

This will make it the highest level the U.S. central bank has raised its interest rates in the last 16 years.

About 89% of market experts believe that Feds’ officials will go with this new direction in its interest rate decision, while 11% believe that the interest rate would remain at 5%.

Nonetheless, experts believe that the recent hike will be the last for a long time.

📢💥#FedMeetingAlert💥📢

🚨Today marks the highly anticipated meeting of the Federal Reserve, with a potential interest rate hike looming. Hold on tight!💼

Probability:

🔴0bp = 11%

🟢0.25bp = 89%#FedWatch #MarketVolatility #InterestRateHike #FederalReserve

👇 (Continue Reading) pic.twitter.com/thsJfbPyvz— The Independent Banker (@Mykhailo_Por) May 3, 2023

With this new interest rate, the expected figure that banks will trade amongst themselves will most likely be in the range of 5% to 5.25%.

The federal funds rate is the overnight interest rate at which depository institutions trade federal funds with one another.

The Federal Reserve's interest rate hike decision is upon us. Many investors are expecting a rate hike despite recent signs of economic cooling. What do you think?

— TipRanks (@TipRanks) May 2, 2023

With this expected hike, mid and regional banks may be pushed further into a corner as the Feds continue its fight against inflation.

The latest interest rate increase is the 10th in a series started by Fed Chair Jerome Powell in March 2022.

Powell has continued to reiterate the need to raise interest given the U.S. economy’s volatile condition.

So far, several banks have capitulated under the impact of a rate hike across the economy. The latest is the First Republic Bank which has recently been put into receivership following large withdrawals.

The Feds are attempting to prevent what they consider the U.S. economy’s dangerously pivoting axle.

The Fed is expected to announce the latest rate hike at 2:00 PM ET, followed by a statement from Jerome Powell at 2:30 PM.

The recent rate hike follows the recently released Personal Consumption Expenditure Index (PCEI) by the Bureau of Economic Analysis (BEA).

The PCEI increased 0.3% after volatile factors such as food and energy costs were removed, according to the document.

The PCEI price index also went up 0.1%, putting its overall percentage gain at 4.6% in March 2023, higher than the 4.2% it posted a year ago.

The Feds have put their annual inflation for PCEI at 2%.

With the ongoing trend, investors are torn on where to pitch their tents. So far, the U.S. stock market fear and greed index is in the neutral zone, with the DOW Jones down 1.08% in the past day.

The S&P 500 has also slumped 1.16%, with NASDAQ rounding up with a similar figure to the DOW.

Current Interest Rate Hikes Feeding Bitcoin’s Bullish Surge

The expected rate hike may be playing into Bitcoin’s bullish rise, as today’s broader market rally shows.

So far, the largest crypto asset by market cap is trading just north of the $28,700 price range.

If the market continues its remarkable pushback at the bears, Bitcoin could retest the $29,000 range and easily scale above the $29,916 resistance level it failed to beat on April 27, 2023.

This positive market sentiment is buoying the foremost cryptocurrency’s relative strength index (RSI) to an oscillator figure of 50.03, making it largely underbought.

This presents a viable entry point for investors to buy BTC and ride with the market.

Interestingly, its moving average convergence and divergence (MACD) indicator shows a sell signal.

However, the orange trendline is nosediving sharply, with its blue counterpart leading the rise back up.

This could see the buy signal switch positions with the sell signal once the Feds make the expected hike official.

Bitcoin would then be on a bull run as it continues to solidify its position in the nascent financial landscape.

Meanwhile, investors searching for low-cap crypto gems with lower volatility could easily turn to crypto presales.

These come with bigger upsides, lower risks, and better exposure to a new ecosystem with minimal investments.

Related News

- Microstrategy Says It Bought 7,500 Bitcoin in Q1, Holds BTC Worth Over $4 Billion

- Market Update: What’s Next For Bitcoin As Fed Rate Hike Looms?

- Why The Bitcoin Price Is Crashing to $25k, While Love Hate Inu Pumps To $10 Million

Join Our Telegram channel to stay up to date on breaking news coverage