Join Our Telegram channel to stay up to date on breaking news coverage

In a surprising turn of events, Litecoin has gained significant traction as users seek alternatives amidst the congestion and high fees on the Bitcoin network.

Litecoin Witnesses Surge in Transactions Amidst Bitcoin’s Congestion and High Fees

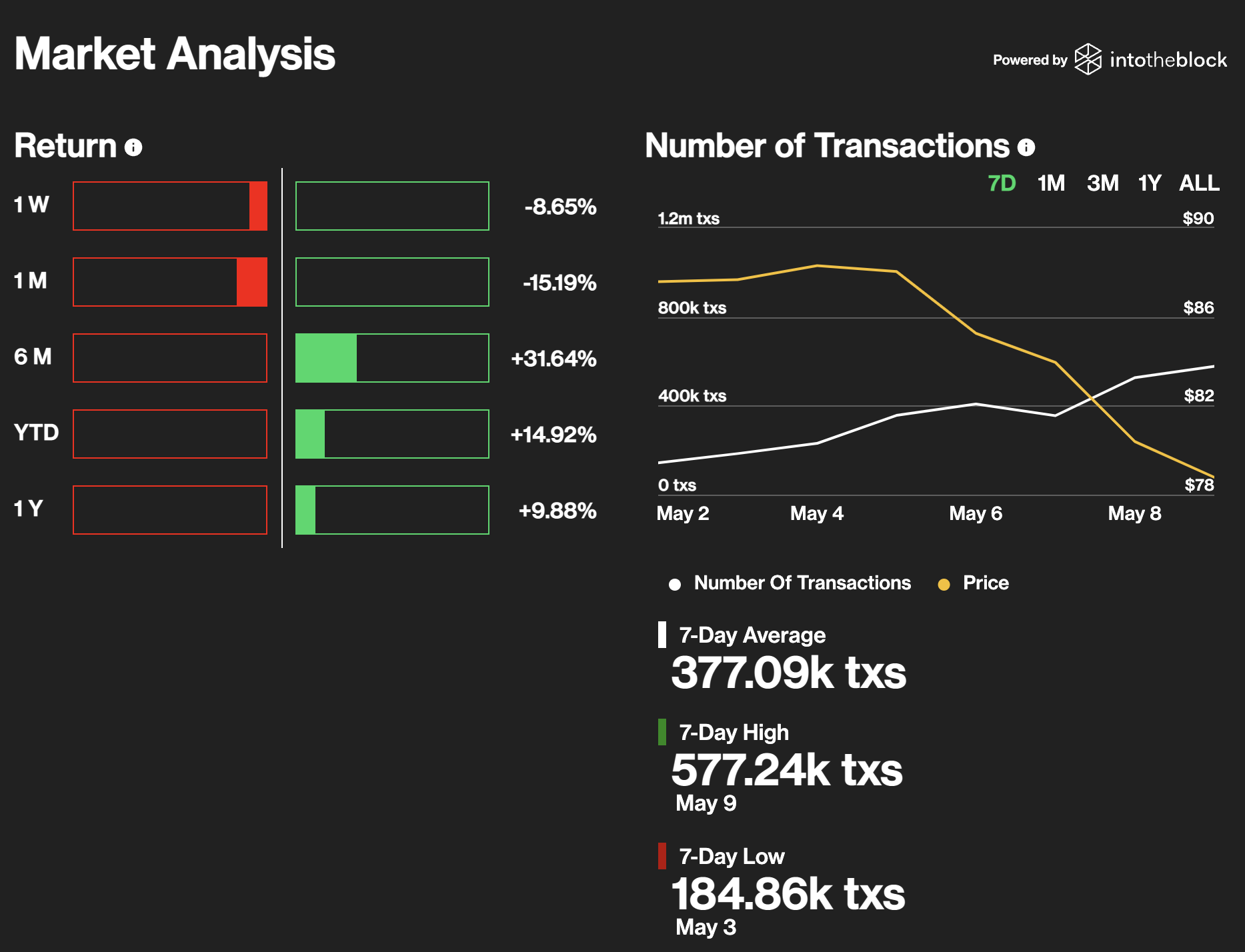

During a single day on May 8, Litecoin witnessed a significant surge in transaction activity, with BitInfoCharts data indicating that over 525,000 transactions were executed. This figure approached the daily transaction volume of Bitcoin, which stood at 575,000.

The surge in Litecoin transactions during this period was remarkable, surpassing the average transaction volume earlier this year by a factor of five and more than doubling the previous all-time high achieved during the peak of the bull market in January 2018.

The growing demand for BRC-20 tokens based on Bitcoin has caused a significant bottleneck on the Bitcoin blockchain, resulting in a notable increase in transaction fees comparable to the levels observed in May 2021.

As a consequence, users have been actively seeking out more cost-effective alternatives, including stablecoins and the Lightning network, to facilitate value transfers through blockchain technology.

Amidst the obstacles encountered by Bitcoin, Litecoin has experienced favorable outcomes. Notably, Glassnode’s data reveals a surge in active wallet addresses on the Litecoin network, reaching an unprecedented peak of 718,000.

Furthermore, there has been a substantial influx of nearly 500,000 newly created Litecoin addresses within a recent day. The renewed attention directed towards Litecoin has resulted in a 3.5% price surge of LTC, with its current trading value hovering around $80. Surpassing Bitcoin’s marginal 1% increase, Litecoin has displayed stronger performance in this regard.

Litecoin’s surge in transactions coincides with the significant spike in Bitcoin network activity due to the influx of BRC-20 tokens and the meme coin craze. Litecoin’s faster transaction speed and lower fees have attracted users looking for a more efficient alternative to Bitcoin.

While Litecoin transactions reached an all-time high of 576,000 on May 9, Bitcoin transactions also surpassed 580,000 per day this week. However, Litecoin transaction fees remain significantly lower, with average daily fees amounting to just $0.003, compared to Bitcoin’s average fees of over $20. Ethereum fees, though lower than Bitcoin, were still around $18.

The Litecoin Foundation reported a noteworthy increase in new address creation, surpassing the number of new Bitcoin addresses. This growth rate has impressed industry observers who believe that Litecoin has a promising future as a liquid alternative to Bitcoin.

Glassnode data further reveals a surge in active addresses on the Litecoin network, reaching 813,000 on May 9, marking a 278% increase since the start of the month.

The current state of Bitcoin usage, characterized by painful fees and a substantial backlog of over 400,000 pending transactions in the mempool, has prompted a prominent core developer to criticize BRC-20 memecoins and Ordinals, considering them network spam.

Bitcoin Network Grapples with Escalated Fees and Backlog of Transactions

The Bitcoin network is currently grappling with escalated fees and a backlog of transactions resulting from the popularity of a novel “token” standard, as per analysis from a CryptoQuant expert.

The average transaction fee has experienced a notable increase, as indicated by CryptoQuant data, surpassing $16 and peaking at $29 on May 9. Likewise, Bitinfocharts reported a rise in the average transaction fee to $31 on May 8, compared to approximately $19 the day before.

On May 8, the total fees per block temporarily exceeded the block subsidy reward of 6.25 BTC for the first time since 2017. Moreover, Bitinfochart data revealed an all-time high in the seven-day moving average of Bitcoin transactions, reaching a peak of 534,000 on May 9. Raw values even indicated two spikes over 600,000 daily transactions this month.

Blockchain.com confirmed the data, reporting that the average transactions per block have also reached an all-time high of 3,778.

The network congestion is causing a backlog of approximately 400,000 unconfirmed transactions, preventing the clearance of the backlog and keeping transaction prices elevated.

The market capitalization of BRC-20 tokens surpassed $1 billion on May 9. This situation has prompted Bitcoin core developers to consider potential actions against BRC-20 tokens and Ordinals, viewing them as network spam.

On a positive note, miners are benefiting from the circumstances, with profitability, or hash price, surging by 66% since the beginning of the month.

Is Bitcoin Network Congestion Linked to BTC Ordinals? Unveiling the Connection

The ongoing discussion regarding the purpose of Bitcoin (BTC) Ordinals has taken center stage within the community, prompted by a surge in ordinal mints that resulted in network congestion.

Over the weekend, the Bitcoin network faced overwhelming demand, leading to an unpleasant rise in transaction fees for users. Within a span of fewer than two weeks, unconfirmed transactions in the mempool surged from 134,000 to 469,000 on May 7, causing transaction fees to increase by 343%.

These transaction fees reached the highest levels seen in two years, with high-priority transactions costing up to 654 sat/vB (approximately $26), as reported by mempool.space. Many users expressed frustration, attributing the situation to Bitcoin Ordinals, while others viewed it as an attack on the network.

BTC Ordinals have witnessed a daily increase in trading volume over the past week, with more than 3 million mints recorded within the first 5 months. Despite data suggesting a correlation between fees and Ordinals, users took to Twitter to assert that their beloved assets were under attack.

Dylan LeClair, a Bitcoin maximalist, also discussed the theory of an “attack vector,” though he added that it would have no long-term impact on the network. He noted that it could be an obvious strategy for certain agencies with substantial resources in the short term, but ultimately it would not alter the overall dynamics of the network, and miners would continue their operations.

Amidst the network congestion, Binance, the largest cryptocurrency exchange by trading volume, temporarily suspended BTC withdrawals twice within a 24-hour period, citing the congested network as the reason.

The exchange has now resumed withdrawals, implementing adjusted fees to prevent a recurrence of the issue. Binance also plans to explore the Bitcoin Lightning Network, aiming to enable BTC Lightning network withdrawals for users in the coming months.

Concerns about the exchange’s stability circulated on social media following the withdrawal pause, leading to a slight decrease in Bitcoin’s price. At the time of writing, BTC is trading at $27,667, reflecting a 0.04% decline in the past 24 hours.

Related Articles

Join Our Telegram channel to stay up to date on breaking news coverage