Join Our Telegram channel to stay up to date on breaking news coverage

The Bitcoin Fear and Greed Index has plunged into a “neutral” zone following Bitcoin’s 13.5% drop from last week’s intraday high after the approval of spot Bitcoin ETFs (exchange-traded funds) in the US.

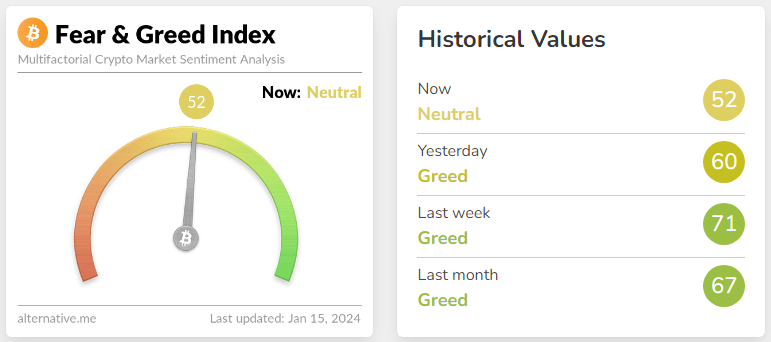

The index currently lies at 52, close to neutral on a scale of 0 to 100. It is at its lowest score since October 19, and indicates market uncertainty.

The index shows “greed” at near the 100 level and “fear” at the near 0 level. On January 9, it moved above 70, indicating “greed” as the crypto market anticipated the approval of spot BTC ETFs.

The index considers trading volumes, volatility, social media mentions, trends, and dominance. At the current level of 52, the index shows traders are adopting a wait-and-see approach.

Bitcoin rallied to almost $49K after the US Securities and Exchange Commission (SEC) reluctantly approved a BTC ETF. It was trading at $42,298 at 11:04 a.m. EST.

Despite Bitcoin’s price drop, BTC ETFs raked in net flows of $3.6 billion posted in the two days after approval to prompt warnings from some analysts of a potential Bitcoin supply crunch.

LATEST: With two days in the books, the Nine Newborns have taken in +$1.4b in new cash, overwhelming $GBTC's -$579m of outflows for net total of +$819m. $IBIT now leading pack w/ half a bil, Fidelity close second tho. The newborns' $3.6b in trading volume on 500k indiv trades… pic.twitter.com/b7U5DjENaw

— Eric Balchunas (@EricBalchunas) January 13, 2024

JPMorgan Doubts Fresh Capital Will Flow Into BTC After Bitcoin ETF Approvals

JPMorgan analysts are skeptical that a lot of fresh capital will flow into spot BTC ETFs. Rather, the inflows will come from the existing crypto products, they say.

EXCLUSIVE: JPMorgan says spot bitcoin ETFs could see up to $36 billion of inflows in rotational capital https://t.co/ldW33QQtIB

— The Block (@TheBlock__) January 11, 2024

Despite a lack of significant fresh capital, they say the new ETFs will rake in up to $36 billion. They also expect $5 billion to $10 billion to exit the Grayscale Bitcoin Trust ETF and move to new spot ETFs as investors profit from buying discounted GBTC shares.

Also Read

- Bitcoin Price Prediction: As Morgan Stanley Says BTC ETFs Are A ”Potential Paradigm Shift,” This Bitcoin Derivative Might Be The Best Crypto To Buy Now

- Bitcoin Price Prediction: BlackRock CEO Larry Fink Says BTC Is An Asset Class As Investors Rush To Buy This ICO Boosted By Bitcoin ETFs

- Vanguard Customers Threaten To Close Accounts As Fund Management Titan Refuses To Sell Spot Bitcoin ETFs

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage