Join Our Telegram channel to stay up to date on breaking news coverage

Cryptocurrency investment products racked up a record $17.5 billion in trading volume last week as sentiment soared amid the landmark launch of spot Bitcoin ETF products, CoinShares said.

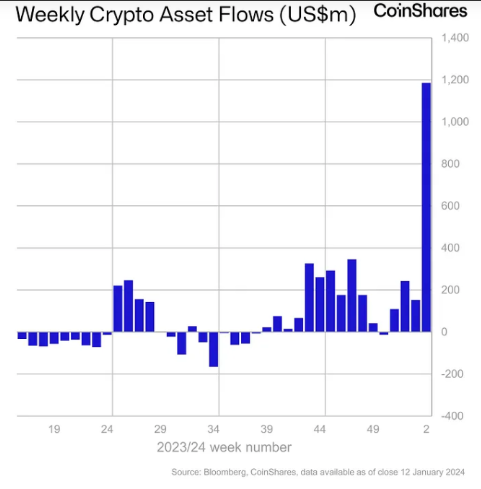

Inflows Reach $1.18 Billion With Bitcoin Funds Dominating

With trading volumes skyrocketing, inflows receive by funds including such names as Bitwise, Grayscale and 21Shares reached $1.18 billion, an amount that failed to break the $1.5 billion record set at the launch of futures-based Bitcoin ETFs in October 2021, said head of research James Butterfill.

Bitcoin funds dominated with $1.16 billion in inflows, constituting 98% of the total. Meanwhile, short BTC investment products recorded inflows of up to $4.1 million.

Altcoins, with a special interest in Ethereum-based products recorded inflows of up to $25.7 million while XRP-related funds witnessed $2.2 million of inflows. Solana-based investment products recorded inflows of $0.5 million.

US Draws $1.24 Billion As BTC ETF Funds Launched

The US led other markets with $1.24 billion of inflows, while Switzerland was next with $21 million. Butterfill said he suspects that outflows from Europe & Canada (Canada $44m, Germany $27m and Sweden $16m) were traders looking to switch from Europe to the US.

Also Read:

- BlackRock Spot Bitcoin ETF Ad Targeting Wealthy Boomers Praised As “So Boring It’s Brilliant”

- BlackRock, Fidelity And Grayscale Dominate Spot Bitcoin ETF Trading On First Day

- Vanguard Customers Threaten To Close Accounts As Fund Management Titan Refuses To Sell Spot Bitcoin ETFs

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage