Join Our Telegram channel to stay up to date on breaking news coverage

Bitcoin made a successful start to March by climbing above the critical $23,100 level and registering the highest gain of 2.06% throughout the day. After having a fairly stagnant month in February, this uprise is a good sign for investors & miners who were on the edge of their seats with Bitcoin’s near-term performance.

Bitcoin Defeats $23,100 But Struggles to Cross $24,000

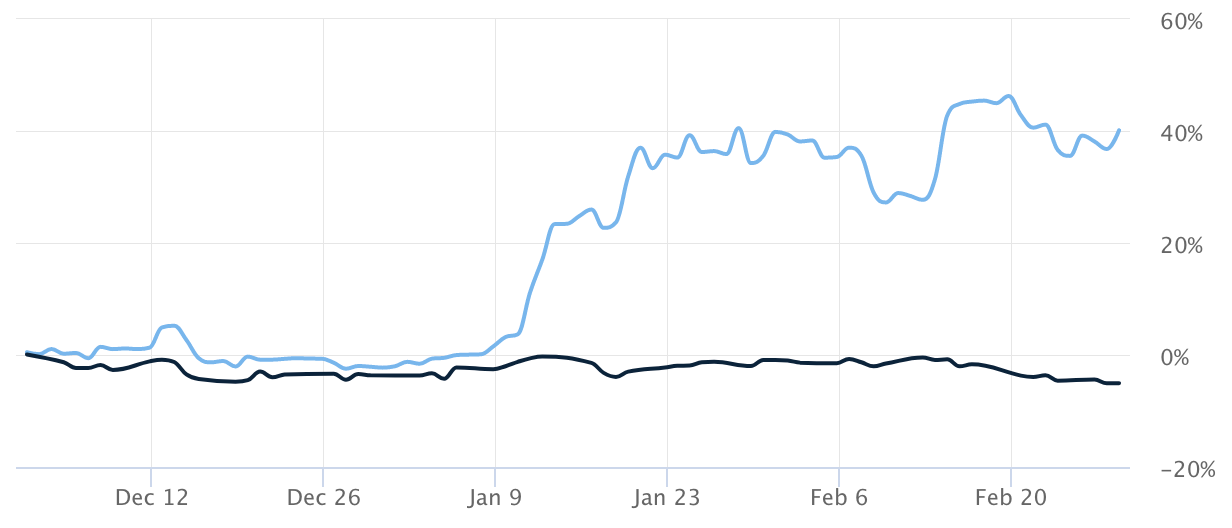

Bitcoin has increased by more than 40% since the start of the year, balancing the excitement for investors in the fourth quarter of last year. The token by the largest market cap has, however, struggled to consolidate above the $24,000 level.

After hinting at a potential price rise above $25,000, a high the token reached in the recent rally, it has since failed to border this price level. The token rose from roughly $16,500 at the end of December to $23,000 by the end of January, but a performance of this intensity was not reflected in February.

Bitcoin’s performance in January outperformed the Dow Jones Industrial Average and S&P 500 Index, resulting in a fading correlation between the crypto and the stock market. Apart from the regulatory scrutiny, the sentiment for riskier assets has remained decently positive this year.

BTC vs Dow Jones Industrial Average (3 month comparison)

Fear regarding the possibility of an increase in inflation next month has in part left investors concerned, and prevented them from taking long positions on the token. Inflation could continue to rise in the future, as suggested by recent sentiment. Sentiment across options desks & derivatives market looks strong for now.

Alex Kuptsikevich, an analyst at broker FxPro has said that March has historically been a great month for Bitcoin since it has gained an average of 16%.

“The strong growth momentum in January and the renewal of local highs in February suggest that the bulls prevail,”, “At the same time, the technical picture on the weekly time frame suggests that only a consolidation above $25,000 will strengthen the bullish view of the market,” he said further.

Miners At Relief As Bitcoin Marks a Rally

The recent rally from Bitcoin has given hope to struggling crypto mining companies that didn’t have a good quarter last year. The decrease in the prices of digital assets, and high electricity costs, clubbed with the network competition in the fourth quarter of 2022 reduced the profit margins for miners, with many anticipating liquidity crunches and even filing for bankruptcy.

Although Bitcoin underwent a rally of 40% since the start of the year, miners are still under stress. However, the rally has, to some extent, proven to be a relief for miners by making it easy for them to raise capital from the equity market, at a time when interest payments have outpaced cash flows.

Many miners are still facing financial difficulties, even after restructuring obligations. Matthew Kimmell, a digital asset analyst at CoinShares, said that miners may face major financial woes in the warmer weather, as electricity costs tend to skyrocket during heat waves.

Miners still remain vulnerable to swings in electricity prices, and many have not been able to declare sufficient capital for power purchase agreements. Winter storms across North America forced a lot of miners to shut their operations due to an increase in the cost of electricity in the last quarter of 2022.

A lot of miners disposed of their mining machines, because of the inability to maintain the cost of operation. Institutional investors too remain cautious in the current market conditions. Considering all these factors, an uprise in the crypto market could open up miners to the equity market, possibly providing them with financing options.

Bitcoin Price Prediction

On a daily chart, Bitcoin has been pretty bullish but it has stuck between an ascending channel and might signal a consolidation. Bitcoin has been unsuccessful to break the midpoint of this metric, but there has been a development in the MRI indicator, suggesting a bullish trajectory.

The last two times this indicator has shown a buy signal, Bitcoin has rallied 24% and 16% respectively. If the same pattern continues, Bitcoin could very well cross $25,000 in March and possibly reach as high as $30,000. A flip below the $21,000 level could indicate a possible crash to $18,745.

In 2023, the token is expected to maintain a similar performance, unless an event is to trigger the prices marketwide. While some predictions project the token to reach as high as $75,000, it’s unlikely for the token to scale this high. For 2024, the target seems more realistic.

Read More:

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage