Join Our Telegram channel to stay up to date on breaking news coverage

Never mind equities – when/where is bitcoin going to bottom?

With the bitcoin price languishing just above $6,000, it wasn’t meant to be like this.

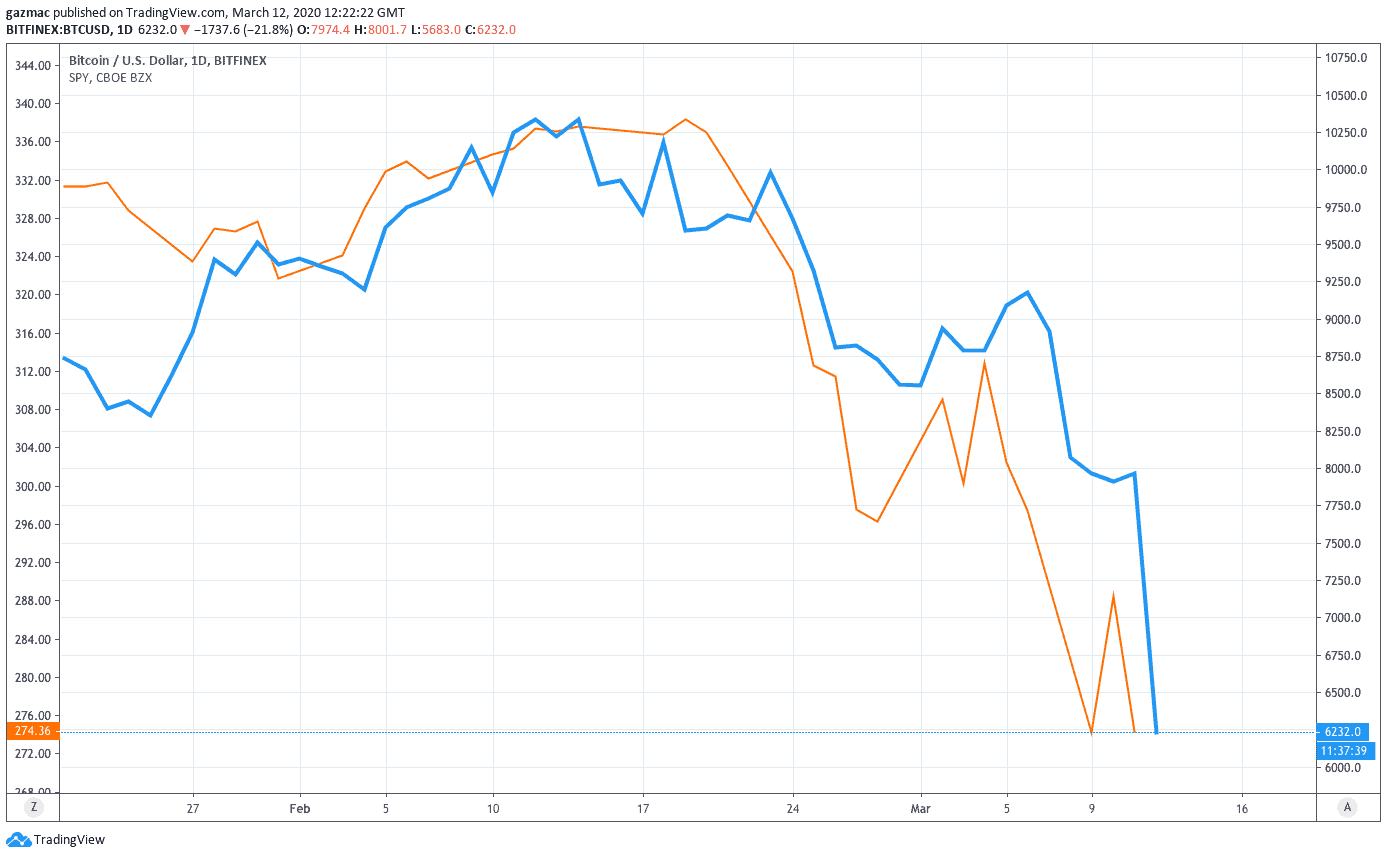

Remember all that stuff about bitcoin’s negative correlation to equities and its positive correlation with gold?

Turns out when there was a reversal step-change in the markets of the magnitude we are now seeing, it’s the folks at FT Alphaville who have proven to be closer to the mark. Someone over there (Izabella or Jemima) said this would happen – that when everything was being sold, bitcoin would be sold too.

At times like this, when liquidity is being sucked out of the financial system it manifests itself most forcefully among dangerously overstretched investors, which basically means those who borrowed to go long. But it affects the less adventurous too – those who are just plain scared and are running for the hills. Hard cash is king.

Trading on margin in a bull market is not as risky as doing so at an inflection point such as this. And for those taking long positions, the margin calls will have been piling up, forcing affected investors – retail and institutional – to raise funds in a hurry.

The sad truth of the matter – on a short-term view at any rate – is that bitcoin, far from being a different kind of asset class that provides unparalleled diversification, it has been exhibiting strong positive correlation with equities.

Here’s the BTC/SPY (the biggest S&P 500 ETF) chart to make it clear:

So, when does bitcoin bottom and at what price level?

If we are looking for a shift in sentiment to guide us what might be the determinant?

Let’s assume that we are staring at the beginnings of a new bear market (in fact we are now in one as far as the Dow goes, with the rest to follow soon enough). That being so, then market participants will be looking for a decisive decoupling from the stock market to kick in soon.

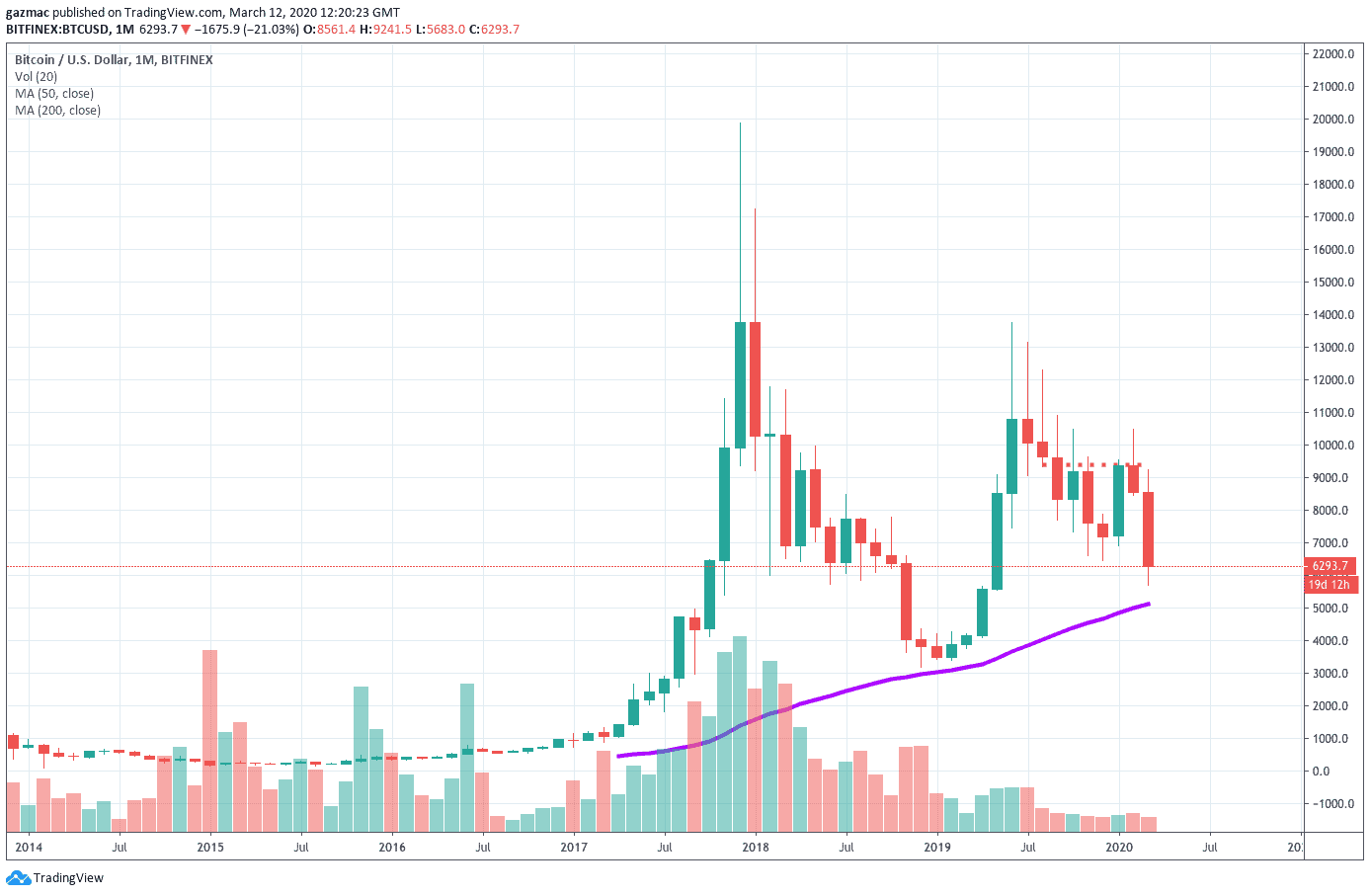

Today there is no sign of that being the case, with the selling in both asset classes accelerating (see 1-month candles below and the 50MA in purple).

The nightmare question is what happens when the implosion in the markets feeds back into the real economy – in addition to firms going under, there could be whole countries going the same way.

There’s already a well-worn list of basket cases that includes the likes of Iran and Venezuela.

But with oil tanking alongside stocks, the petro-economies such as most of the Middle East in addition to Nigeria and Russia may be joining the list soonish.

Then there’s dollar-indebted emerging markets. Sure, many learnt lessons from past crises and the Asian ones will certainly be beneficiaries of the oil price slide, but when demand is holed below the water line none of that matters. All those well-laid plans had growth metrics built in; now that’s all gone into reverse.

Bitcoin still a disaster play?

Remember those stories of mosques mining bitcoin in Iran? Well, expect a lot more of that coming down the line… and not just at mosques.

When local currencies start to wither then bitcoin starts to look more attractive, assuming it is at least losing value at a slower rate than its fiat brethren.

But it could be precisely the demand emerging in distressed economies that starts to stabilise the price.

At the end of the day, the nearer bitcoin can get to its intended use case as a store of value and means of exchange the better the chances of stemming the rout.

All risk assets are being offloaded. Nothing is safe in stocks and the same goes for crypto. With bitcoin crashing through $6,000, touching the 3,700 low is a reasonable possibility.

Don’t even consider buying the dip – it would be trying to catch a falling knife.

Beyond considerations of bitcoin fundamentals in terms of usage, the guide for investors of all stripes is the progress of the virus.

Until governments look like they’ve got a grip, this gets worse. And as it gets worse other stuff can start happening – like a meltdown in the credit markets as delinquency rises and companies run out of funds.

Image courtesy Pixabay

Join Our Telegram channel to stay up to date on breaking news coverage