Join Our Telegram channel to stay up to date on breaking news coverage

Bitcoin (BTC) Price Prediction – October 25, 2020

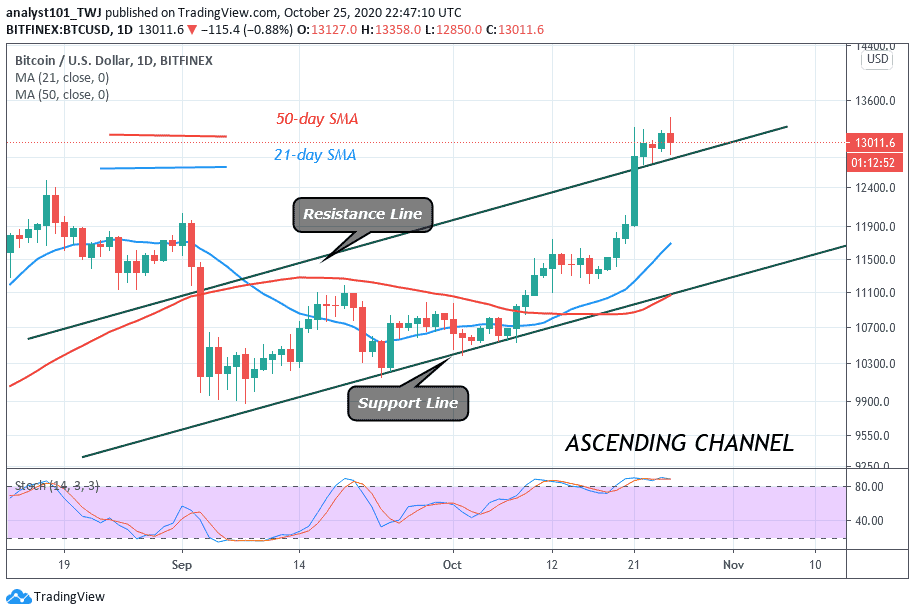

BTC/USD Price has continued to fluctuate between $12,800 and $13,200. Today, the bulls broke the $13,200 resistance but the upward move was subsequently repelled. The price fell to the range-bound zone to resume a sideways move.

Resistance Levels: $13,000, $14,000, $15,000

Support Levels: $7,000, $6,000, $5,000

Today, buyers faced strong rejection above the range-bound zone of $13,200 as price broke the upper price range. The coin broke the $13,200 resistance but faced rejection at the $13,300 to $13,500 resistance zones. Bitcoin’s upward move is under threat as the bulls must clear the resistance zones. The resistance at $13,500 must be broken for BTC price to resumed upside momentum. Otherwise, the range-bound movement between $12,800 and $13,200 will continue. Bitcoin price is trading above the 80% range of the daily stochastic. This implies that sellers may emerge to push BTC price downward.

Ethereum Will Soon Become the First Blockchain to Settle $1 Trillion in One Year

The Ethereum network is said to process twice the transaction volume of Bitcoin and is on-course to process $1 trillion this year. On the other hand, Bitcoin is on track to process $800 million transactions. Ethereum has been able to process twice the transaction volume of Bitcoin as a result of the third-quarter decentralized finance boom. According to reports, the 30-day rolling daily average for Ethereum transaction volume is currently at $7 billion. In the case of Bitcoin, it processes less than $3 billion.

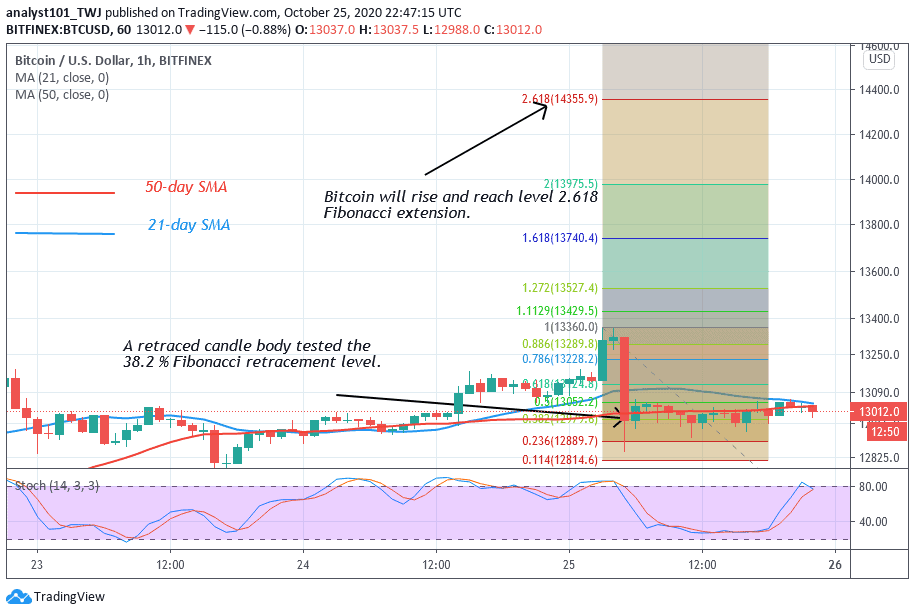

Bitcoin upside momentum is likely to continue if the price clears the resistance zones of $13,300 to $13,500. On October 25 uptrend; BTC was resisted at $13,358 high. The retraced candle body tested the 38.2% Fibonacci retracement level. This indicates that the coin will rise to level 2.618 Fibonacci extension. This is equivalent to a high of $14,355.90.

Join Our Telegram channel to stay up to date on breaking news coverage