Join Our Telegram channel to stay up to date on breaking news coverage

Bitcoin (BTC) Price Prediction – November 25, 2020

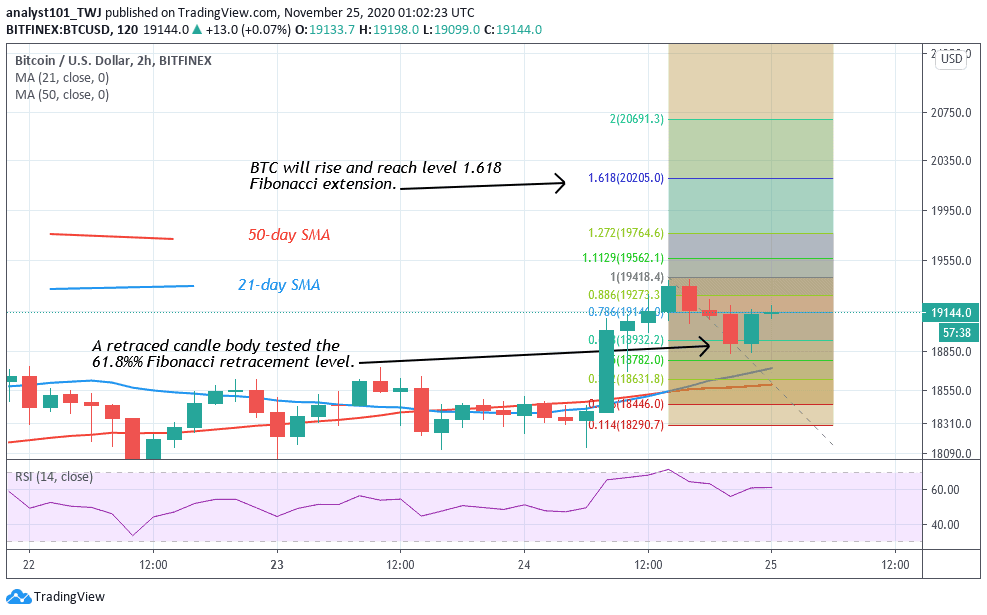

Yesterday, Bitcoin rebounded above $18,400 as price broke the $18,800 overhead resistance. BTC price rallied to $19,400. The king coin is now a striking distance to the psychological price level. Today, BTC/USD is trading at $19,144 at the time of writing.

Resistance Levels: $13,000, $14,000, $15,000

Support Levels: $7,000, $6,000, $5,000

On November 24, Bitcoin resumed its rally as price rallied to $19,400. Before now BTC has been in a downward correction. The price has been fluctuating below the $18,800 resistance for the past four days. Buyers were unable to push BTC above the overhead resistance. Yesterday, a strong bounce above $18,400 propels the price to break the $18,600 and 18,800 resistances.

BTC is now trading above $19,000. After reaching the $19,400 resistance zone, BTC retraced and found support above the $18,850 price level. The coin has resumed upward move to retest the recent high. On the upside, if buyers can push BTC above $19,400, the coin will rally above $20,200. In the previous price action at the $18,800 resistance, BTC took more than three days of correction before resuming upside momentum.

Bitcoin (BTC) Indicator Reading

Bitcoin is at level 80 of the Relative Strength index period 14. Since October 21, BTC has been trading in the overbought region of the market. The coin has been trading in a strong bullish momentum. However, the overbought conditions do not hold as BTC has been trading in a strong trend market. The 21-day and 50-day moving averages are pointing northward indicating the uptrend

Nevertheless, Bitcoin has resumed the upside momentum as bulls break the $18,800 resistance. Meanwhile, the Fibonacci tool indicates a possible upward move of the coin. On November 24 uptrend; the retraced candle body tested the 61.8% Fibonacci retracement level. This retracement indicates that the market will rise to level 1.618 Fibonacci extensions. In other words, Bitcoin will rise to $20,205 high.

Join Our Telegram channel to stay up to date on breaking news coverage