Join Our Telegram channel to stay up to date on breaking news coverage

Bitcoin (BTC) Price Prediction – November 12, 2020

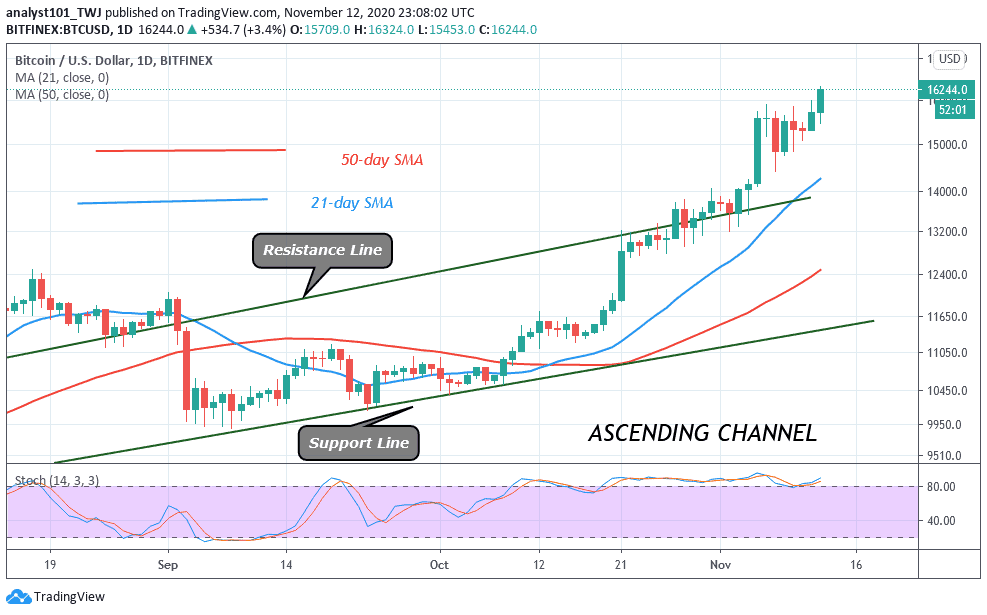

Today, November 12, BTC/USD has broken above the $16,000 resistance. The king coin is now trading at $16,168 at the time of writing. The breakout becomes possible after several retests in the previous week at the $16,000 high.

Resistance Levels: $13,000, $14,000, $15,000

Support Levels: $7,000, $6,000, $5,000

For the past week, Bitcoin has been compelled to a sideways move because of buyers’ inability to break the $16,000 resistance. The king coin has been range-bound between $14,600 and $15,800. Today, the bulls have broken the $16,000 resistance. The bulls pushed on the upside in three phases before breaching the resistance. In the first phase, buyers pushed the price to $16,155 but were repelled as BTC dropped to $15,666. In the second phase, the coin rebounded to reach $16,152 high.

This time BTC fell to a low of $15,950. In the last phase, the price momentum broke the resistance and sustained the momentum above the high of $16,168. As the bulls succeed, the coin is out of the range-bound zone. The king coin has a target price of $17,200. Meanwhile, Bitcoin has traded above the 80% range of the daily stochastic since October 10. That is the coin is in the overbought region of the market.

Deutsche Central Bank Digital Currency Will Replace Cash in Long Term By Deutsche Bank Research Department

Deutsche Bank is the largest banking institution in Germany. The bank has called on Europe to accelerate the development of central bank digital currencies (CBDC). This development when operational will replace cash in the future. On November 10, the Deutsche Bank Research department made a publication on a new report on economic estimations and proposals to assist global economies hit by the coronavirus pandemic. Titled “What We Must Do to Rebuild” The report has it that the Deutsche Bank called on national governments and private companies to work on alternatives to credit cards, stating:

“Worldwide lockdowns and social distancing measures have only increased the use of cards over cash. To respond, companies and policymakers must design alternatives to credit cards and remove middle man fees. […] For now, the priority must be on regional digital payment systems. In the long term, central bank digital currencies will replace cash.”

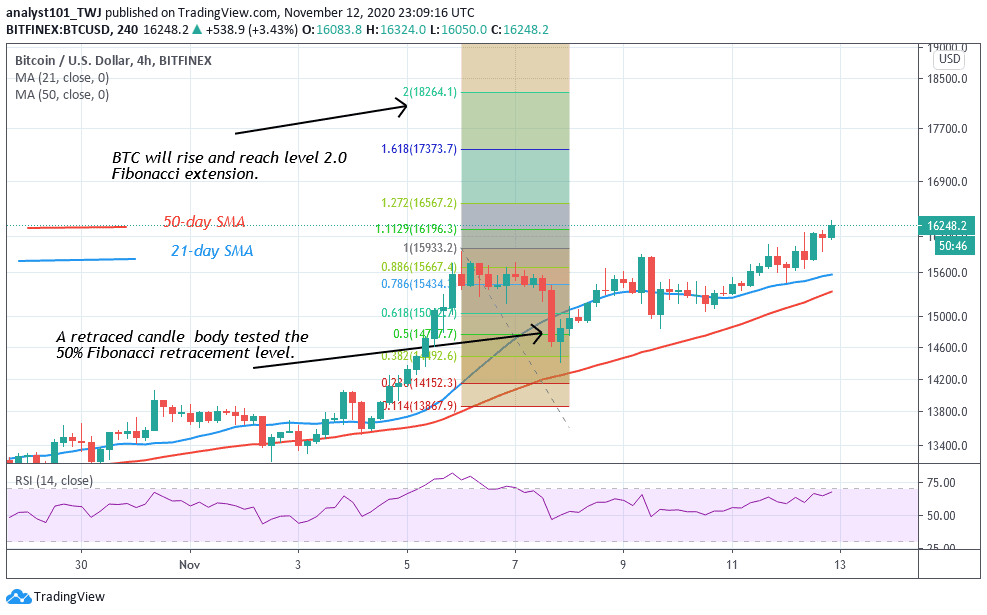

According to the Fibonacci tool analysis, Bitcoin will make a further upward move. On November 5 and 9, buyers failed to break the $16,000 overhead resistance. Nevertheless, the retraced candle body on November 7 tested the 50% Fibonacci retracement level. This retracement indicates that Bitcoin will rise and reach level 2.0 Fibonacci extension. That is the coin will reach a high of $18,264.10.

Join Our Telegram channel to stay up to date on breaking news coverage