Join Our Telegram channel to stay up to date on breaking news coverage

Bitcoin (BTC) Price Prediction – June 15, 2021

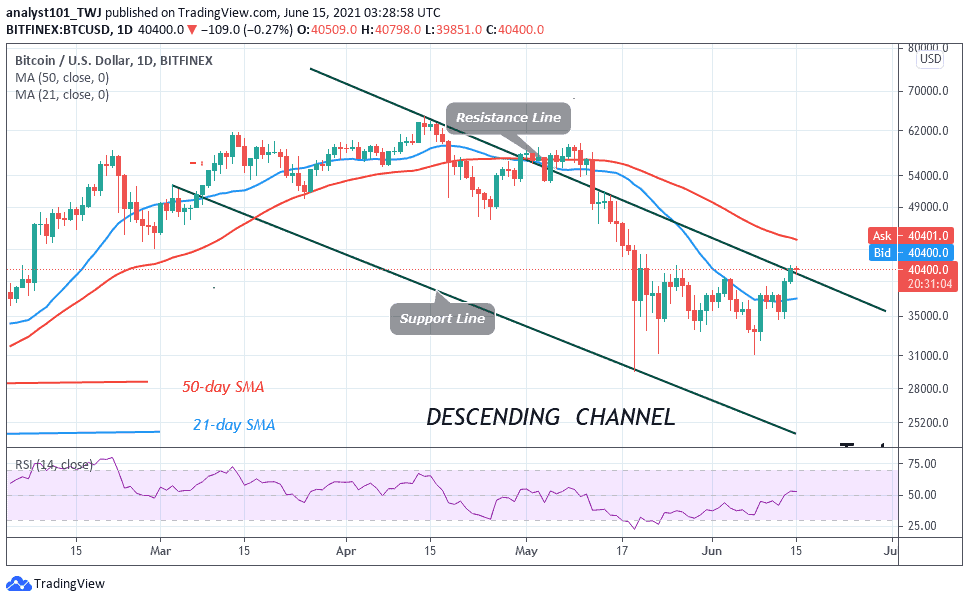

BTC/USD price makes positive moves to the previous highs as Bitcoin reclaims $40,000. The bulls are yet to sustain above $40,000 resistance convincingly. Presently, BTC price is fluctuating below and above the resistance level. This is the first time Bitcoin has broken the $40,000 price level since May 20. Can the bulls sustain the bullish momentum?

Resistance Levels: $45,000, $46,000, $47,000

Support Levels: $35,000, $34,000, $33,000

Bitcoin (BTC) has been in a downward correction since May 19. On June 12 and June 13, BTC price retested the $35,000 support which resulted in a rebound above the current support. The rebound catapulted the coin to rally to $39,000 resistance. After two days of the correction below the resistance, BTC price broke the resistance and rallied above $40,000.

Buyers are yet to sustain the bullish momentum above the recent high. On the upside, if buyers reclaim the $40,000 support, Bitcoin will rally to $46,000 high. The bullish momentum will extend to $50,000 high where it will face resistance. Conversely, if buyers fail to reclaim the $40,000 support, BTC price will fall and become range bound between $30,000 and $40,000 for a few more days.

Remittance Firms Undecided to Support BTC despite Legal Tender Law in El Salvador as Bitcoin Reclaims $40,000

Recently, El Salvador adopted Bitcoin as a legal tender by law. According to reports, Remittance firms operating in El Salvador are reluctant to support Bitcoin despite the country’s new law. The parliament has enacted a law mandating the crypto asset as legal tender but local remittance firms are reportedly hesitant to adopt Bitcoin.

According to analyst Kenneth Suchoski of Autonomous Research fintech indicated that remittance firms may not have support for Bitcoin and other crypto-assets until prompted to do so by customer demand.

These constraints will create a stalemate for the local payments industry. He also said: “For Western Union and some of the other remittance providers, keep in mind that most of the volume in the remittance industry is going from developed markets to emerging markets primarily to people — families and friends — that operate in cash,” Suchocki added that less than 1% of global cross-border remittances are done through crypto-assets.

He remarked that: “To the extent that bitcoin isn’t adopted and there’s not widespread acceptance, these remittance providers are still going to be relevant for the years to come.”

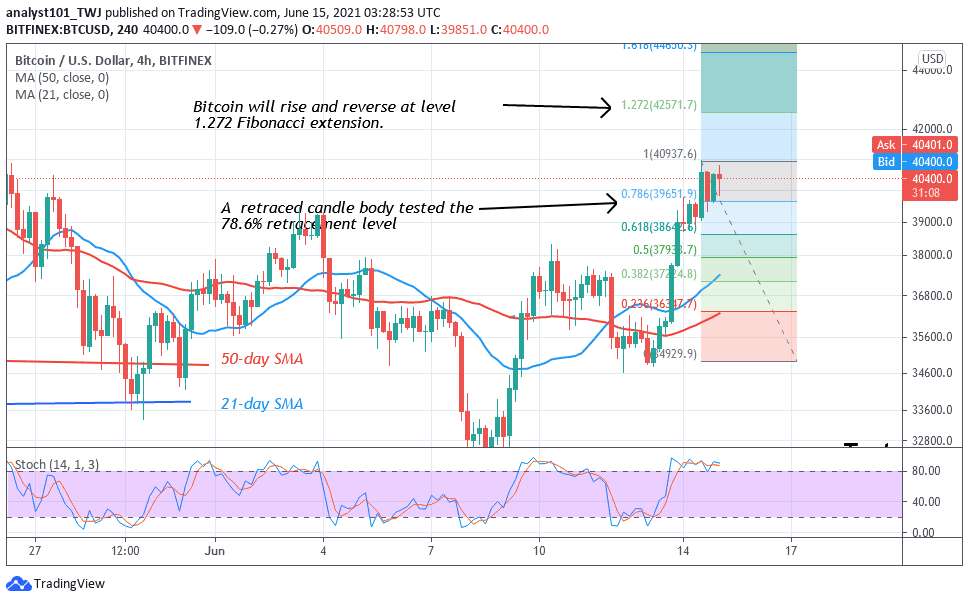

Presently, Bitcoin has broken the $39,000 resistance as buyers attempt to sustain the bullish momentum above the $40,000 high. Meanwhile, on June 14 downtrend; a retraced candle body tested the 78.6% Fibonacci retracement level. The retracement indicates that Bitcoin will rise to level 1.272 Fibonacci extension and reverse. That is the high of level $42,571.70. Bitcoin will reverse to 78.6% Fibonacci retracement level where it originated.

Looking to buy or trade Bitcoin (BTC) now? Invest at eToro!

75% of retail investor accounts lose money when trading CFDs with this provider

Join Our Telegram channel to stay up to date on breaking news coverage