Join Our Telegram channel to stay up to date on breaking news coverage

Bitcoin (BTC) Price Prediction – August 26, 2020

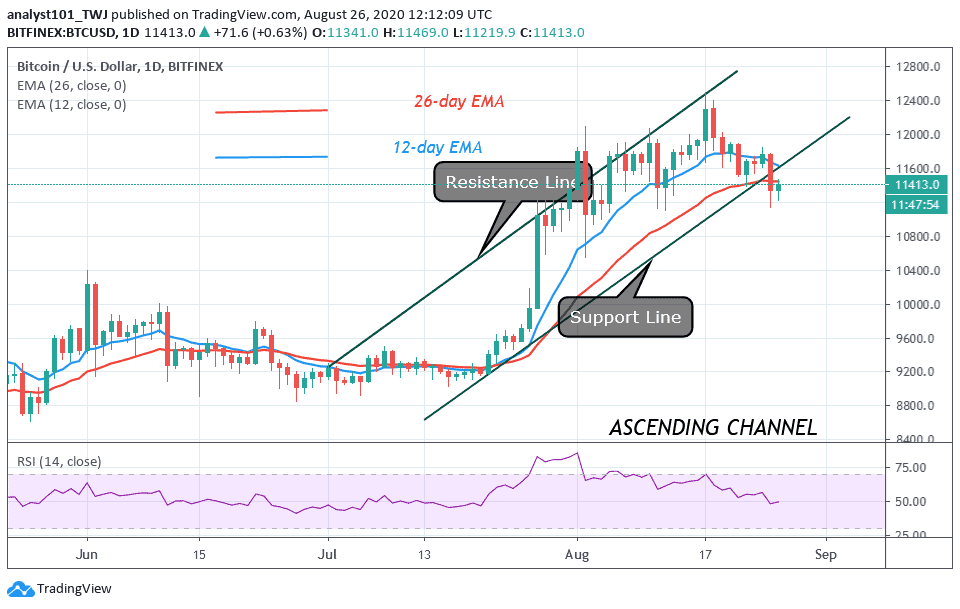

Yesterday, BTC/USD dropped to $11,100 after the bulls retested the $11,800 resistance . Buyers’ inability to push BTC above the $11,800 resistance has resulted in a bearish consequence.

Resistance Levels: $10,000, $11, 000, $12,000

Support Levels: $7,000, $6,000, $5,000

The recent downtrend broke the $11,400 and $11,600 support levels of Bitcoin. Any time price falls to these lows; BTC will resume a fresh uptrend. However, the overwhelming selling pressure broke these crucial support levels as the market approaches the $11,200 support. This may perhaps be the last crucial support for Bitcoin before the resumption of the downtrend. However, the price action is showing a bullish signal.

On the upside, if price continues its fall to $11,200 low, BTC may rebound above the $11,200 support and resume the uptrend. Conversely, if buyers fail to defend the $11,200 support, the coin will fall to $11,000. The selling pressure will accelerate on the downside to $10.400 low. Today, BTC’s price is holding above $11,300 as it makes a fragile upward move.

Bitcoin Mining Difficulty Rises by 9% Since May 11 halving

According to reports, mining difficulty has increased by 9% since May 11 halving. After May 11 halving, some critics were contemplating that miners would give up and the entire process would enter a death spiral. Nonetheless, after three months the Bitcoin hash rate is at a record high. This is a positive sign for the long term trend of Bitcoin.

Data from Glassnode indicated that the mining difficulty of Bitcoin increased by 3.6% on August 24. The data shows many miners actively mining BTC even before the halving occurred. Bitcoin hash rate also increased as a result of the profitability of miners in China. Conversely, miners are one of the sources of external selling pressure on Bitcoin price. Miners will exact significant pressure on the crypto currency market when they sell off BTC.

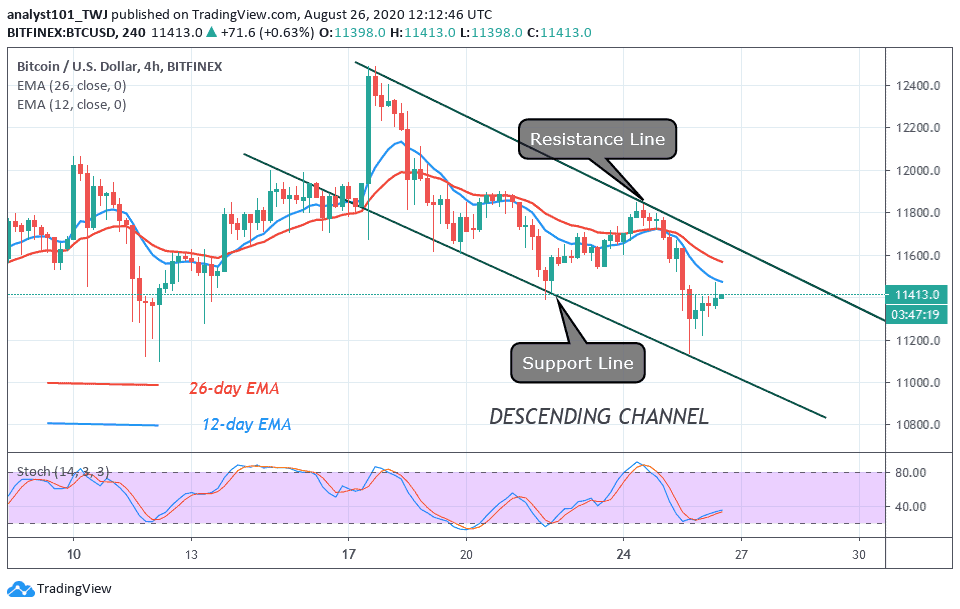

Meanwhile, the BTC price was corrected upward after the downtrend. The king coin has survived the bearish onslaught as price breaks above $11,400 price level. On the upside, if the bulls break and close above the resistance line of the descending channel, BTC will resume the uptrend.

Join Our Telegram channel to stay up to date on breaking news coverage