Join Our Telegram channel to stay up to date on breaking news coverage

Bitcoin’s (BTC) price lacks directional bias, but all signs point to bears being in control. The flagship crypto continues to intertwine along an equilibrium at $29,398. Market observers and experts have weighed in on this price action. In their opinion, BTC making a decisive candlestick close below the level above in the four-hour timeframe would spell doom for traders.

I knew this would be the case and we would remain just above this EQ for the weekend. 0.01% move yesterday, so my attention for now is on #Altcoins and i have my alerts set incase we do drop below the EQ on #Bitcoin pic.twitter.com/ybJ1ngxLHS

— Crypto Tony (@CryptoTony__) August 13, 2023

Expert Opinions On Why Bitcoin Appears Stuck

According to industry sleuths, Bitcoin price oscillates within a fixed position for one particular reason, the lack of impulse.

Lack Of Impulse/Catalyst

The lack of impulse to drive Bitcoin price comes as the US Securities and Exchange Commission (SEC) continues to delay spot BTC Exchange Traded Funds (ETF) applications. Ark Invest CEO Cathie Wood had expressed hope that the Commission would approve multiple spot BTC applications simultaneously. In a recent development, the SEC hinted at a possible delay, opening the floor for public commentary.

The SEC (as expected) delay a final decision on a spot #Bitcoin ETF.

There are 56 instances of the word 'manipulation' in the SEC's release… seemingly the applicants must prove that BTC is not a 'manipulated' asset class, before a spot ETF will be approved. pic.twitter.com/ham63WPr8D

— ted (@tedtalksmacro) August 11, 2023

Multiple instances of the word “manipulation” are featured in the Commission’s release. Experts claim it may be a new angle for rejecting filings. Based on the release, the agency wants the institutions that have filed for approval to prove that BTC is not a manipulated asset class. A paragraph in the filing reads:

The Commission asks that commentators address the sufficiency of the Exchange’s statements in support of the proposal…

It is worth mentioning that August 14 was the due date for a decision in Ark Invest’s spot BTC ETF application. With the release, therefore, that date may have been put off, with some speculating a verdict in 2024.

If manipulation does prove to be a criterion for approval, then it would add to the list given recently by former chair of the SEC, Jay Clayton. In his interview with Fox Business, Clayton said that if the applicants proved efficacy, the agency would be inclined to approve.

JUST IN: 🇺🇸 Former SEC Chairman says Spot #Bitcoin ETFs should be approved. pic.twitter.com/szb6vTzpLj

— Watcher.Guru (@WatcherGuru) July 10, 2023

However, BTC may be subject to manipulation, considering it is an international asset with players worldwide. The SEC may be able to enforce regulation in the United States. However, actions from players outside the country could still influence Bitcoin prices in the US. (and

Updates on Bitcoin ETF Applications, Partisan Issues May Be An Obstacle

In the latest news on BTC ETF filings, Bloomberg analysis believes that the SEC will postpone all decisions. This is despite Bitwise Bitcoin ETP Trust and the spot Bitcoin ETF applications of BlackRock, VanEck, WisdomTree, and Invesco being due around September 1.

Former SEC official John Reed Stark has also questioned the possibility of approvals, saying that the odds would be higher if a Republican president took office.

Will the SEC Approve Any Of The Recent Bitcoin Spot ETF Applications?

People often ask for my opinion on whether the SEC will approve any of the recent spate of bitcoin spot ETF applications, which is an interesting and important question.

My take is that the current SEC will… pic.twitter.com/lPXebl03Y4

— John Reed Stark (@JohnReedStark) August 13, 2023

Stark’s bone of contention is that in the current state, Democrats form the majority of the SEC’s team of commissioners. If a Republican president is elected in the 2024 elections, Crypto Mom, Hester Pierce, will step in as interim chair during the transition. Stark said this would allow her to balance the scale, creating a fair chance for positive crypto recommendations and reduced crackdowns.

Spot Bitcoin ETF As Possible Catalyst For Bitcoin and Crypto Prices

Popular belief is that the SEC approving the spot BTC ETF filings would provide the impulse needed to drive the market. Yann Allemann, co-founder at Glassnode and CEO of Swissblock Technologies, called for an “industry shake-up.” In his opinion, this would inspire a new wave of capital inflow.

Meanwhile, traders and investors hold out hope for ETF approvals as a possible driver for the market. As long as the SEC delays the decision, Bitcoin price could remain rangebound. Worse, momentum could weaken even as experts anticipate a retest of the $27,000 to $26,000 range.

Bitcoin Price Analysis As BTC Binds Along Equilibrium

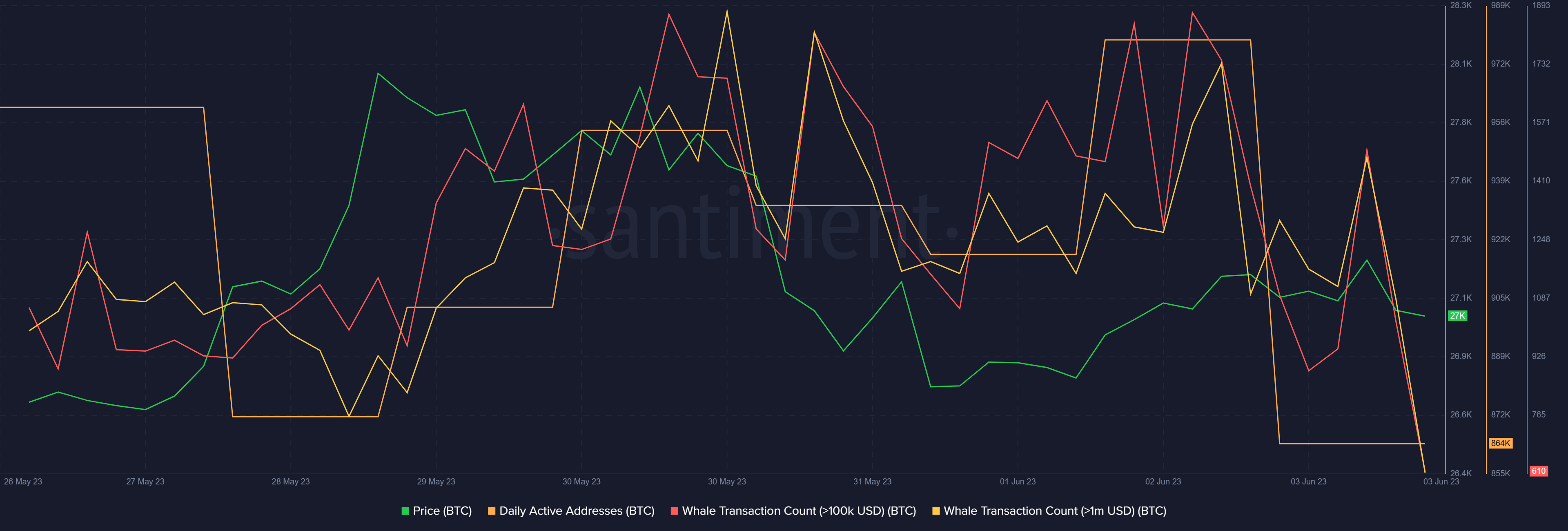

With decreasing volatility, Bitcoin price is moving along an equilibrium line in the 4-hour chart. One can easily pass this for the weekend vibe, with low trading volume. Nevertheless, it is impossible to ignore that whales have also been sitting on their hands.

Sentiment data shows that the whale transaction count for large holders with over $100,000 and a $1 million balance has steadily declined since May. The same goes for the number of daily active addresses, as indicated in the chart above.

Unless bullish momentum increases, Bitcoin price could drop, first losing the support offered by the 50 MA at $29,365. This is before a drop to $28,998, or in the dire case, a retest of the August 7 lows around $28,806.

The Relative Strength Index (RSI) and the Awesome Oscillators (AO) momentum indicators support the bearish thesis. Based on their overall outlook- the RSI heading south and the AO in the negative- momentum is fading. This means bears are taking over.

Conversely, if new capital flows into BTC, possibly because of large holders accumulating, Bitcoin price could rise. In such a move, the flagship crypto could breach the 200 MA at $29,640 or, in a highly bullish case, extend north to tag the $30,052 resistance level.

While Bitcoin price struggles to disentangle from the equilibrium, consider XRP20, a more promising alternative.

Promising Alternative To Bitcoin

XRP20 has emerged as a fresh contender in the ever-evolving realm of cryptocurrencies. Seemingly, it aims to ride the coattails of heightened investor curiosity surrounding Ripple (XRP) after its courtroom triumph. Official project records indicate an impressive $2.54 million has been garnered. This is a substantial step towards the project’s overall target of $3.68 million. The current price of the coin is 0.000092.

https://twitter.com/XRP20AMA/status/1690076524114812928

XRP20 finds itself in a pivotal presale phase, wherein the market’s response will determine its initial price once it debits on decentralized exchanges (DEX). The anticipation surrounding this market debut underscores the notion that its valuation will be influenced by investor sentiment and demand dynamics.

Interestingly, XRP20’s developers have strategically chosen the path of an ERC20 token on decentralized exchanges, emphasizing compatibility with the Ethereum blockchain. This strategic move reflects the project’s alignment with the broader crypto ecosystem and its intent to facilitate seamless interactions within this decentralized landscape.

https://twitter.com/XRP20AMA/status/1690348259384934400

An intriguing facet of the XRP20 narrative is its roadmap, which reveals that staking is earmarked as an integral component in the forthcoming stages. While details regarding the specifics of this staking mechanism remain undisclosed, this developmental direction signifies a conscious effort to enhance user engagement and participation. Staking often incentivizes coin holders by enabling them to earn rewards for maintaining their holdings in a designated wallet.

Also Read:

- Bitcoin’s Dominance Tested: BTC Drops to $29,300 Threshold – Analysts Discuss Its Next Chapter

- How To Buy XRP20 Token – $XRP20 Token Presale Review

- How To Buy XRP20 Presale Guide – Alessandro De Crypto Reviews’ The New XRP’

- Keep an Eye on XRP20, a New Cryptocurrency Launch; Could It Surge by 22,700% Like XRP Did, Through its Stake to Earn Model?

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage