Join Our Telegram channel to stay up to date on breaking news coverage

Cryptocurrencies have an history of high volatility, driven by varied factors from global demand and usage and changes in software, to political changes and social and economical events, and have often been compared to history’s biggest bubbles, whether the Dutch Tulip mania in the 17th century, the Mississippi Bubble in the 18th century or the UK Canal and Railway mania in the 19th century. Perhaps the most popular comparison is the Dot-com bubble of 2000.

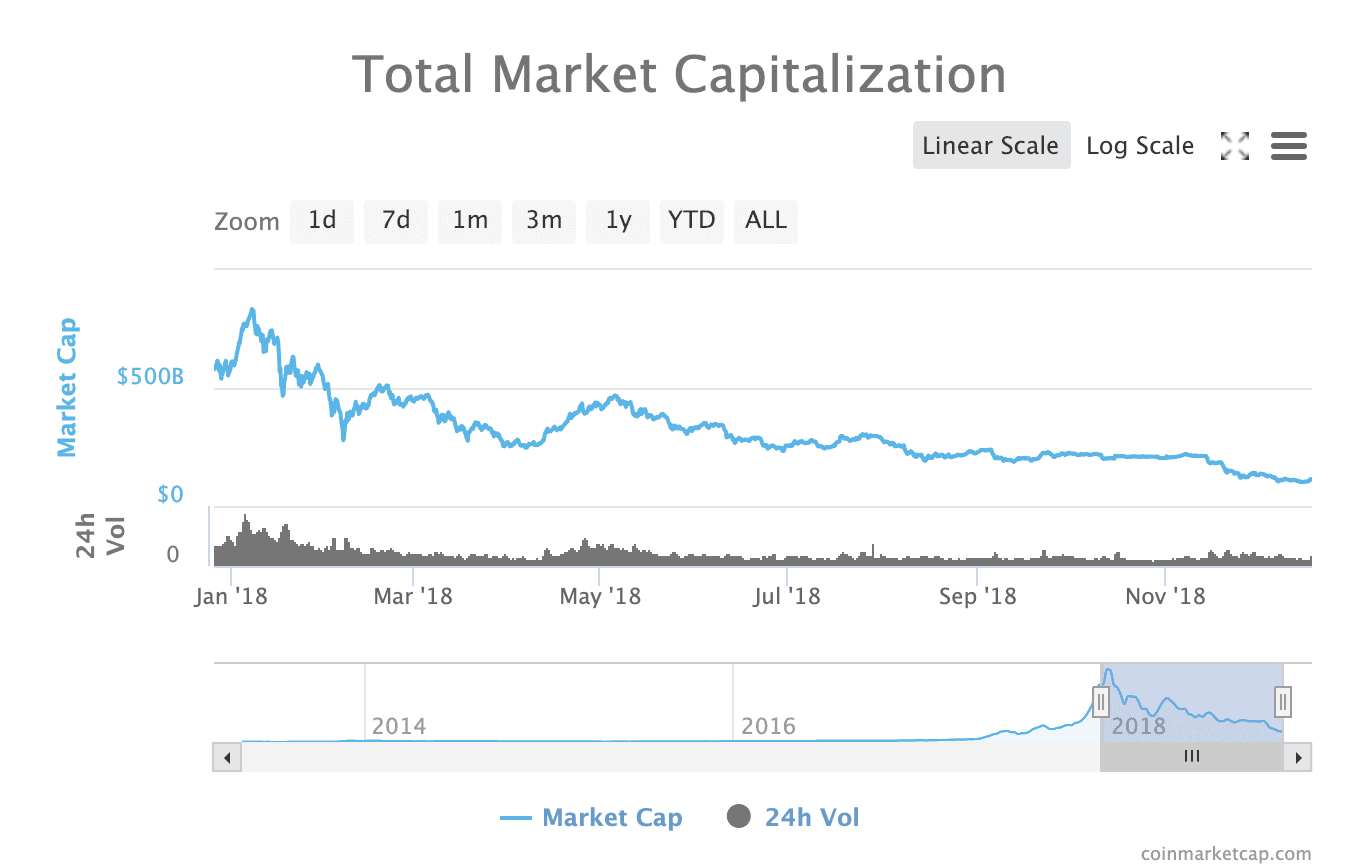

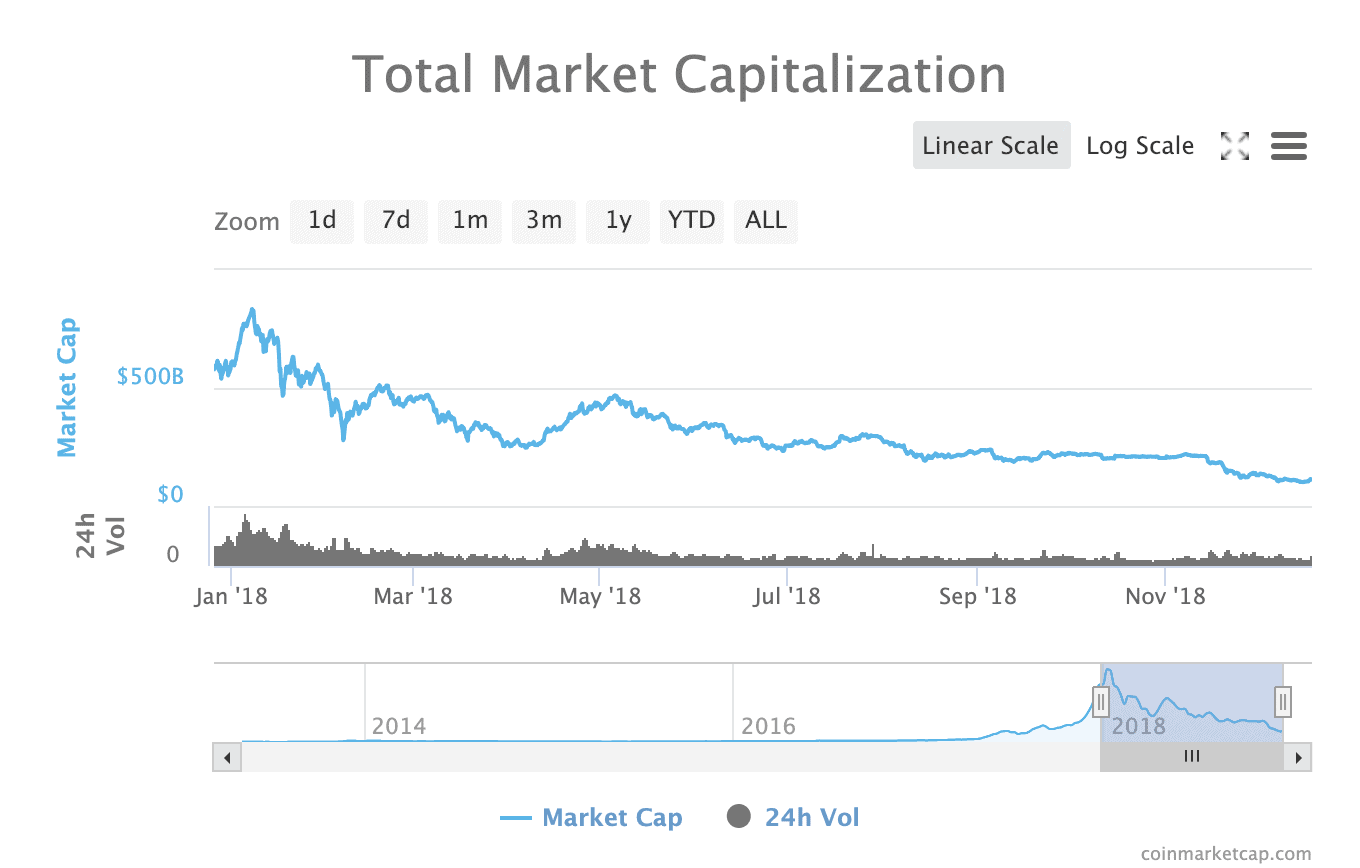

Since December 2017, the cryptocurrency market has followed a similar trajectory in what has been deemed the 2018 Cryptocurrency Crash. Cryptocurrencies dropped from an all-time high market capitalization of US$823 billion in early January 2018 to now US$112 billion, an 86% decline from the beginning of the year.

Total Crypto Market Capitalization, Coinmarketcap.com

As the cryptocurrency market continues through one of its worst sell-off periods, we look at five of bitcoin’s and ether’s biggest monthly losses of all-time:

Bitcoin crashes

Bitcoin via MaxPixel.net

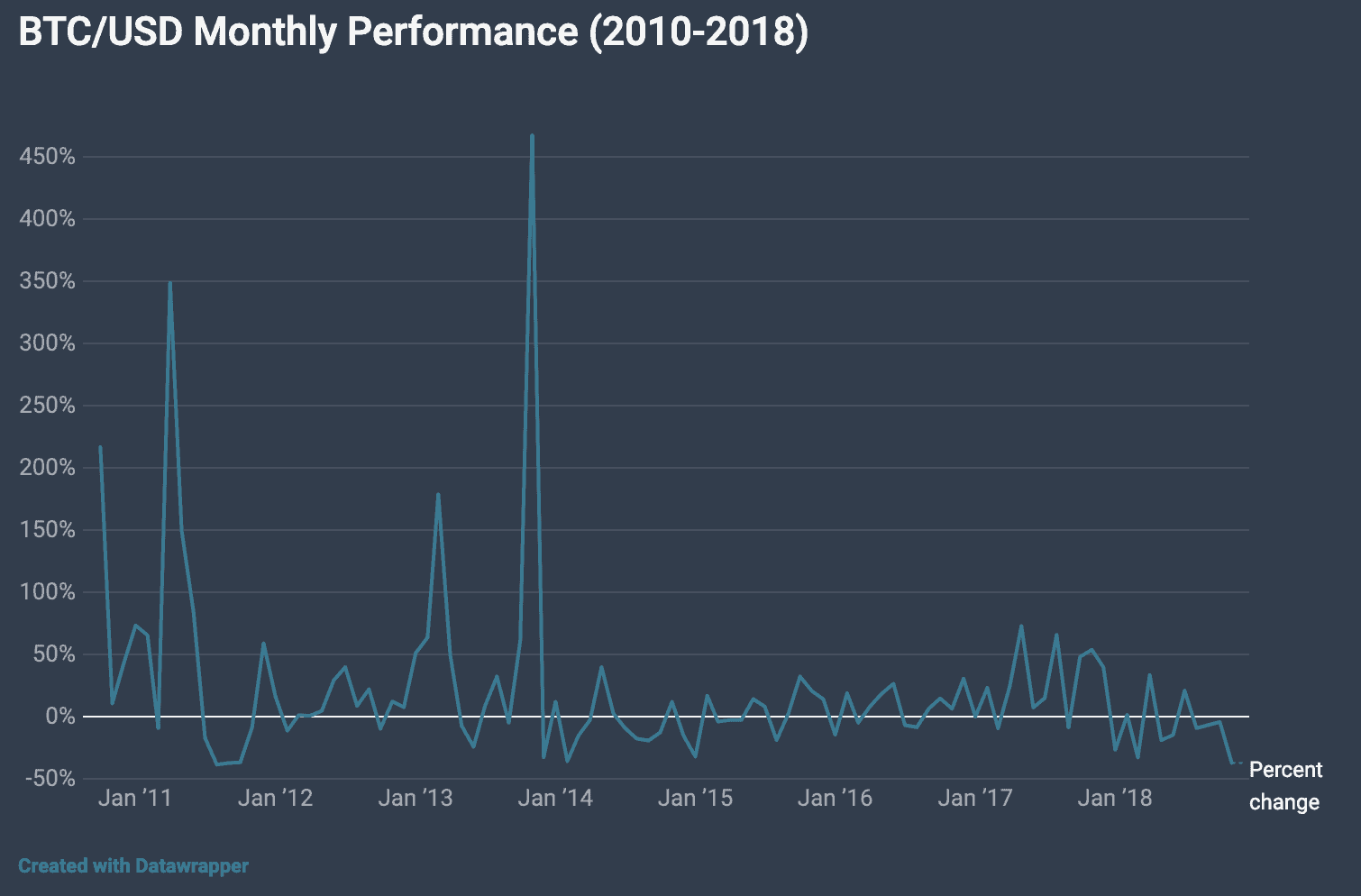

The Great Bitcoin Bubble of 2011

June 2011 was the peak of the Great Bitcoin Bubble of 2011. The price of bitcoin rose to hit an all-time high of US$31 before crashing down to US$10 and beginning a slow and steady decline that bottomed out at US$2 in November 2011, decreasing its value by over 90% over the following four months. Prices didn’t return to this peak again until 2013.

August 2011: -39%

September 2011: -37%

October 2011: -37%

The Late 2013 Crash

In December 2013, the price of bitcoin crashed to US$500 from a high of US$1,150 in late November. It eventually rebounded to US$1,000 before crashing again to the US$500 range then stabilizing to the US$650-US$800 range.

Adding to the long road to recovery after the collapse in December 2013 was the shutdown of Mt. Gox. The price of bitcoin grew steadily through January and February 2014 when suddenly fell nearly 50% from US$860 to US$440.

In early February 2014, one of the largest bitcoin exchanges, Mt. Gox, suspended withdrawals citing technical issues. By the end of the month, Mt. Gox had filed for bankruptcy protection in Japan amid reports that 744,000 bitcoins had been stolen.

February 2014: -36%

The 2018 Cryptocurrency Crash

Since January 2018, the cryptocurrency market has been undergoing the so-called the 2018 Cryptocurrency Crash, also referred to as the Great Crypto Crash, a massive sell-off period of most cryptocurrencies.

After an unprecedented boom in 2017, the price of bitcoin fell by 27% in January 2018, then 33% in March. Nearly all other cryptocurrencies also peaked from December 2017 through January 2018, and then followed bitcoin. The cryptocurrencies’ market capitalization lost at least US$342 billion in the first quarter of 2018, the largest loss in cryptocurrencies up to that date.

By September 2018, cryptocurrencies collapsed 80% from their peak in January 2018, making the 2018 Cryptocurrency Crash worse than the Dot-com bubble’s 78% collapse. By late November, bitcoin had fallen by over 80% from its peak, having lost almost one-third of its value in the previous week, and registered its biggest monthly decline in more than seven years.

November 2018: -37%

BTC/USD monthly performance, CoinDesk

Ether crashes

Ethereum ETH Crypto Coin Stock Photo, by Crypto360, Flickr

The August 2015 Ether Crash

Following the launch of Ethereum’s first live release Ethereum Frontier in late July 2015, the price of ether, the cryptocurrency native to the decentralized platform, dropped significantly, registering a monthly loss of 56% in August 2015 and 45% in September.

Despite heavy sell offs initially on August 8, price settled around US$1 until January 2016 when market interest picked up, sending the price to an all-time high of US$14 in March 2016.

Ethereum crowdfunded its project in June 2014, raising about US$18 million worth of bitcoins in one of the world’s largest crowdfunding campaigns at the time. During the initial coin offering (ICO), an ether was priced roughly 30 cents per ETH.

August 2015: -56%

September 2015: -45%

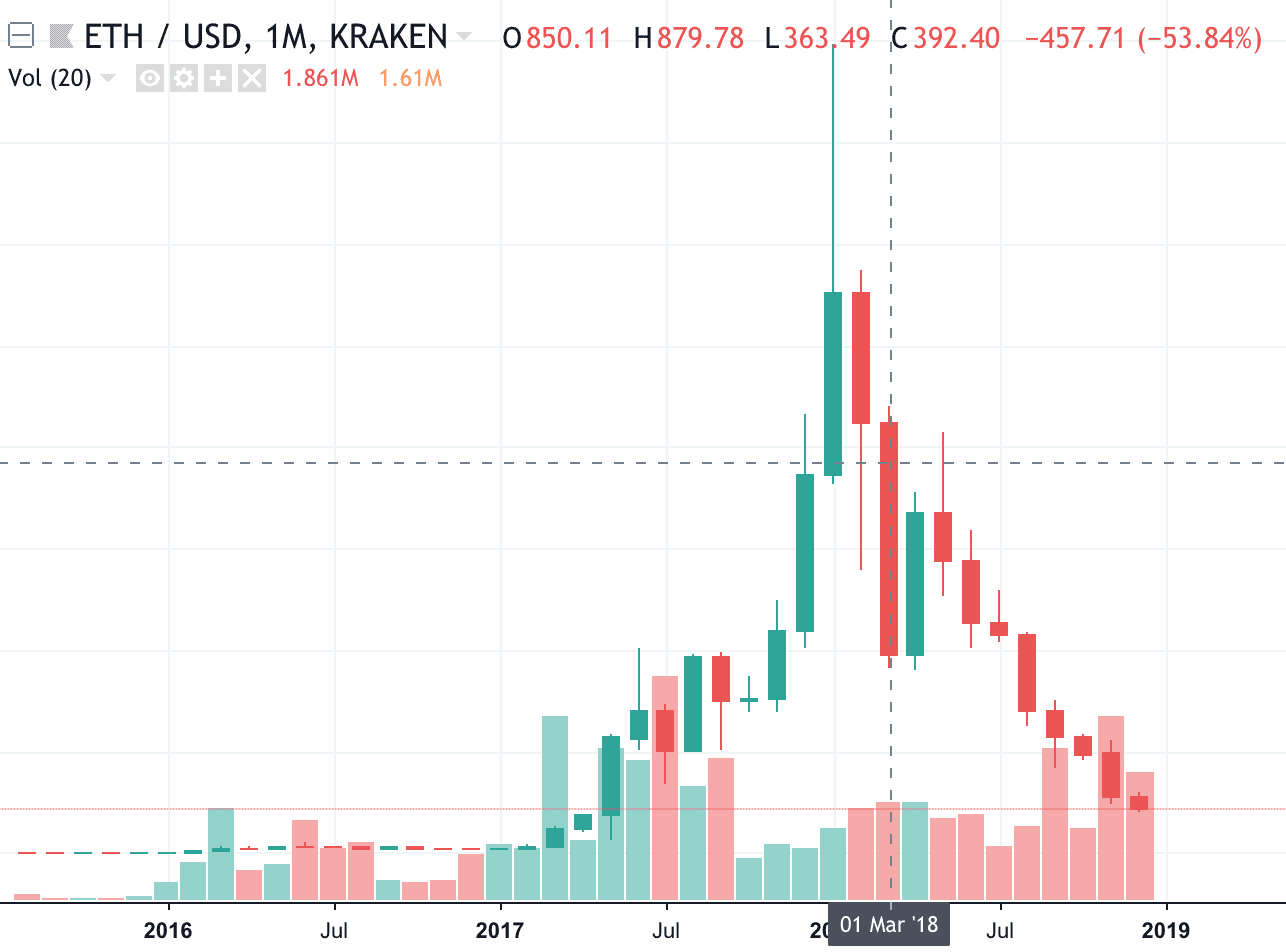

The 2018 Cryptocurrency Crash

During the 2018 Cryptocurrency Crash, the price of ether dropped nearly 90% from its all-time high of US$1,590 in January to about US$90 in December. Ether witnessed one of its biggest monthly losses in March 2018, falling 53% from US$850 to US$400.

February 2018: -23%

March 2018: -53%

November 2018: -43%

ETH/USD Kraken chart, Tradingview

Featured image: Bitcoin with chart, by QuoteInspector.com, via Flickr.

The post Bitcoin and Ether All-Time Highest Biggest Losses appeared first on Fintech Schweiz Digital Finance News – FintechNewsCH.

Join Our Telegram channel to stay up to date on breaking news coverage