Join Our Telegram channel to stay up to date on breaking news coverage

Binance, the top cryptocurrency exchange globally, has launched an innovative tool called the Binance Volatility Index (BVOL) to assist traders in steering the vibrant crypto market.

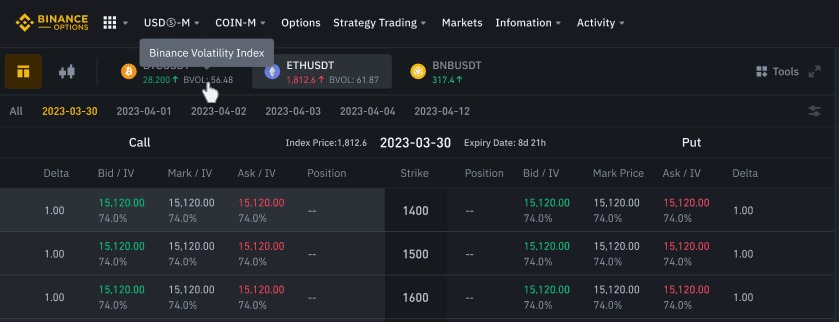

Traders and investors can now access the Binance Volatility Index (BVOL) and a range of extensive trading tools through Binance Options’ user-friendly platform. This inclusive ecosystem enhances users’ trading potential and offers valuable insights into the complexities of cryptocurrency markets, promoting financial education.

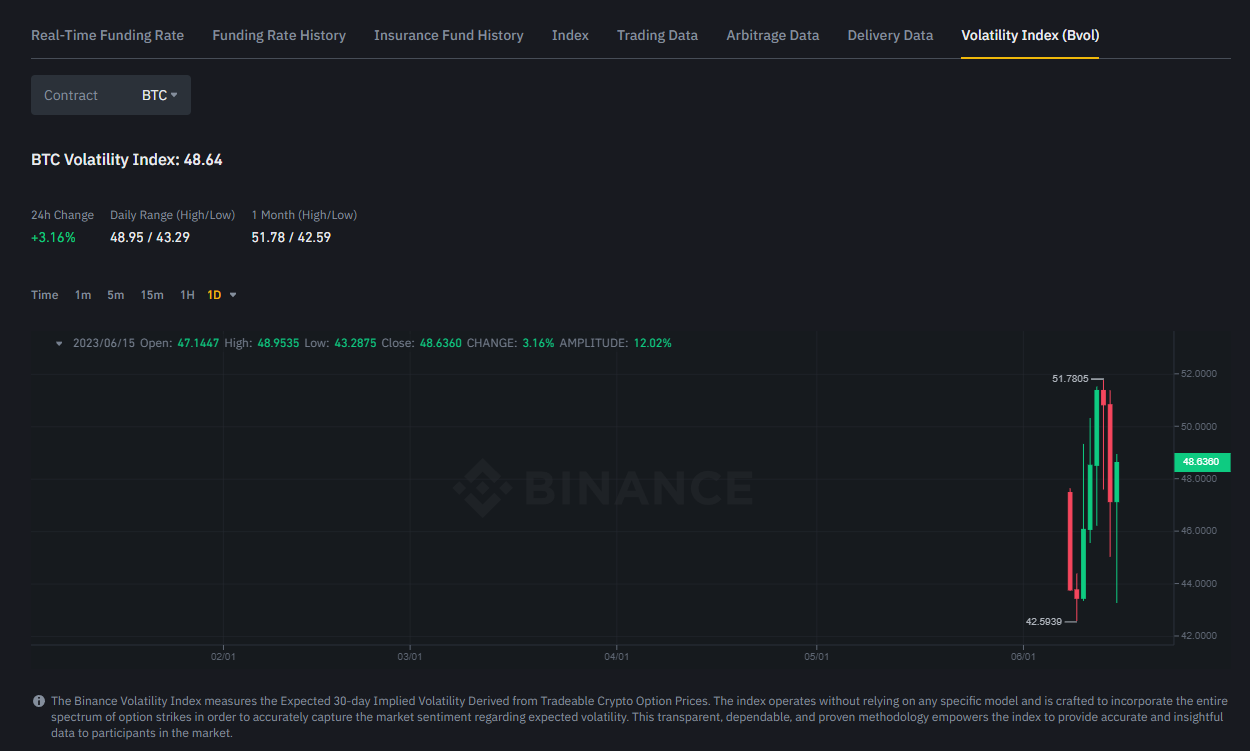

A high BVOL shows that significant price changes are expected, while a low BVOL suggests minor price fluctuations will occur. The Binance Volatility Index (BVOL) is only available for BTC and ETH on the Binance Options trading platform.

Binance BVOL to Empower Traders with Real-Time Insights on Crypto Asset Volatility

Binance has developed BVOL to measure and use the intrinsic volatility of digital assets to offer real-time insights into market fluctuations. This new tool will also help traders make informed decisions and manage their risk exposure effectively.

Binance Options has utilized progressive algorithms and thorough data analysis to create BVOL, which explicitly measures and represents volatility levels in different cryptocurrencies. This one-of-a-kind offering empowers users to evaluate market sentiment, predict price fluctuations, and adapt their trading strategies within the reliable Binance ecosystem.

BVOL reinforces Binance’s dedication to providing innovative and state-of-the-art solutions to the cryptocurrency community. It is another significant achievement in its mission to facilitate transparent and secure trading experiences for users worldwide.

The launch of BVOL has gained significant attention in the crypto community, with experts recognizing its transformative impact on risk management and decision-making for traders of all skill levels. As the cryptocurrency market continues to evolve, BVOL from Binance emerges as a timely and vital addition to the toolbox of crypto enthusiasts. It propels the industry towards a more prosperous and stable future.

What is Binance Volatility Index (BVOL)

The Binance Volatility Index (BVOL) is a tool that measures how much the cryptocurrency market will change in the future. It is based on trading crypto options like BTC and ETH on the Binance platform.

Additionally, traders calculate the index by considering the average volatility of specific crypto options contracts. Traders and investors can benefit from BVOL as it provides them with a real-time indication of market volatility, allowing them to make more informed decisions on how to manage their investments.

Traders can also use the BVOL to understand market sentiment, manage risk, and make better trading decisions. A high BVOL means that major price changes will occur, while a low BVOL suggests that prices will change less.

The Volatility Index estimates future volatility by analyzing the specific volatility in options trading. It considers options before and after 30 days. It looks at near-term and next-term options to calculate the average perceived volatility within that 30-day range.

How to Access BVOL

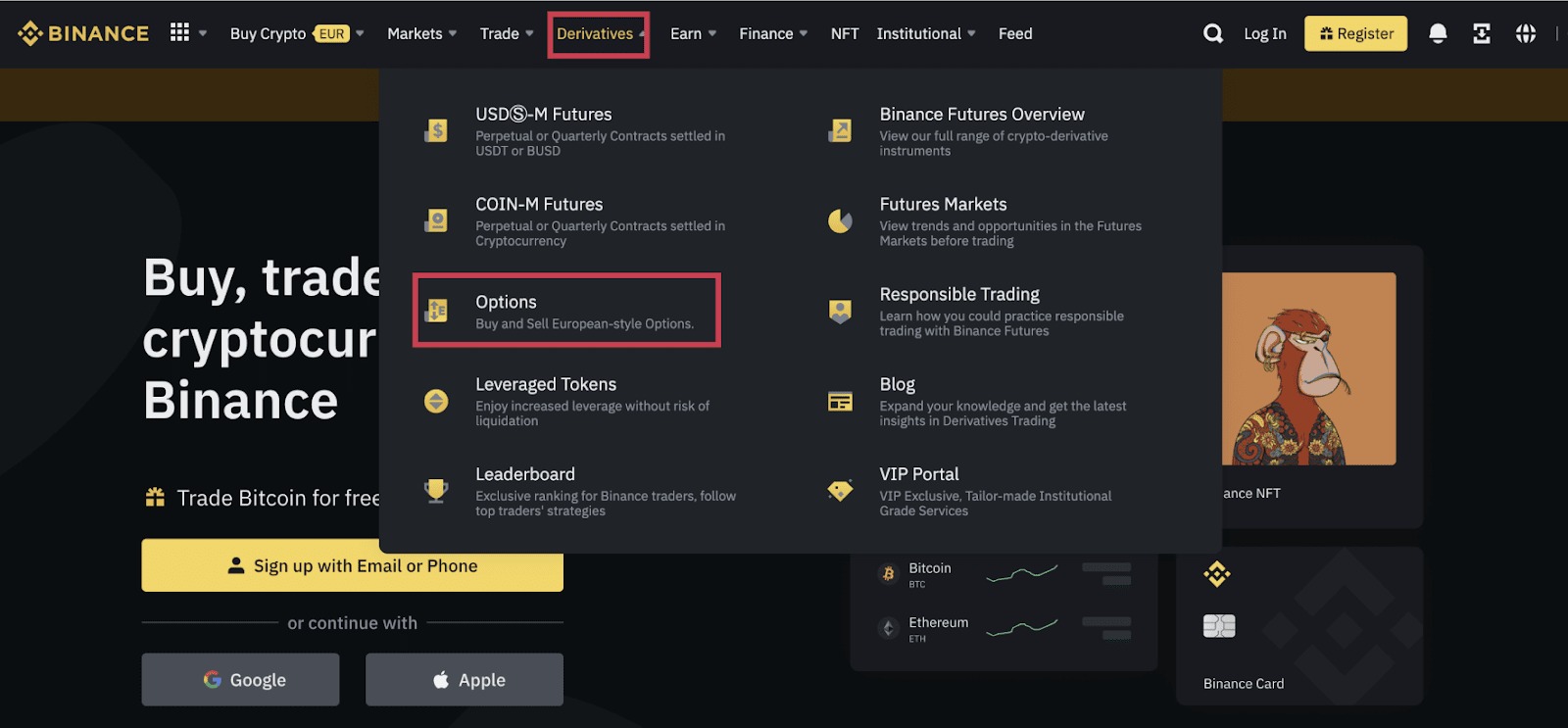

To access the Binance Volatility Index,

- Navigate to the “Derivatives” section and select “Options.” On the Option’s trading page, you will find the Binance Volatility Index displayed alongside the corresponding contracts.

- Click on the [BVOL Index] tab under the [Tools] section on the Option’s trading page. Alternatively, you can find the Binance Volatility Index page directly here.

Options and Strikes for Volatility Index Calculation

To enhance the accuracy of the derived measure, the following steps are taken to select the options and strikes used in the Index calculation

- The options selected must be out-of-the-money BTC calls and puts that focus mainly on an at-the-money strike price (K0).

- Options with zero bid prices for BTC are not part of the calculation.

The number of options used in the volatility index calculation changes over time because the range of strike prices with non-zero bids can expand or contract, leading to variability.

BVOL will disregard options with higher or lower strikes if two consecutive calls or put options register zero bid prices. This means that traders can focus solely on the most relevant options for a more effective trading experience.

Special Adjustments to Expiration Selection

Normally, options within 23 to 37 days prior to expiration are considered here. However, if there aren’t enough quotes for these options, the selection range is broadened to include dates before 23 days and after 37 days. This flexibility ensures the continuous calculation of the index, although this situation is rare.

However, to improve the volatility index’s reliability and usefulness as a reference point, we apply a smoothing mechanism called the Exponential Moving Average (EMA). Currently, a 240-point EMA is used, which means that for each computation performed every second, traders consider data from the preceding 240-second window.

Related News

- Crypto Prime Brokerage FPG Halts Withdrawals After Suffering a $15 Million Cyber Attack

- Draft GOP Bill Earns Applause from Crypto Chiefs, While Democrats Express Reservations

- ChitCAT Price Prediction for Today, June 14: CHITCAT Swings in Range after Failing to Surpass $0.25

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage