Join Our Telegram channel to stay up to date on breaking news coverage

An executive decision was made in Washington to establish a Strategic Bitcoin Reserve, indicating growing government interest in digital assets as a component of the country’s financial strategy. This move signals Bitcoin’s rise to prominence in international economic systems while honoring its beginnings as a decentralized currency.

Investors are taking notice of some altcoins for all the right reasons as cryptocurrency markets reverberate. With their distinct offerings in a rapidly changing market, Jito, Aave, Algorand, and Berachain are among the formidable competitors to be closely watched on June 14. Whether you are interested in rising blockchain infrastructure, DeFi innovation, or next-generation scalability, these initiatives stand out for their aspirational objectives and increasing relevance.

6 Best Altcoins to Watch Today

What is causing these coins to gain popularity right now? Is it their recent strategic actions, ground-breaking use cases, or robust ecosystems? Each of these tokens is supported by technology that is not only popular but also sets the standard. The 6 best altcoins to watch today are not only making waves but also influencing the direction of cryptocurrency by facilitating smooth cross-chain transactions, releasing liquidity, and enabling safe lending practices and next-generation governance structures.

1. Jito (JTO)

Jito is the most prominent MEV-enabled liquid staking platform in Solana. In addition to retaining liquidity, the JitoSOL token compounds benefit from MEV operations and validators.

A Crypto Task Force and Multicoin Capital partnered with Jito Labs in February to investigate the integration of staking into Exchange-Traded Products (ETPs), marking an institutional milestone. In July 2024, it signed a significant auto-across DeFi agreement with Maple Finance, providing JitoSOL yields to institutional USDC lenders.

Your $SOL is capable of more.

• accrue staking and MEV rewards

• swap in size with minimal slippage

• lend, borrow, loop, LP in Solana DeFi

• help make Solana more decentralizedChoose JitoSOL. pic.twitter.com/cSFw0Nmvr5

— Jito (@jito_sol) June 13, 2025

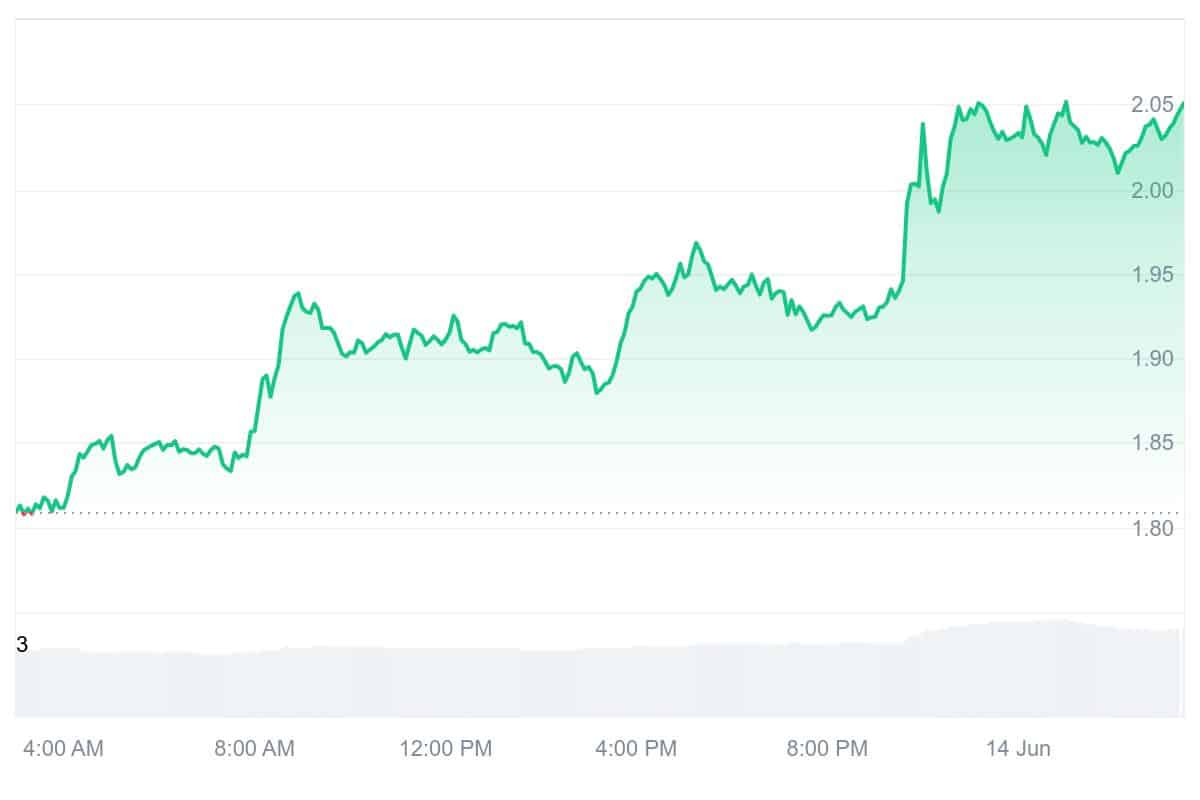

The last day’s price ranged from $1.81 to $2.05, and it is currently trading at about $2.04. Currently surpassing several of its contemporaries, Jito is up roughly +12–13% over the last day and seven days. With a fully diluted valuation (assuming 1 billion tokens) of about $2 billion, the circulating supply is approximately 337 million JTO, resulting in a market worth of about $690 million.

More recently, the Jito Foundation raised brand awareness among sports and web3 audiences by eventually becoming a platinum sponsor of the Mad Drops, LA’s Major League Pickleball team.

2. Aave (AAVE)

Through the use of Ethereum smart contracts, Aave addresses one of the most antiquated aspects of finance: lending and borrowing. Rather than relying on banks or credit checks, Aave enables users to borrow against their assets while keeping them on-chain or deposit cryptocurrency into liquidity pools to earn interest quickly.

Its distinctive features include cross-chain capabilities, Efficiency Mode, Isolation Mode, and “flash loans,” which are quick, uncollateralized loans that must be paid back in a single transaction. These techniques increase capital efficiency and make complex use cases possible, such as yield optimization across different chains and arbitrage.

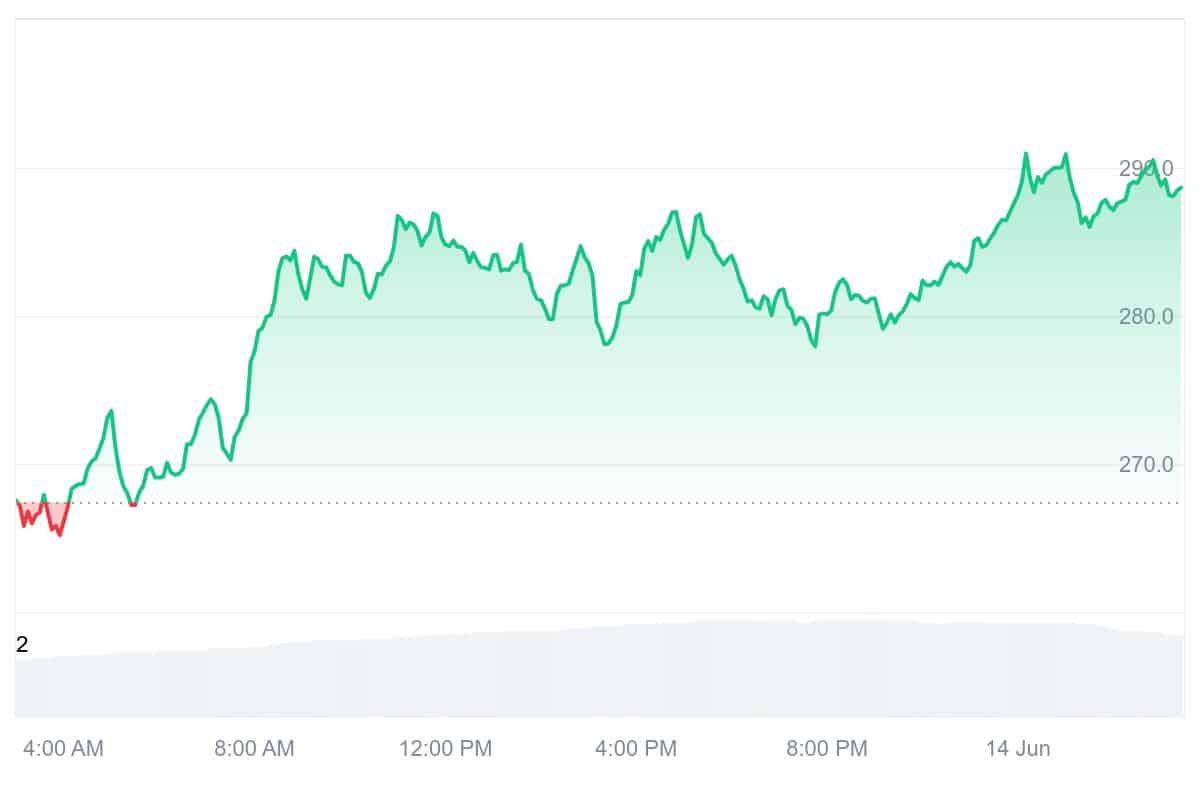

AAVE has risen by roughly +24% in the last month and is up more than 220% so far this year, indicating fresh impetus. Bullish sentiment is evident from the current deep dive on price prediction charts, with forecasts of $341 by June 17 driven mainly by “greed” sentiment index values and strong technical indications pointing upward.

According to reports, institutional purchasers, including World Liberty Financial, purchased millions of dollars worth of AAVE in May, causing a sharp 20% surge and demonstrating the growing trust that big money has in Aave’s DeFi strategy.

3. Algorand (ALGO)

MIT Turing Award recipient Silvio Micali created Algorand in 2019 to resolve the infamous “blockchain trilemma,” which is the difficulty of simultaneously attaining security, scalability, and decentralization.

What is special about Algorand, then? With a settlement time of five seconds and a cost of less than a cent, its speed approaches that of major payment networks like Visa. High throughput, extremely low costs, security, and decentralization make it an ideal platform for applications involving global finance, DeFi, NFTs, and even Central Bank Digital Currency (CBDC).

🇧🇷 Big news in Brazil for @wtrtoken , built on Algorand.

Just weeks after its adoption in Italy, WTR is expanding to Brazil. CearaPar has partnered with parent company Hypercube to bring water credit tokens to Ceará State.https://t.co/mRudwHSEVb

— Algorand Foundation (@AlgoFoundation) June 13, 2025

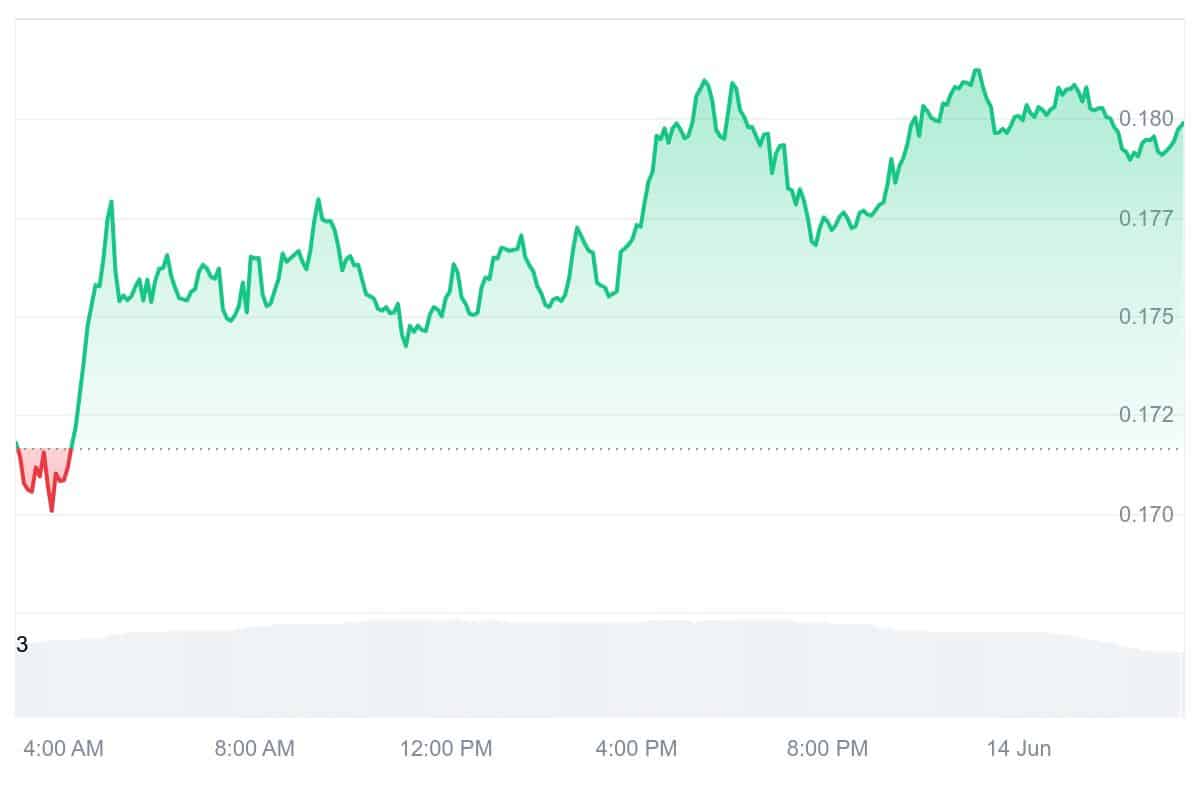

With a market capitalization of around $1.5 billion and a fully diluted valuation of almost $1.8 billion, ALGO is trading at about $0.18 today, up about 5% from yesterday. The 24-hour volume is over $230 million. These figures indicate a well-liquid, mid-cap asset that is well-established in the Layer-1 ecosystem.

The blockchain currently supports India’s women-focused digital ID initiatives, safeguards Italy’s digital guarantees, and serves as the foundation for the first tokenized money market fund introduced this month.

4. Berachain (BERA)

The Proof-of-Liquidity architecture is what makes BERA special. Rather than setting aside money for staking, users keep their money active in DeFi vaults, notably money-market lending rates up to 100% during spikes in demand and BERA-linked LPs that provide yields close to 150% APR without the risk of temporary loss.

One of the most recent updates includes the “Great Rollover” user interface improvement, which allowed users to farm BGT, reinvest, exchange, deposit, and stake LP tokens in a single, efficient flow. Compared to some of its competitors in the PoS space, its BeaconKit consensus fork provides 40% faster block proposals and single-slot finality.

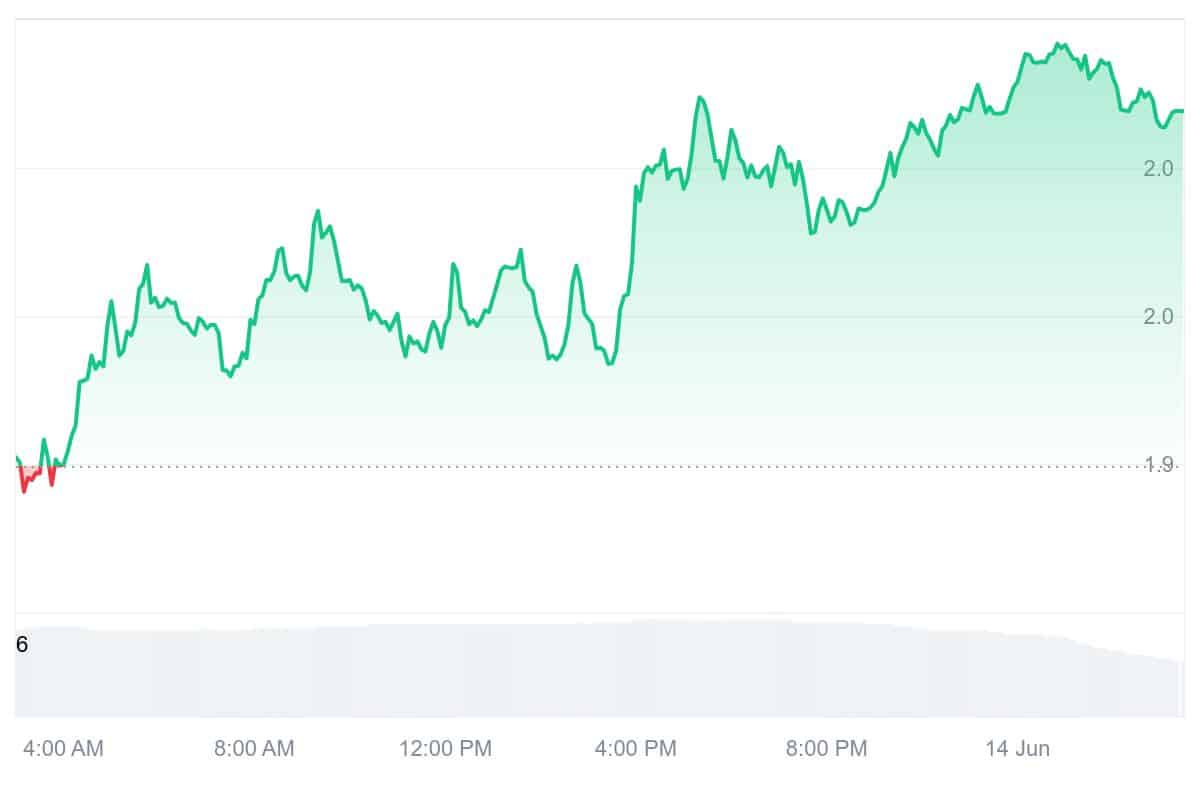

BERA is presently trading at about $2.09, up 4.4% in the last day. It was at the cycle low of $1.95 on June 13, 2025, and has dropped by 86% from its peak of $14.79 in February 2025.

Decisions on the latest batch of RFRVs have been delivered by the @bgtfdn on behalf of the Guardians.

This batch introduces Honeypot Finance’s all-in-one vault and a new wBERA lending market from Euler × MEV Capital. Two governance improvements also went into effect: the holder… pic.twitter.com/JqmYgmDxLm

— Berachain Foundation 🐻⛓ (@berachain) June 10, 2025

DeFi protocols such as Dolomite and Euler have shown interest in Berachain’s vault technology, which is integrated with Reward Vaults to provide profitable BERA loan yields. Berachain also has strong connections to early venture capitalists as one of the 6 best altcoins to watch today; however, this has raised questions about whether it is investor-led or community-led.

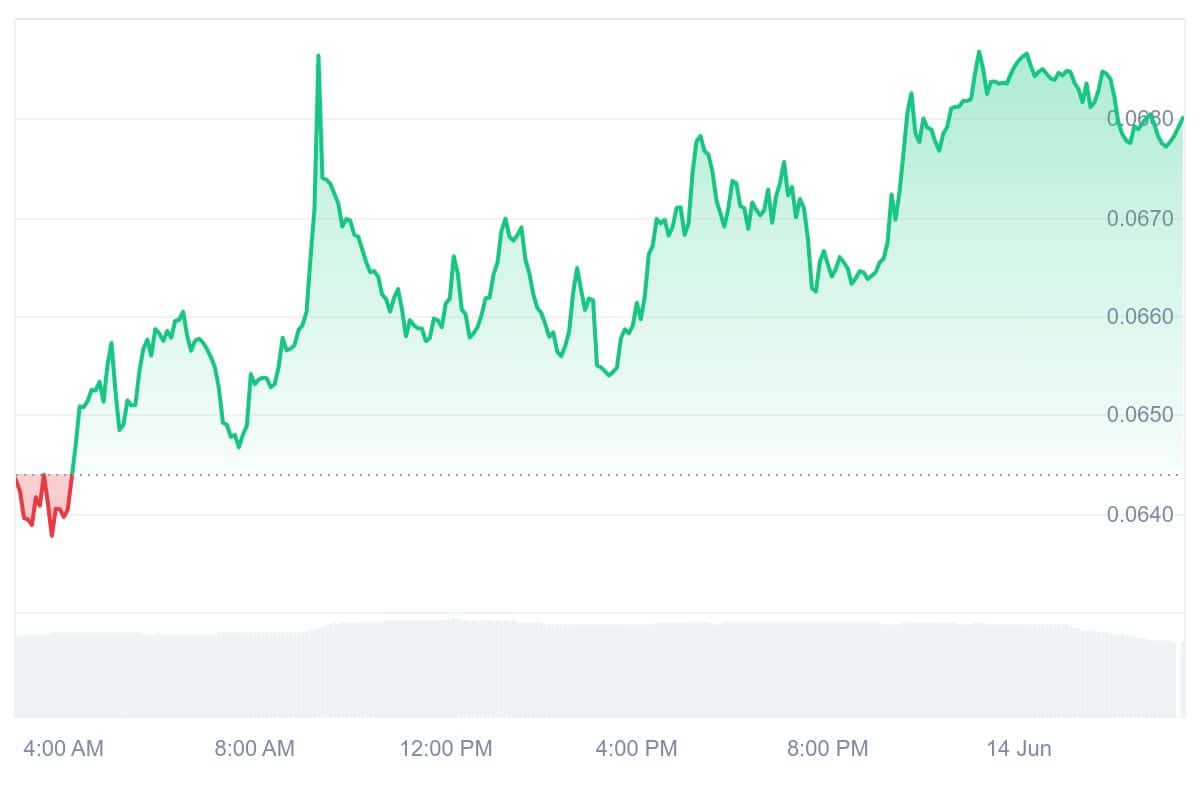

5. Snorter Token (SNORT)

As Snorter Token launches into presale, it promises to transform meme-coin hunting and transform Telegram into your trading cockpit, sending a snorting shockwave across the cryptocurrency industry.

SNORT is generating over $650,000 in less than two weeks at a steady $0.094 during the presale, a momentum that begs for attention and urgency. With over $15K in single purchases and over 5 million tokens invested, investors are snatching it up and chasing mouthwatering APYs close to 500–800%.

Each milestone appears to be a building component for a larger bot-powered DeFi wave, from stacking out presale rounds to governance enhancements. The excitement of meme coin upside and useful trading tools, such as built-in fee reductions, ready-made scam defenses, and staking payouts that rival many high-octane defi plays, are available to early investors.

6. Wormhole (W)

Wormhole’s most notable feature is its unified messaging system. Its ability to function across over 30 chains allows for use cases beyond token bridging, including data oracles, governance messages, cross-chain NFTs, and DeFi techniques spanning many ecosystems.

In addition to being a bridge toll, its W token is positioned as a mechanism for decentralized governance and ecosystem development through grants, node operator incentives (Guardians), and token economics that bring stakeholders into alignment with the network’s expansion.

.@circle's CCTP V2 USDC transfers are now available on Portal to Sonic

Move your USDC to @SonicLabs now: https://t.co/BIYmMr2fg1 pic.twitter.com/5MCKBxvDpN

— Wormhole Portal (@portalbridge_) June 12, 2025

According to forecasts, W will likely stabilize around $0.108 in 2026 and edge up to $0.117 by 2027, ranging between $0.0534 and $0.0774 the following year. More bullish projections place the token between $0.59 and $1.05 by 2025 and between $0.73 and even $0.90 by 2030.

Wormhole’s recent partnership with Flow Traders to improve cross-chain liquidity and integrate institutional backing is an indicator of increasing real-world acceptance. Each additional integration increases its significance as a neutral layer of interoperability between fragmented blockchain ecosystems.

Learn More

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage