Join Our Telegram channel to stay up to date on breaking news coverage

BNB Price Analysis – September 2

The $23 support level is a critical support level, but the market fails to rebound and if the market continues its downtrend, the price could drop below the current price zone, BNB price is struggling to hold at the $21 support level.

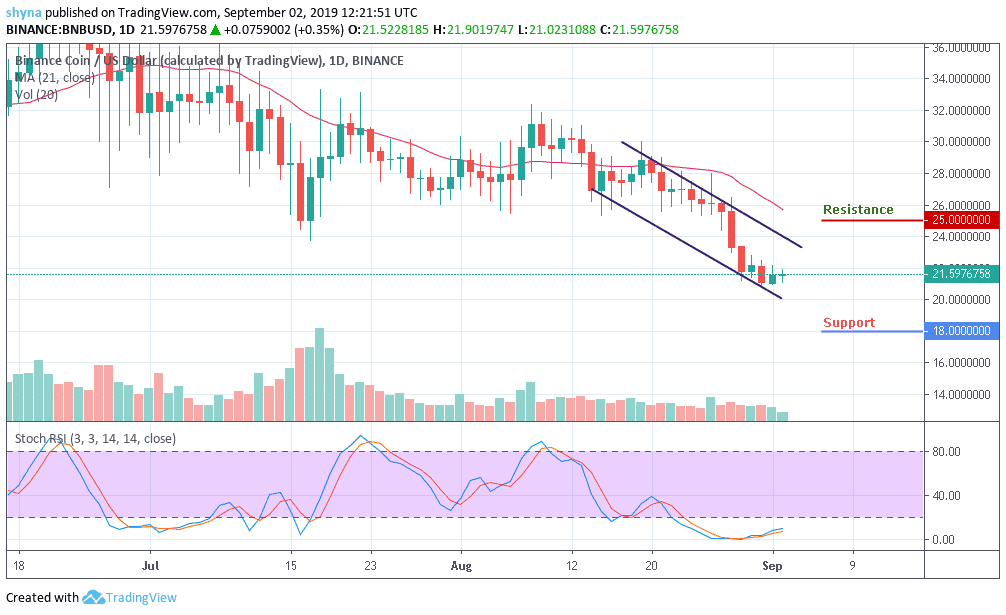

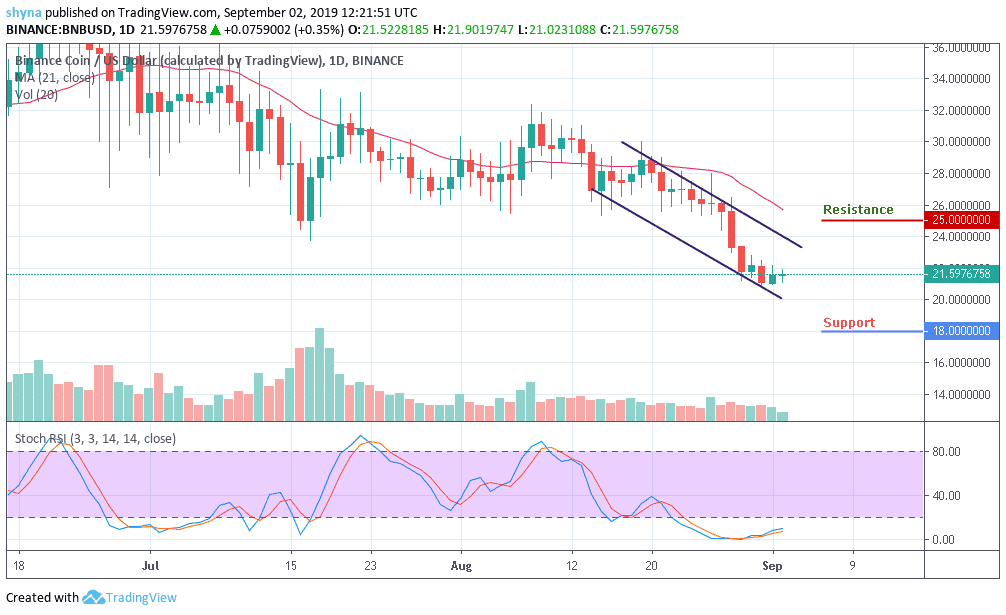

BNB/USD Market

Key Levels:

Resistance levels: $25, $27, $29

Support levels: $18, $16, $14

The BNB price has finally broken the $23 support level, and it continues its downward fall. The $23 support level is a critical support where price has been holding for some sometimes. The market has earlier consolidated at this level before making an upward movement. This makes the support level a strong support zone. BNB price is likely to hold if price respects the previous price zone.

Moreover, BNB/USD pair is likely to rise if the bulls defend the $22 support level. In other words, if the bulls break the $24 resistance level, the coin may resume its upward move and could hit $25, $27 and $29 resistance levels. However, the analysis will be invalidated if the bears break the $20 support level, and Binance Coin (BNB)’s price may likely fall to the low of either $18, $16 and $14 support levels. The Stochastic RSI is already in the oversold zone; possible buying pressure may likely occur if it turns upward.

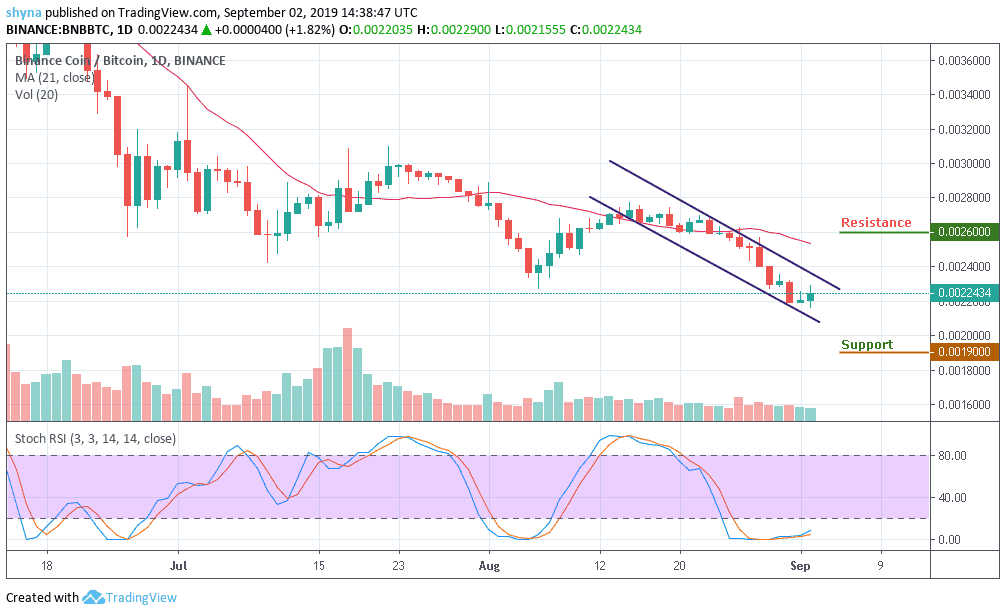

BNB/BTC Market

Against Bitcoin, the price is moving within the descending channel and in as much as the price actions keep respecting the channel formation, Binance Coin will remain perpetually under the control of bear radar. Meanwhile, we need more strong and consistent resistance to snatch the price from the bear-run for the BNB market.

For now, with the current movement in the chart, if the price breaks down the channel, it may likely reach the potential support levels at 0.0019 BTC and below. In other words, if the market could break out of the channel and move above the 21-day moving average,, the price of BNB is likely to hit $0.0026 BTC, $0.0028 BTC, and $0.0030 BTC resistances. The stochastic RSI is still at the oversold indicating more of bearish signals.

Please note: Insidebitcoins.com is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results.

Join Our Telegram channel to stay up to date on breaking news coverage