Join Our Telegram channel to stay up to date on breaking news coverage

BNB Price Analysis – July 11

Despite the recent pullback, Binance Coin is still up by a total of 63% over the past 3 months. BNB remains the 7th largest cryptocurrency with a market cap of $4.1 billion.

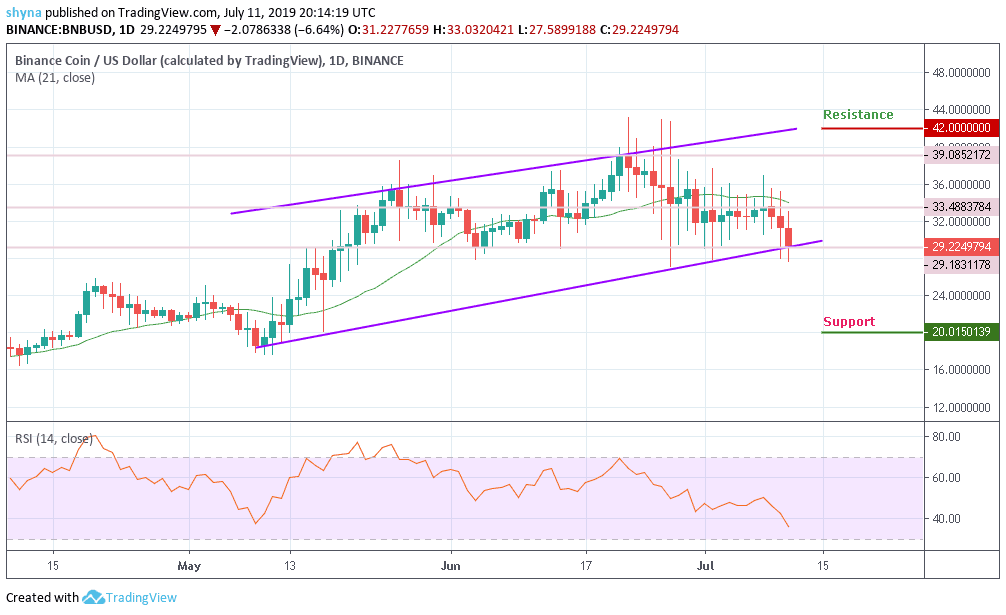

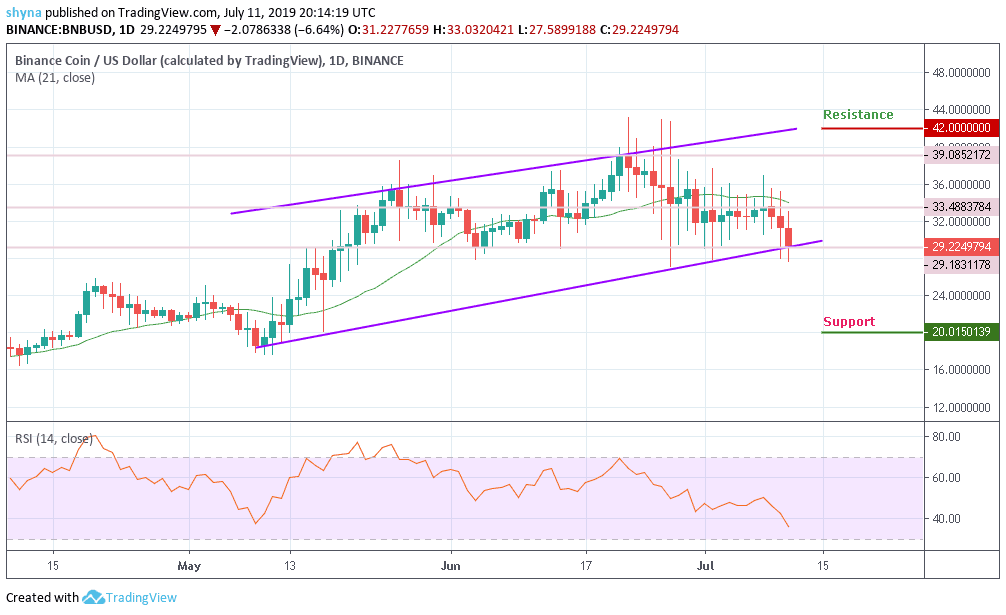

BNB/USD Market

Key Levels:

Resistance levels: $42, $44, $46

Support levels: $20, $18, $16

The price of Binance Coin tumbled over the past 24 hours, decreasing by more than 5.7%. This brought it to its current level below the 21-day moving average at $30 and the price is currently moving at $29.22. The recent price fall coincides with the sharp decline in Bitcoin price.

Moreover, on July 10, BNB broke above the $35.21 resistance level and eventually rolled over at this level. Today, the price went on to drop which led to BNB falling below $30 level. If the bulls climb back above $35, higher resistance lies at $42, $44, and $46. Else, if the sellers continue below $24, the next level of strong support lies at $20, $18 and $16. RSI has broken below the 40-level which shows that the bears are in complete control over the market.

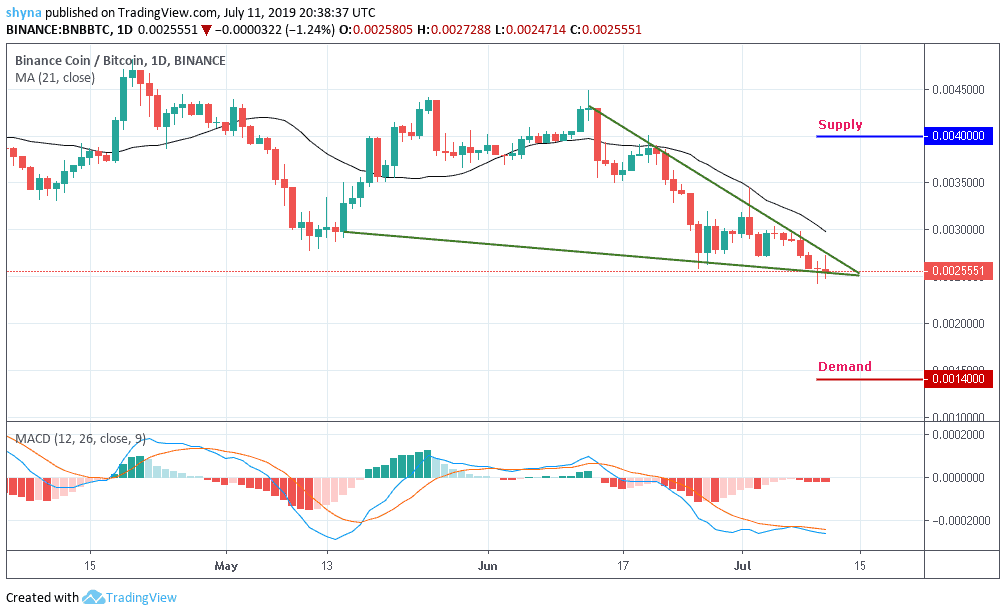

BNB/BTC Market

BNB has also been suffering against Bitcoin. The recent drop beneath the 0.0026BTC level has caused BNB/BTC to drop to fresh 5-month price lows. It can be seen that the market had found demand at 0.00259BTC yesterday but BNB still looks like it will head lower.

Looking at it from above, if the bulls can bring the price above 0.0028BTC, higher supply lies at 0.00295BTC and 0.0030BTC. If the bulls continue to move above 0.0030BTC, further supply lies at 0.0040BTC and 0.0045BTC. However, the nearest level of demand toward the downside lies at 0.0014BTC and the MACD is still moving at the negative side, which shows the sellers remain in control of this falling market.

Please note: insidebitcoins.com is not a financial advisor. Do your own research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results.

Join Our Telegram channel to stay up to date on breaking news coverage