Join Our Telegram channel to stay up to date on breaking news coverage

Bitcoin’s recent drop below $95,000 has caused a ripple effect in the cryptocurrency market, influencing the performance of many altcoins. This shift has drawn attention to several digital assets showing potential upward trends. Avalanche (AVAX) and Polkadot (DOT) have been standout performers, respectively, rising 62.74% and 105.55% over the past month. These gains highlight the growing interest in their ecosystems.

Meanwhile, XDC has shown a significant 11% increase in just 24 hours, reflecting renewed interest and possible shifts in market sentiment. Core has also seen modest gains, with a 1.92% uptick in the last 24 hours. These patterns reveal a mix of volatility and opportunity, suggesting increasing confidence in the potential of these altcoins. As the market demonstrates resilience, many investors are reassessing the best crypto to buy right now as potential portfolio additions.

Best Crypto to Buy Right Now

dYdX is priced at $1.48, marking a 17.71% increase over the past week. Market analysis highlights a positive trend for eCash, which is trading 16.21% above its 200-day simple moving average (SMA) of $0.00003751. This performance indicates strong market activity and liquidity for the token.

Meanwhile, Flockerz has garnered significant interest, raising over $3.3 million during its presale phase. In other news, Rumble announced plans to allocate part of its excess cash reserves to Bitcoin, intending to invest up to $20 million in the cryptocurrency.

1. dYdX (Native) (DYDX)

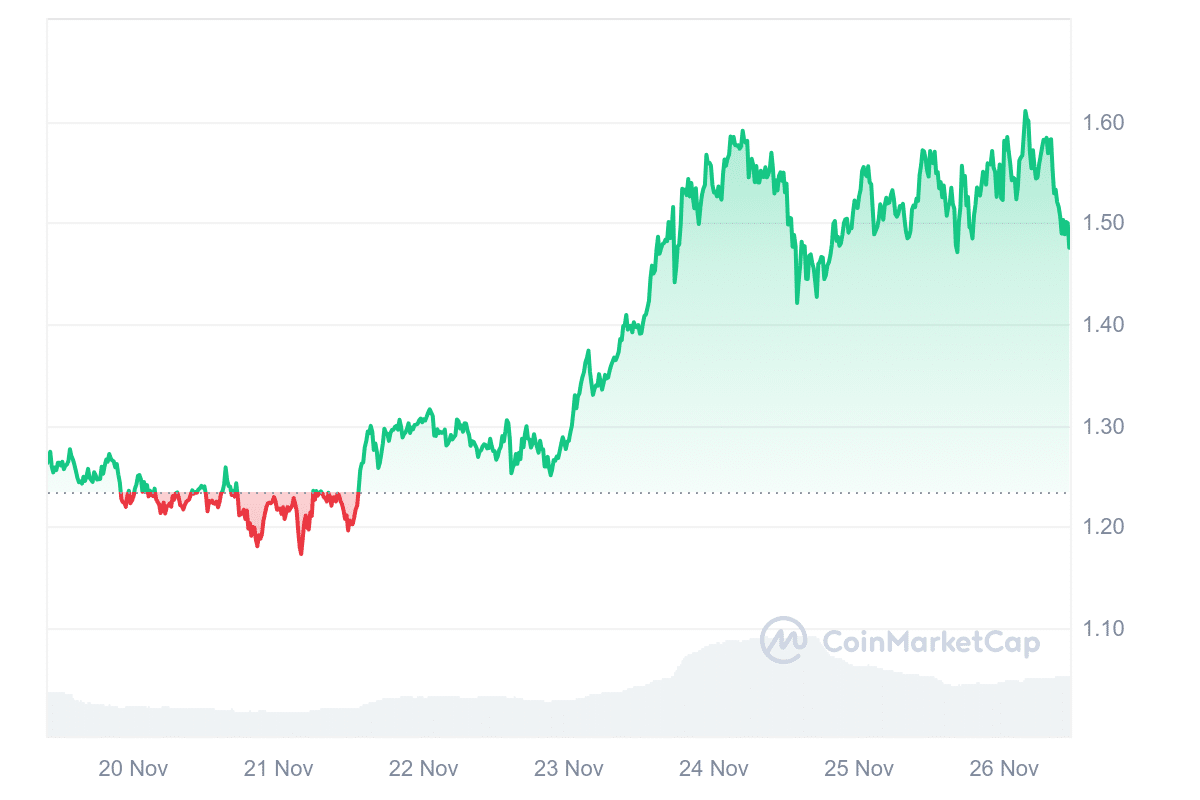

The current price of dYdX is $1.48, reflecting a 17.71% increase over the past week. Market sentiment around the cryptocurrency appears bullish, supported by a Fear & Greed Index score of 79, indicating an extreme greed state among investors.

Furthermore, dYdX is trading above its 200-day simple moving average (SMA), currently priced at $1.3872, with a margin of 6.28%. This technical indicator is often viewed as a positive signal, suggesting the potential for continued upward momentum. The Relative Strength Index (RSI) for 14 days is at 57.91, signaling a neutral zone.

This reading implies the cryptocurrency may experience relatively stable trading without significant movement in either direction. Over the past month, the token recorded 17 “green” days out of 30, indicating a 57% rate of positive daily performance. Additionally, its high liquidity relative to market capitalization supports strong market activity.

You can now list and trade the markets you want, with instant liquidity.

Without the need for a governance vote, Instant Market Listings gives you the opportunity to list and trade your favourite markets at any time.

Here's how it works ⬇️https://t.co/fJEz6EBuaz

— dYdX (@dYdX) November 22, 2024

The platform recently introduced Instant Market Listings, a feature allowing users to list and trade perpetual futures for any asset quickly. This innovation removes the need for governance approvals or third-party permissions, streamlining the process. For decentralized finance (DeFi) enthusiasts, this offers an efficient way to access and trade various assets on dYdX. The feature aims to enhance user flexibility and broaden trading opportunities.

2. Ethereum Classic (ETC)

Ethereum Classic functions as a decentralized platform that supports smart contracts and decentralized applications (dApps). The network uses a Proof-of-Work (PoW) consensus mechanism, similar to Bitcoin, to secure transactions and maintain operations.

Since its inception, Ethereum Classic has diverged from Ethereum in its development path. These differences have led to unique technical roadmaps for the two networks. While Ethereum has moved toward adopting Proof-of-Stake (PoS), Ethereum Classic remains committed to its PoW foundation.

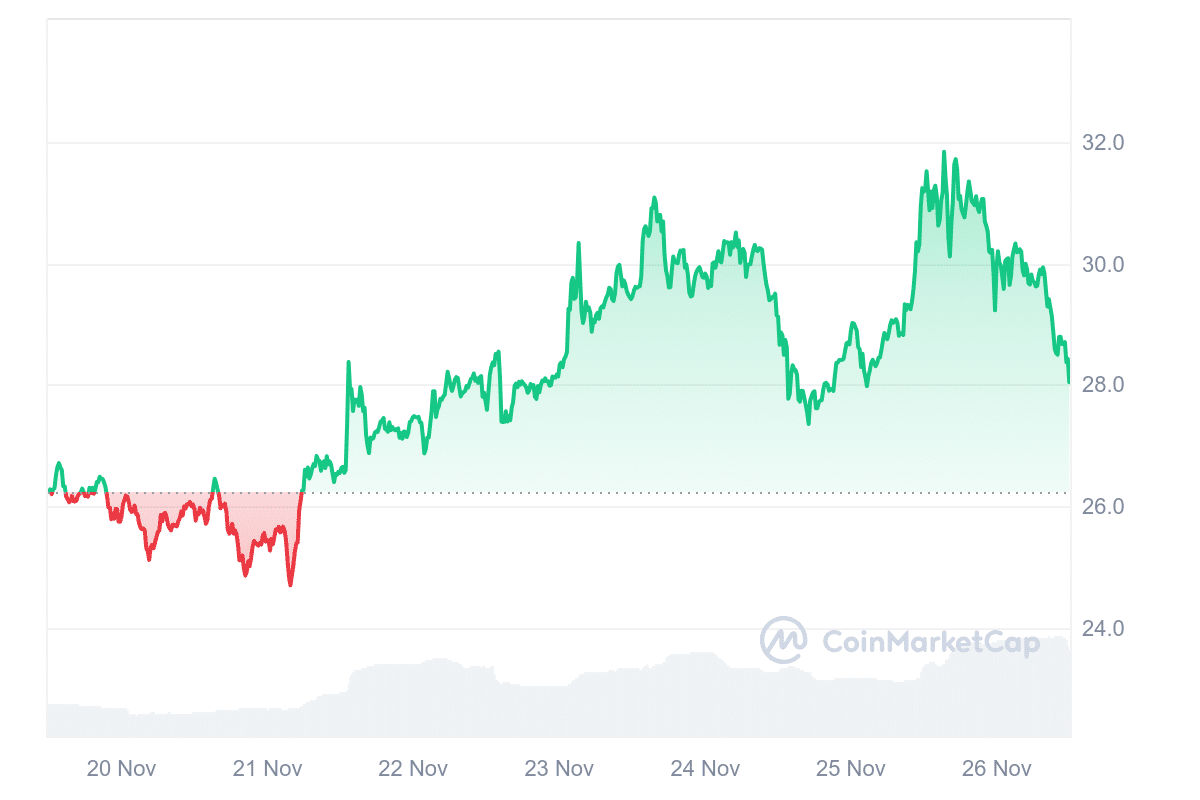

ETC is currently trading at $28.04, reflecting a daily increase of 6.87%. It shows notable market activity, with a 24-hour volume-to-market-cap ratio of 0.4041, suggesting relatively high liquidity. The price is trading 28.38% above its 200-day simple moving average (SMA) of $21.90, indicating strong performance over an extended period.

Additionally, it has seen 18 positive trading days in the last 30 days, which signals a relatively stable uptrend. Technical indicators offer mixed insights. The 14-day Relative Strength Index records 64.96, which is in the neutral range, suggesting the possibility of sideways movement in the short term.

Meanwhile, sentiment around the token appears bullish, with predictions of a significant price increase. Furthermore, according to current trends, Coincodex anticipates ETC may rise by 107.94% to reach $61.70 in the coming month.

3. Flockerz (FLOCK)

Flockerz (FLOCK) has gained significant attention by raising over $3.3 million in its presale. This cryptocurrency introduces a Vote-to-Earn (V2E) model, allowing its community to influence the project’s decisions. Every token holder has equal voting rights through its decentralized autonomous organization (DAO), called Flocktopia.

This system allows members to propose changes or decide on the project’s direction. To encourage participation, Flockerz rewards users who vote with additional FLOCK tokens. This feature aims to boost engagement and foster a sense of collective responsibility among the community. By tying rewards to voting, the project hopes to maintain active involvement in its development.

Currently in its presale phase, each FLOCK token is priced at $0.0061504, and it will be limited in availability as the sale ends soon. Projections suggest a significant return on investment, though potential investors must consider the inherent risks in emerging cryptocurrency projects.

💙This Flock is Strong!!💙

3M raised and counting! Everyone in this flock is why $FLOCK will be the biggest and best community in crypto!

This presale is chugging along at record speeds! Grab your share here: https://t.co/HKN509Un5J pic.twitter.com/N4ObF230ig

— Flockerz (@FlockerzToken) November 23, 2024

This approach to decentralization highlights the growing trend of community-led governance in blockchain, where users play a more direct role in shaping a project. The Vote-to-Earn model represents an innovative use of blockchain technology, merging financial incentives with democratic participation.

4. eCash (XEC)

eCash the Avalanche protocol with Nakamoto consensus, setting it apart from traditional systems like Proof of Work (PoW) or Proof of Stake (PoS) with Masternodes. One notable feature of eCash’s Avalanche integration is the capability to create subnets that operate independently while remaining connected to the main blockchain. These subnets allow for flexibility, enabling protocols with unique rules.

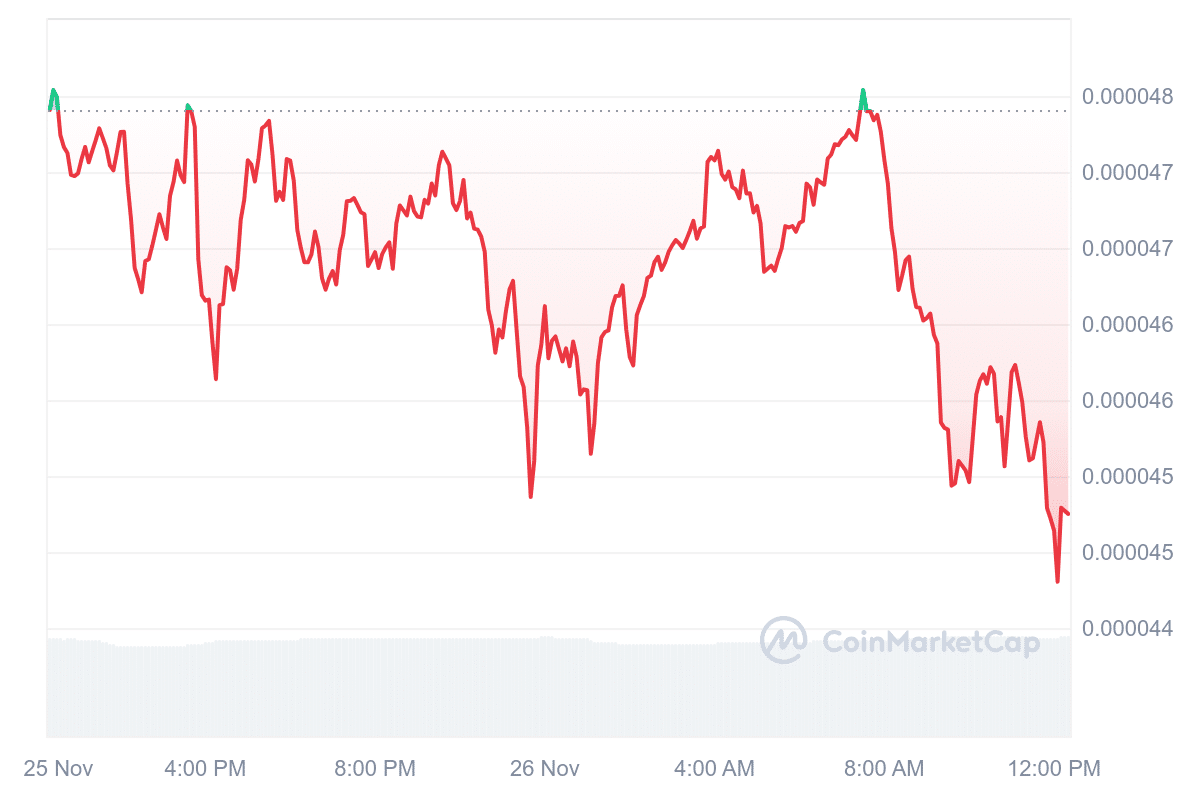

Recent indicators show a positive outlook for eCash. The token trades above its 200-day simple moving average (SMA) by 16.21%, with the SMA value at $0.00003751. eCash has also demonstrated liquidity in the market, with 16 positive trading days out of the past 30, equating to a 53% success rate.

The 14-day Relative Strength Index (RSI) stands at 60.90, suggesting neutral momentum. This could indicate that the price may remain stable or move within a limited range in the short term.

Crypto development is a technological arms race for the defense of personal freedom. eCash $XEC is the technology of financial freedom. That's why we're here. pic.twitter.com/UmFJyVtLmh

— eCash (@eCashOfficial) November 26, 2024

Furthermore, predictions suggest the price may rise next month, potentially reaching $0.00009215. The forecasted range spans from $0.00004671 to $0.000158. Based on current trading levels, this could result in a return on investment (ROI) of approximately 262.77% if purchased at current prices and sold at projected highs.

By the end of the year, analysts predict further growth, with the price estimated to range between $0.000155 and $0.000194. This would represent a price increase of 298.17% compared to current levels. If the average price prediction of $0.000174 holds, the potential ROI could reach 345.24%.

5. Core (CORE)

Core DAO operates as a Layer 1 blockchain designed to work seamlessly with Ethereum’s Virtual Machine (EVM). This compatibility supports Ethereum-based smart contracts and decentralized applications (dApps). The Core blockchain introduces a unique feature: enabling Bitcoin holders to earn returns on their Bitcoin through Non-Custodial Bitcoin Staking.

This approach eliminates the need to rely on external parties or intermediaries. Core DAO is the first blockchain to offer an end-to-end Proof of Stake model tailored for Bitcoin. It combines a Bitcoin yield product with an ecosystem for BTC-based decentralized finance.

Over 18 million transactions have taken place on Core in the last 30 days. 🚀

One of the most active blockchains in the world! 🌎 🔶 pic.twitter.com/dINBNzDty8

— Core DAO 🔶 (@Coredao_Org) November 22, 2024

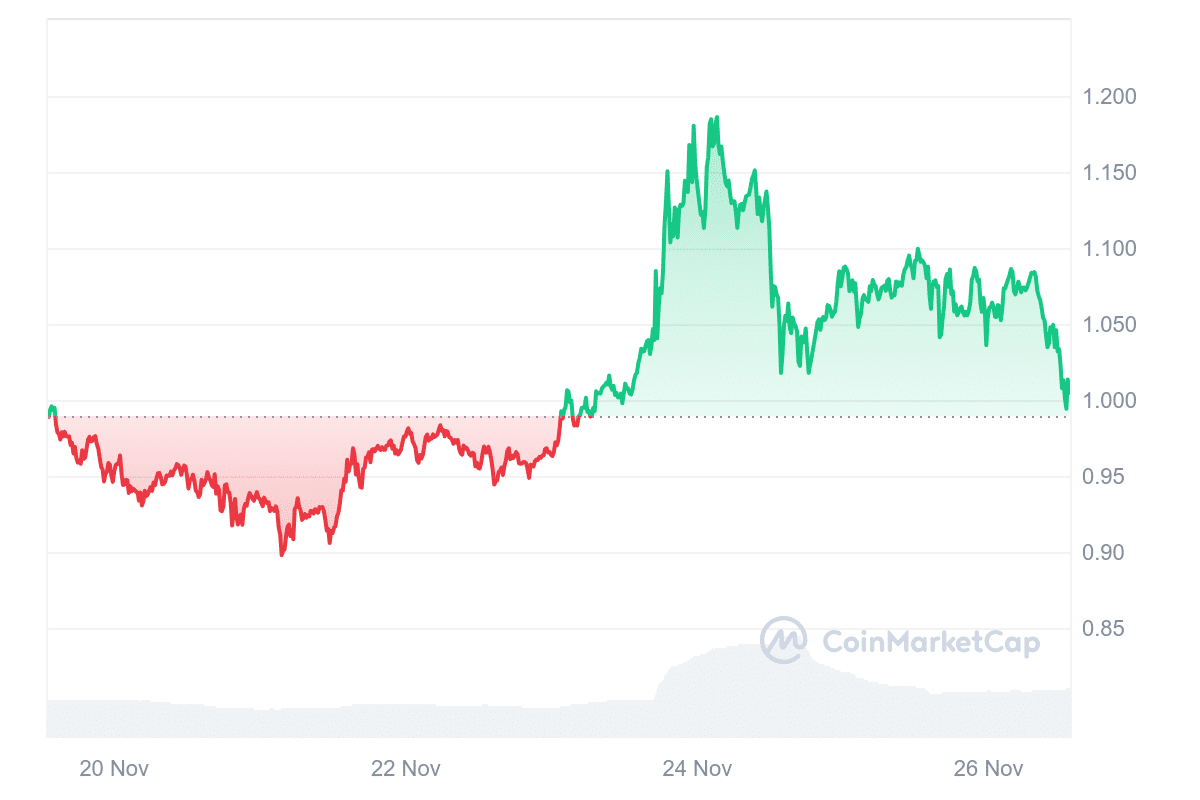

The network’s native token, CORE, recently traded at $1.01, marking a daily gain of 1.92%. Furthermore, CORE is trading significantly above its 200-day simple moving average (SMA) of $0.703124, with a gap of 43.47%.

This suggests positive market momentum. Its 14-day Relative Strength Index (RSI) sits at 55.23, which indicates a neutral stance. The RSI implies the price could move sideways in the near term. Current predictions for the CORE token suggest a potential rise of 227.88%, targeting a price of $3.53 in the next month.

Read More

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage