Join Our Telegram channel to stay up to date on breaking news coverage

InsideBitcoins regularly provides a rundown of the best cryptocurrencies to buy now, taking into account their recent price performance.

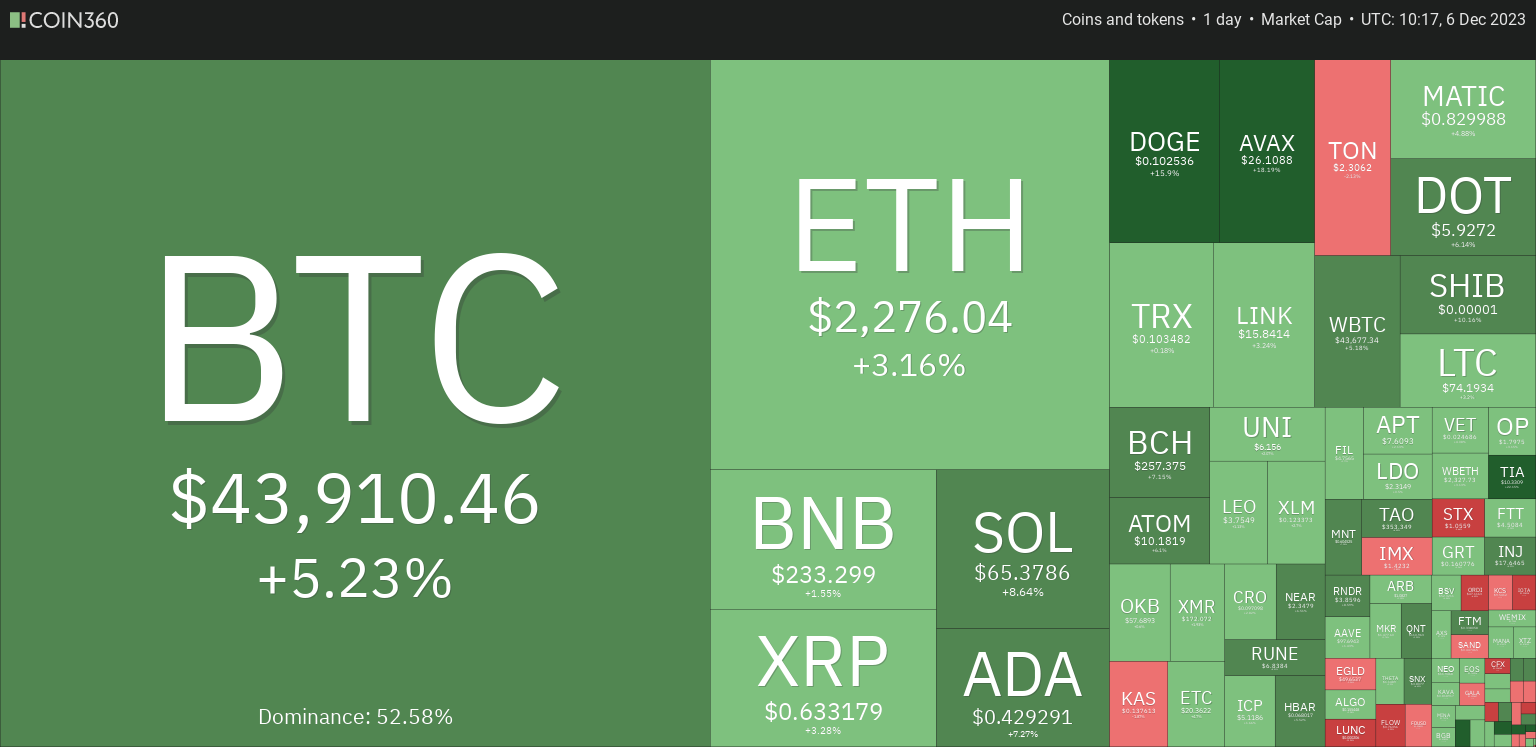

Decentralized Finance (DeFi) accounts for $9.12 billion in trading volume, constituting 10.48% of the overall crypto market‘s 24-hour activity. Meanwhile, stablecoins have emerged as dominant players, commanding a significant share of $76.95 billion, equivalent to 88.50% of the total volume.

Best Crypto to Buy Now

Bitcoin maintains its current dominance of 53.58%, indicating a marginal uptick of 0.47% within the day.

Bitcoin’s incremental increase in dominance underlines its ongoing influence. Yet, the market remains diverse, with various assets contributing to its overall activity. As the crypto sphere undergoes these subtle shifts, market participants observe the evolving interplay between decentralized and traditional elements, shaping the ecosystem’s intricate dynamics.

1. Sui (SUI)

Sui has undergone notable fluctuations in its pricing and market performance. Achieving its peak value on May 3, 2023, at $1.839970, the cryptocurrency’s lowest recorded price is $0.00. Following its all-time high, the lowest observed price reached $0.363263, marking a cycle low. Subsequently, the highest price after this cycle low was $0.688792, indicating a cycle high.

Current sentiment analysis indicates a bullish outlook for Sui Crypto, aligning with the Fear & Greed Index, registering at 72(Greed). This sentiment analysis provides insights into market perceptions and potential investor behavior.

SUI’s circulating supply is 1.03 billion out of a maximum supply of 10.00 billion. This places the cryptocurrency at the 43rd position within the Layer 1 sector. Notably, the project maintains a position above the 200-day simple moving average, indicating a positive trend.

#ICYMI: Sui surpassed $150,000,000 in Total Value Locked (TVL), placing it in the top 20 of all chains listed on DefiLlama! pic.twitter.com/8GUrzXPHUZ

— Sui (@SuiNetwork) December 1, 2023

Additionally, Sui’s performance is underscored by its positive track record compared to the token sale price. The data reveals 16 green days in the last 30 days, accounting for 53% of the observed period. This consistent positive performance suggests resilience and potential stability in the market.

2. Synthetix (SNX)

Synthetix has seen a substantial 94% price surge in the last year. Currently, it boasts a circulating supply of 114.84 million SNX out of a maximum supply of 212.42 million SNX. Hence securing its position at 15th in the DeFi Coins sector and 4th in Yield Farming. It also ranks 33rd in Ethereum (ERC20) Tokens and 7th in Layer 2 based on market capitalization.

On February 14, 2021, Synthetix peaked at $28.63, while its all-time low was recorded on January 5, 2019, at $0.032478. SNX touched a low of $1.400150 and a high of $4.13 in the subsequent cycles. The current sentiment for Synthetix’s price prediction is neutral, and the Fear & Greed Index is at 72(Greed).

Synthetix has surpassed 75% of the top 100 crypto assets in the past year. It is trading above its 200-day simple moving average, reflecting positive performance compared to its token sale price. Over the last 30 days, Synthetix has seen 18 green days, constituting 60% of the observed period. The project also enjoys high liquidity based on its market capitalization.

🔍 Explore Arbitrage Trading with Synthetix Perps!

Our new blog post covers how to arbitrage premiums & discounts for arbitrage in imbalanced markets.

Dive into detailed examples, in-depth explanations, and practical insights for arbitrage strategies. 👇https://t.co/NgtVnBKk8Y pic.twitter.com/PZW8a1hXrp

— Synthetix ⚔️ (@synthetix_io) December 1, 2023

Synthetix’s performance metrics underscore a significant price surge, a resilient market position across various sectors, and positive trading indicators, making it a notable player in cryptocurrency.

3. Polkadot (DOT)

Polkadot is trading above its 200-day simple moving average, showcasing positive performance compared to its token sale price. It presently has a circulating supply of 987.58 million DOT out of its maximum supply of 1.00 billion DOT. In the last 30 days, the coin has experienced 18 green days, constituting 60% of the observed period.

🔹 @Web3foundation's Decentralized Futures Program

🔹 Polkadot referenda & treasury updates

🔹 An update on the @Ledger Generic Polkadot App, and more…Check out today's #PolkadotDigest 👇 https://t.co/FzRWMIJZ7V

— Polkadot (@Polkadot) December 1, 2023

The project’s liquidity, assessed by its market capitalization, is considered high. DOT holds the eighth position in the Proof-of-Stake Coins sector. It ranks eleventh in the Layer 1 sector based on market capitalization. Over the past year, Polkadot has seen a modest 9% increase in its price.

On November 4, 2021, Polkadot reached its all-time high at $54.98, while its all-time low was recorded on August 22, 2020, at $2.82. Following this low, the price at the cycle’s lowest point was $3.59; at its highest point, it reached $5.99. Market sentiment indicates a bullish outlook, complemented by a Fear & Greed Index reading 72, signifying investor greed.

4. yPredict (YPRED)

yPredict’s presale has secured over $5,132,194.85 from a diverse group of global investors, indicating considerable interest in the project. The initiative aims to fund the development of yPredict’s AI-driven Web3 ecosystem, specifically focusing on AI analytics tools for crypto and SEO analysis.

🚀 Exciting News in the Crypto Space! 🌐 Investors are buzzing around yPredict (YPRED) as its presale approaches the finish line, having raised a staggering $5 million! 📈🚀

🤖 yPredict is set to revolutionize crypto analytics, making advanced insights accessible to all traders… pic.twitter.com/P9nr3OGvmx

— yPredict.ai (@yPredict_ai) November 25, 2023

The presale offers 80% of the total token supply, amounting to 100 million YPRED tokens, to potential buyers. YPRED token holders are promised attractive benefits, including quarterly staking rewards of up to 45%, substantial discounts on yPredict’s AI tools, and lifelong free access to the platform’s acclaimed crypto price prediction system.

Currently in its seventh stage, the presale offers YPRED tokens at $0.11 each. Prospective investors must act promptly, as the token price is set to increase to $0.12 once the presale reaches $6,507,551.25.

YPRED token is gaining recognition for its utility in AI, driven by its diverse range of AI applications. The appeal is further enhanced by the generous staking rewards and substantial discounts on yPredict’s tools, creating incentives for token holders to retain their investments.

A noteworthy aspect is the distribution of the token supply, with 80% accessible through the presale, mitigating concerns about potential insider token dumps that could adversely affect the token’s price. The remaining 20% is allocated to liquidity (10%), treasury (5%), and development (5%), establishing a well-balanced tokenomics structure to minimize the risk of unexpected market manipulation within the yPredict ecosystem.

Visit yPredict.

5. Dai (DAI)

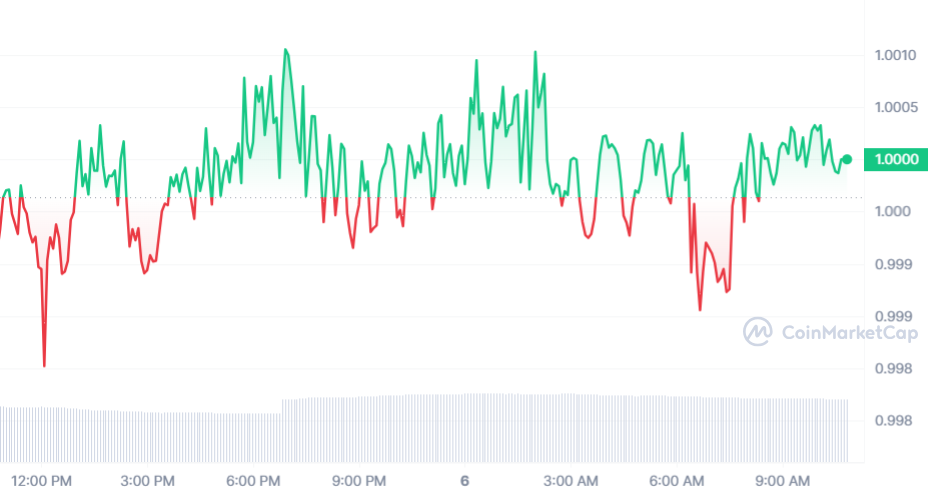

Dai, an Ethereum-based stablecoin, has undergone notable price fluctuations throughout its history. On June 7, 2023, it peaked at $1.136630, contrasting with its all-time low of $0.300344 recorded on January 10, 2018. Subsequently, it experienced a cycle low at $0.977628 and a high at $1.028460.

Presently, the sentiment surrounding Dai’s price prediction is neutral, with a Fear & Greed Index registering 72(Greed). Acknowledging that sentiment analysis is subject to change based on market conditions is crucial. Concerning its circulating supply, DAI has 5.35 billion out of a maximum supply of 5.90 billion in circulation.

The token has demonstrated a negative yearly supply inflation rate of 6.50 %, creating approximately -372.03 million DAI in the past year. Dai has maintained its position within the broader cryptocurrency landscape, ranking third in the DeFi Coins sector and third in the Stablecoins sector. The token also ranked sixth in the Ethereum (ERC20) Tokens sector by market cap.

The token has not exhibited significant price movement in the last year, showing a 0% increase. However, within the last 30 days, there have been 15 green days, constituting 50% of the observed period.

⚡️ @sparkdotfi's borrows reached a new all-time high, surpassing Maker's previous 400-million debt ceiling.

Maker's credit line was doubled to 800 million last week, and the demand responded immediately.

→ https://t.co/2ZIuhRu3bA pic.twitter.com/VK7gU1XzVS

— Maker (@MakerDAO) November 27, 2023

One notable aspect of Dai is its high liquidity, as evidenced by its market capitalization. This liquidity is crucial for its role as a stablecoin, ensuring stability in value and facilitating its use as a medium of exchange within the decentralized finance (DeFi) ecosystem.

In summary, Dai’s performance is characterized by a stable but varied price history, a negative yearly supply inflation rate, and a current market sentiment that leans toward greed. Its ranking in various sectors attests to its standing within the broader cryptocurrency landscape. Investors and observers may find value in monitoring how the token responds to market dynamics and sentiment shifts in the coming periods.

Read More

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage