Join Our Telegram channel to stay up to date on breaking news coverage

Banq, a troubled crypto custodian Prime Trust subsidiary, has filed for bankruptcy in the United States District Court of Nevada. The recent development comes as Banq’s parent company, Prime Trust, attempts to complete an acquisition with BitGo after experiencing a financial crisis due to the Celsius bankruptcy.

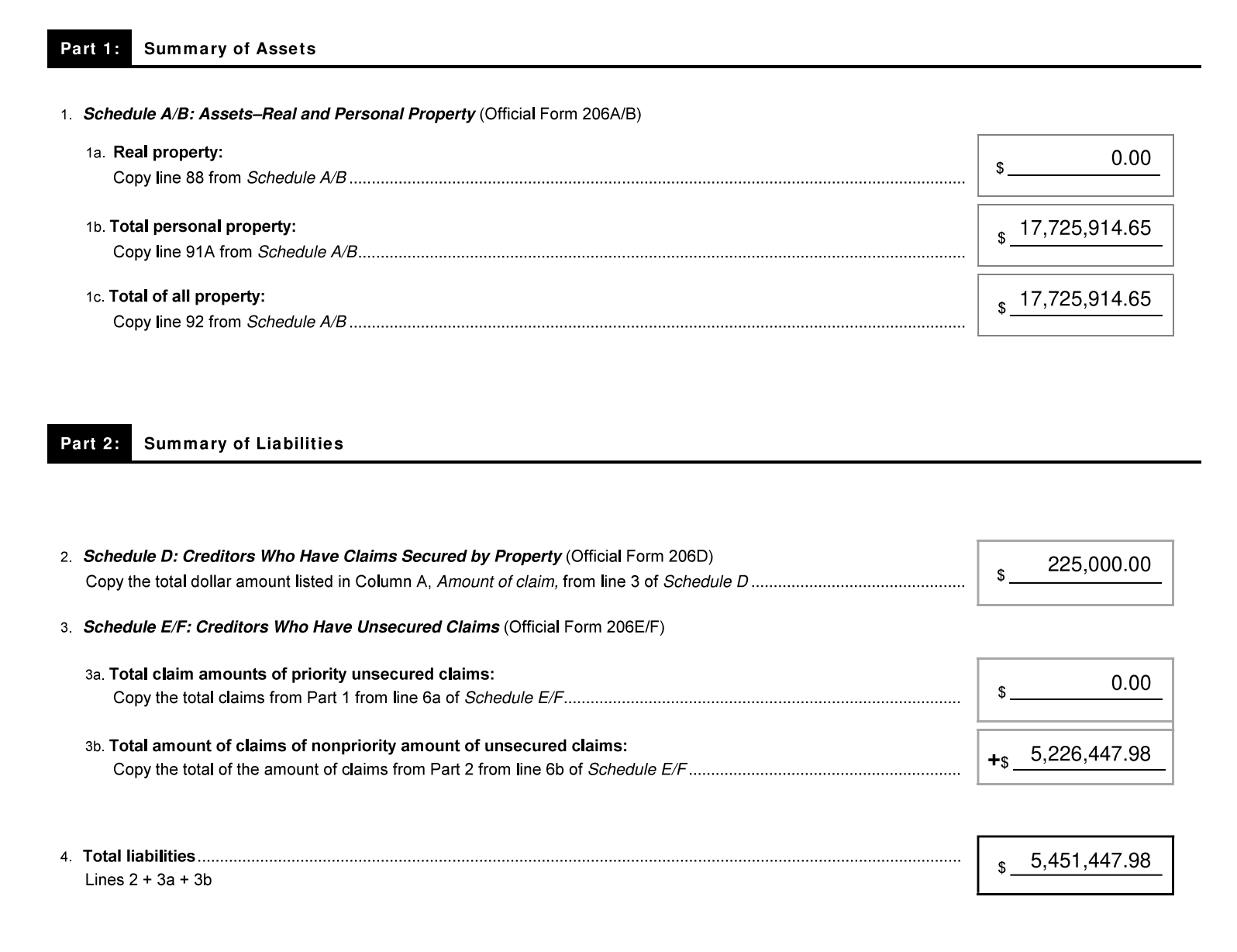

Source: Chapter11Dockets.com

Haru Invest, a crypto yield firm based in South Korea, has also suspended related operations linked to a problematic service provider believed to be either Prime Trust or its bankrupt subsidiary, Banq.

The South Korea-founded and Singapore-based crypto investment platform said:

Recently, we have encountered a particular issue with one of the service partners we have worked with. We are further investigating the case with them and seeking a contingency plan to rectify it.

Further, according to the details on its website, Haru Invest offered yields as high as 50% on crypto and claims to manage assets under $1 billion for over 80,000 individuals globally.

Banq, Powered By Prime Trust

Founded in 2020, Banq provides “mobile SDKs (software development kits) on top of Prime Trust APIs for easy integration of all the crypto and fiat funding services,” according to its website.

In the bankruptcy filing, Banq has assets worth around $17 million and liabilities of around $5 million. The bank’s bankruptcy, however, is partly due to an incident in which former employees acquired over $17.5 million in assets without authorization. The assets contained commercial secrets, classified information, and technology, transferred to Fortress NFT Group, a company founded by Scott Purcell, the platform’s former CEO.

Banq’s former CEO, CTO, and CPO created Fortress NFT Group. Banq has sued Fortress for allegedly obtaining trade secrets to develop competing NFT platforms, Fortress NFT and Planet NFT. Notably, Banq claims that the three engaged in deceptive operations to conceal the wrongdoings.

As per the complaint, the defendants “stole not only Banq’s technology, but also significant other value of Banq’s, and used the purloined property to launch Defendants Fortress NFT and Planet NFT using Banq’s assets, employees, trade secrets and proprietary technology, claiming all of it to be their own.’’

In a lawsuit against the three, Banq claimed that Scott Purcell, its former CEO, intended to steer the company towards NFTs. Purcell and the other defendants in the lawsuit signed arbitration provisions, leading to a judge arbitrating the matter in early 2023.

On the other hand, TrueUSD, which has a banking connection with Banq’s parent company Prime Trust, suspended it’s stablecoin minting and redemptions, citing Prime Trust’s bandwidth concerns. TrueUSD noted:

TUSD mints via Prime Trust are paused for further notification. We, the TUSD team, are diligently working towards resuming TUSD minting on Prime Trust.

Related News

- How Binance CEO Changpeng Zhao Is Picking Winners And Losers In Stablecoins Like BUSD, TUSD

- Justin Sun wants to increase the presence of stablecoins on the Tron network

- Stablecoin Market Continues To Shrink For 14th Consecutive Month, But Whale Accumulation Persists

- Crypto.com Shutting down US Exchange After Recent Regulatory Issues

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage