Join Our Telegram channel to stay up to date on breaking news coverage

In the BITDAO ecosystem, the community drives the project. Therefore, the price performance depends on several human factors but mainly on market sentiment at the leading end of the market. Find below BitDAO price predictions for the coming few weeks.

BitDOA (BIT): Price Predictions

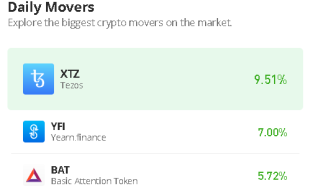

The current BitDAO price is $0.584825, and the asset ranks 45 across the entire crypto ecosystem, according to the latest data. With a market cap of $1,222,837,413, BitDAO has a circulation supply of 2,090,946,169 BIT.

Based on BitDAO’s price fluctuations at the beginning of 2023, crypto experts predict the average BIT rate might close in February 2023 at $0.639936. Prices can be expected to range from $0.579942 to $0.659934 at their minimum and maximum, respectively.

By February 27, 2023, BitDAO’s value is predicted to rise by 9.62% and reach $0.646854. We currently have a bearish sentiment for BitDAO and a greed index of 59. In the last 30 days, BitDAO experienced 19/30 (63%) green days and 4.62% price volatility.

The minimum trading cost for March might be $0.639936, while the maximum might be $0.69993. The value of BitDAO is expected to be around $0.669933 on average. BitDAO price predictions are bearish according to data from February 22, 2023, with 12 technical indicators showing bullish signals and 16 showing bearish signals.

Does BitDAO Offer a Good Investment Opportunity?

Some consider BitDAO one of the most incredible cryptocurrencies of the year. According to the 2023 forecast, the BIT price may reach $0.885554 in the year’s second half. Like other cryptocurrencies, it may rise gradually but not experience sharp drops.

Given expected collaborations and advancements, averaging $0.826517 in price is feasible soon. There is an expectation that the value of BIT could be at least $0.708443 eventually.

The current bearish trend in BitDAO price movements shows the cryptocurrency will continue to suffer price declines. We recommend you do your research before making any investment.

How the BitDAO Ecosystem Works

Cryptocurrency projects often use decentralized autonomous organizations (DAOs) for on-chain governance. DAO systems allow token holders to make key decisions on issues within the network, such as treasury assets and code upgrades.

BitDAO operates under this governance system and doesn’t consider itself a company because BIT token holders control the DAO. No board of directors or employees exists in the BitDAO ecosystem.

Instead, BitDAO users and development teams can suggest collaborations, token swaps, and upgrades. It is up to the BIT token holders to vote on whether to approve or reject the proposed changes.

Founders Fund, Peter Thiel, and Bybit have all contributed to making BitDAO one of the largest DAO networks in the world. By building a network of DeFi, NFTs, games, and DAO projects, BitDAO is creating a permissionless token economy and a transparent financial system.

They will conduct intensive research and fund and potential bootstrap start-ups in the blockchain field as part of their support.

An Alternative to BIT

With BitDAO’s price struggling, traders may want to consider FGHT, the native token of the Fight Out ecosystem. The Fight Out platform is a move-to-earn (M2E) platform that rewards users for completing fitness and health-related tasks.

In Fight Out, an algorithm tracks a user’s daily movement and effort, sleep, and diet via M2E technology. Developers devise training regimens specific to a user’s fitness profile using these tools.

FHGT token has already raised over $4.5 million in its stage 2 presale. Visit Fight Out to learn how to participate in the ongoing presale.

More News

Best NFTs to Buy and How to Buy NFTs

Best DAO Crypto Projects to Invest In

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage