Join Our Telegram channel to stay up to date on breaking news coverage

BitMEX co-founder Arthur Hayes said that risk assets such as cryptocurrencies will crash shortly after the Federal Reserve’s anticipated rate cut later today, the first in more than four years

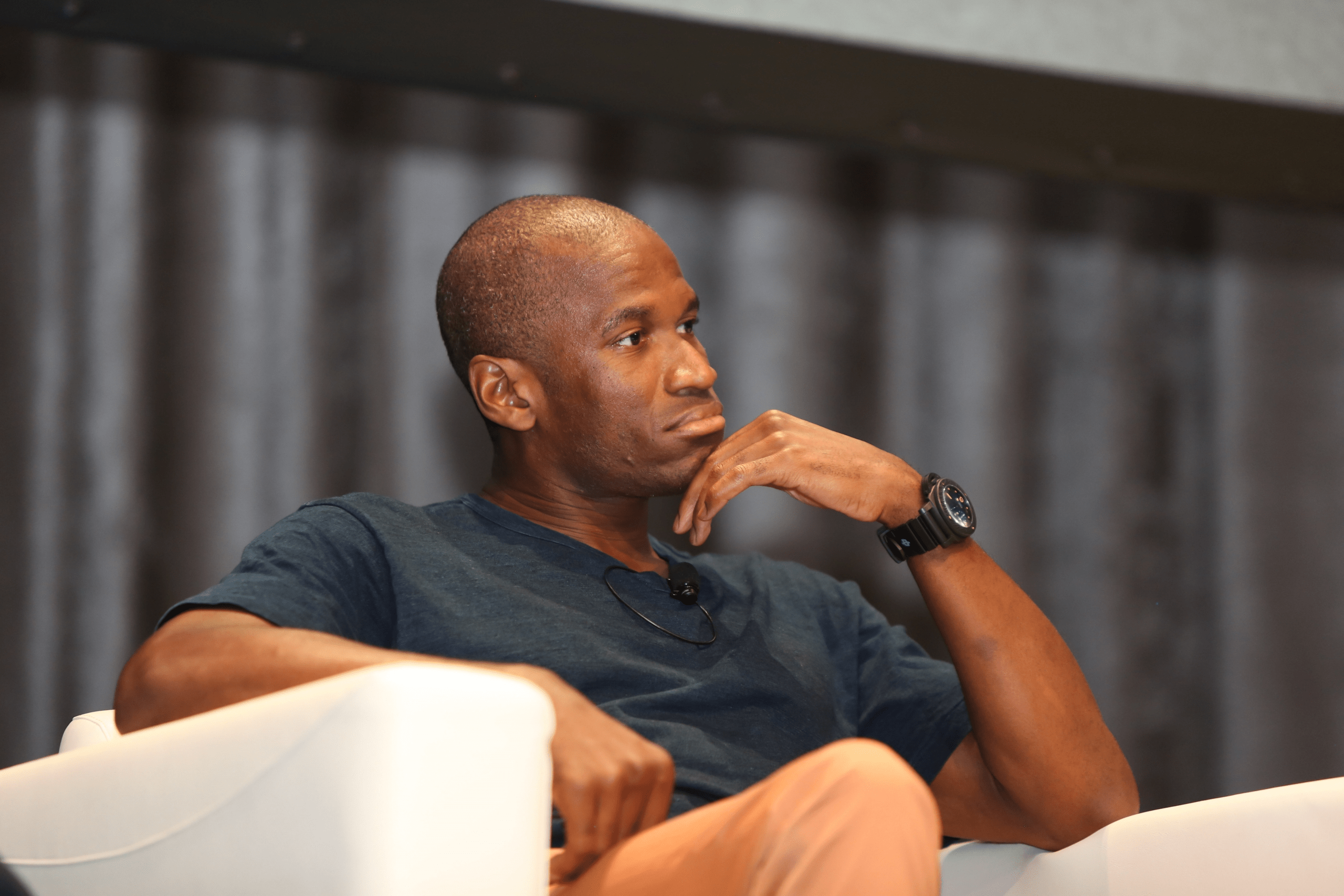

“I think that the Fed is making a colossal mistake cutting rates at a time when the US government is printing and spending as much money as they ever have in peacetime,” Hayes said in a keynote speech at Token2049 in Singapore on Sept. 18. “While I think a lot of people are looking forward to a rate cut, meaning that they think the stock market and other things are going to pump up the jam, I think the markets are going to collapse a few days after the Fed’s rates.”

Arthur Hayes Says Cutting Rates Adds To Inflation Pressure

Cutting rates is a bad idea because inflation is still an issue in the US, with the government being the biggest contributor to the sticky price pressures, he said. Making borrowing cheaper, adds to inflation, he said.

He slammed the Federal Reserve for even considering cutting interest rates amid increased government spending in the US and an uptick in dollar issuance.

Right now: Arthur Hayes on main stage pic.twitter.com/r4Nhs751Q6

— Zach Humphries (@Z_Humphries) September 18, 2024

Hayes warned that many investors and traders could be caught off guard. He believes that an inverse scenario is more likely, and that “markets are going to collapse” in the days after the Federal Reserve’s decision.

Market Could Repeat Yen Carry Trade Crash

Hayes forecasts that an interest rate cut could either be 50 or 75 basis points. Should a reduction of this magnitude happen, it will “narrow the interest rate differential between the US dollar and the Japanese yen,” he said.

The yen could subsequently undergo a sharp appreciation, which could trigger unwinding of the yen carry trade, Hayes said. He warned that the “financial stress” the market suffered earlier this year when the yen went from $162 to $142 in a span of around 2 weeks could be revisited after a rate cut.

Related Articles:

- Best Altcoins to Invest In: Unveiling Top Picks for Maximum Returns!

- Atsuko Sato Meme Coin Surges 483% As Woman Behind Dogecoin And NEIRO Sparks A New Market Frenzy

- Is It Too Late To Buy BOBO? BOBO Coin Price Soars 44% And This Might Be The Next Crypto To Explode

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage