Join Our Telegram channel to stay up to date on breaking news coverage

Back when Bitcoin was launched — nearly 14 and a half years ago now — it was because Satoshi Nakamoto decided that centralized financial institutions cannot be trusted with the people’s money.

The concept of Bitcoin offered decentralization as an alternative, and to this day, the US has been extremely reluctant to accept it.

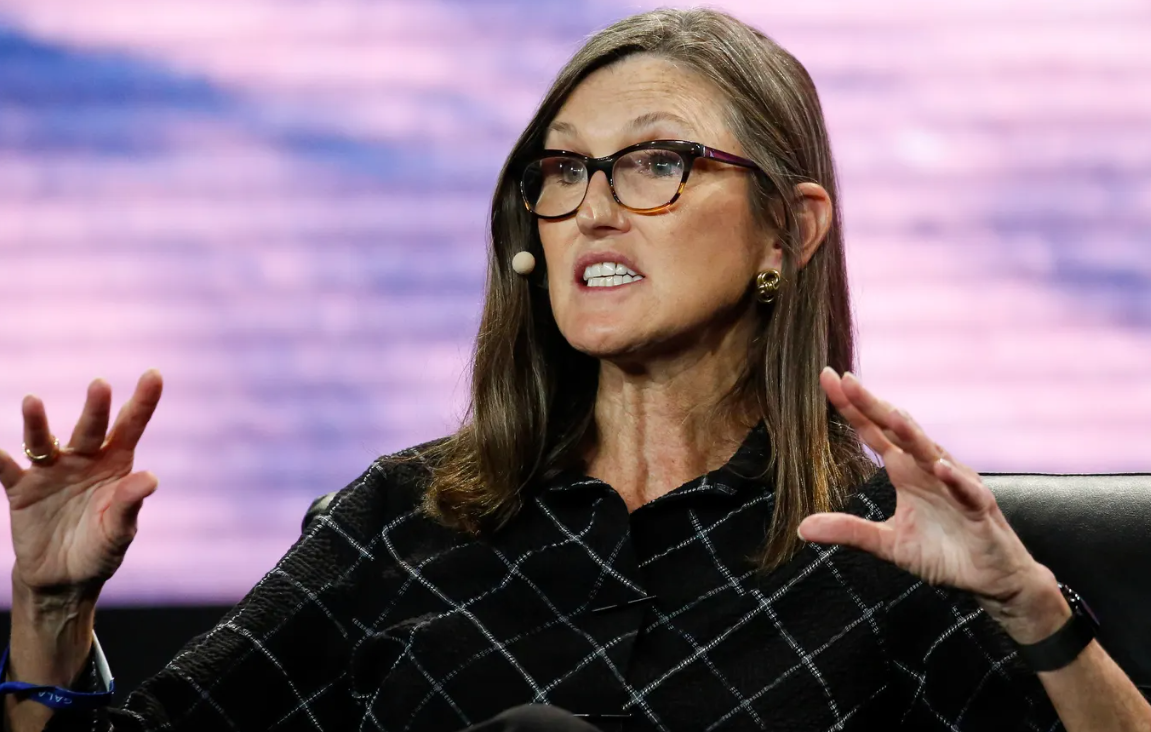

This is why the country still lacks the proper regulations for the cryptocurrency industry, and according to ARK Invest’s Cathie Wood, the US is losing the Bitcoin movement.

Wood, who funded the investment manager ARK Invest, further pointed out the risks of centralization.

She spoke at Fortune’s Most Powerful Next Gen conference last week, stating that the center of gravity of cryptocurrency is moving further and further away from the US.

Meanwhile, the country is not doing anything to establish itself in the crypto sector.

The US is losing the bitcoin movement because of regulation, Cathie Wood has said.

— unusual_whales (@unusual_whales) May 26, 2023

The most recent example of the US missing out on opportunities in crypto is Coinbase’s decision to apply for a license to operate in Bermuda.

With the license already granted, the exchange could decide to move out of the US at any time.

The company is also seeking to establish a presence in Singapore. “It would be nice if the U.S. were leading this movement, but we’re losing it, and we’re losing it because of our regulatory system,” according to Wood.

U.S. is falling behind in the #bitcoin movement: Cathie Wood ?? pic.twitter.com/UvAfTBJ4do

— CryptoSavingExpert ® (@CryptoSavingExp) May 24, 2023

Centralization is the biggest risk in finance

The largest obstacle to the crypto industry’s establishment in the US is considered to be the country’s own securities regulator, the US SEC.

The regulator has insisted that there is no need for a new framework that would specifically regulate cryptocurrencies and that existing laws are more than enough.

Meanwhile, the regulator is filing lawsuits against nearly any crypto business it can get to, including Coinbase and Ripple.

Furthermore, Wood also commented on centralization, which ended up bringing greater risk to the financial industry than decentralization, which the authorities see as chaotic and unlawful.

On the other hand, it was centralized businesses like the crypto exchange FTX, which are collapsing due to corruption, greed, and mismanagement.

As such, they are proving the concept of Bitcoin. FTX is far from being the only example. The US has seen the collapse of multiple banks, including Silvergate, Signature, and Silicon Valley Bank.

According to Wood, these collapses underline that centralization in financial systems is too risky and dangerous and something that Bitcoin is strongly against.

She stressed that the reason Bitcoin even exists is the fact that people lost trust in financial services. The fact that it has grown as much as it did since its launch further confirms this fact.

“And, very interestingly, it took another two crises within the last year to prove the concept. FTX failed because it was centralized, opaque, and not auditable,” she concluded.

Related

- ARK Invest sold over 160,000 Coinbase shares after buying them consistently for months

- ARK Investment to offer 2 crypto strategies for investment advisors

- ARK Invest Bolsters Crypto Confidence on International Workers’ Day: Invests $8M in Coinbase Shares

- Cathie Wood Investment Portfolio

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage