Join Our Telegram channel to stay up to date on breaking news coverage

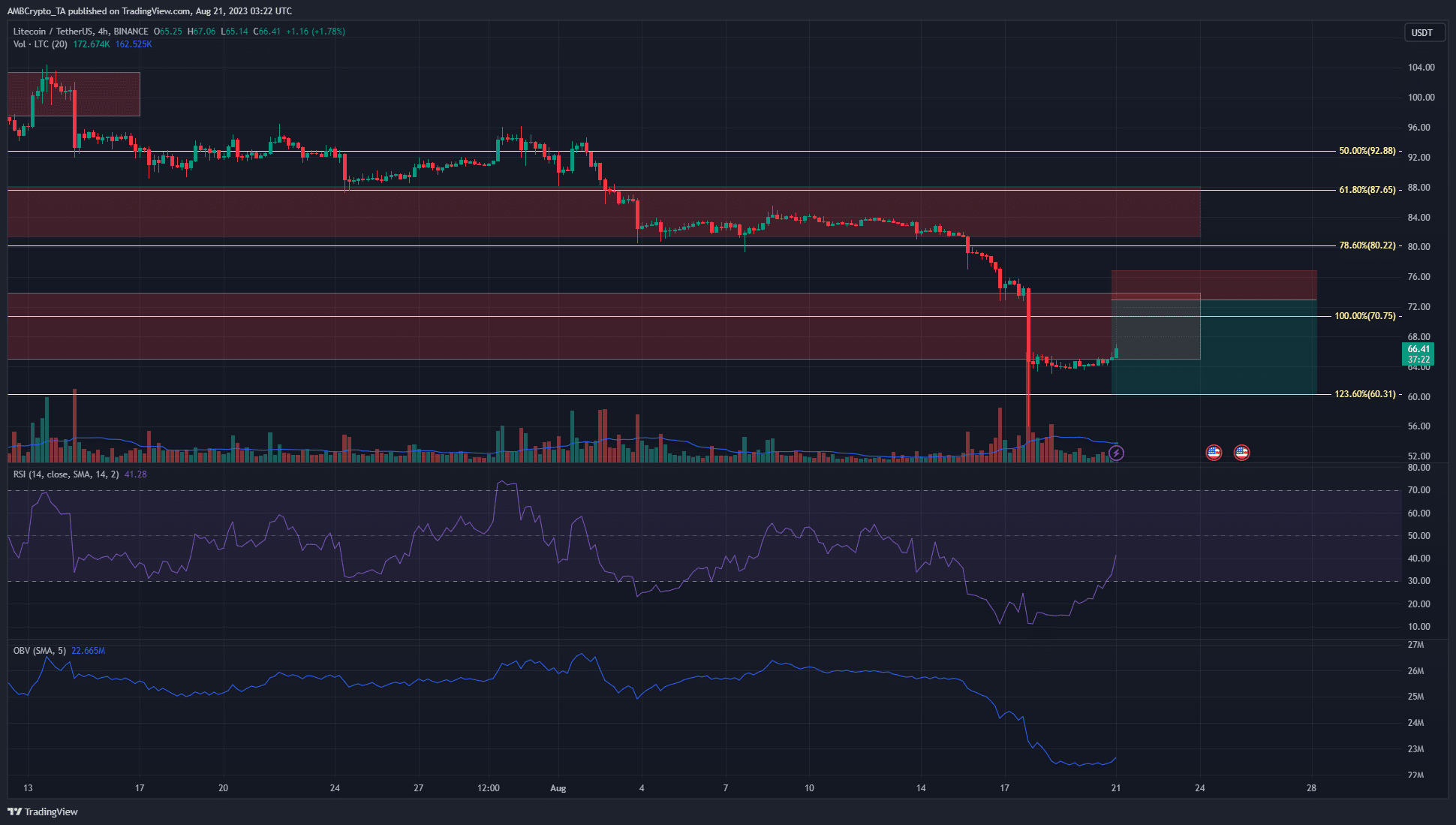

On the H4 chart, Litecoin exhibited a significant price gap (FVG) spanning from $65.97 to $72.79, formed during its swift decline on August 17th. This gap suggested the potential for a rebound towards the $72 mark as the cryptocurrency aimed to bridge this price void.

After Litecoin‘s halving on August 2nd, there was a notable surge in its hash rate, accompanied by a corresponding rise in mining difficulty despite the reduced mining rewards. However, this apparent stability might be poised for a reversal as market dynamics evolve shortly.

The price chart has displayed a bearish trend over the past few weeks. The asset’s decline has breached several crucial support levels that have been integral since July.

As August unfolds, the downward spiral shows no signs of relenting. While the prevailing notion suggests a continuation of this downward trajectory, there remains a glimmer of hope for a potential rebound, possibly propelling the asset toward the $70 mark.

Litecoin’s Fair Value Gap for H4 Could Lead to Higher Prices

The delineation of the resistance zones at $84 and $70 in red on the 1-day chart holds significant historical importance. Once indicative of a bullish order block, these zones transformed as LTC breached them, embodying a bearish connotation. Establishing the $70 zone in mid-March was a pivotal starting point for the subsequent rally, propelling LTC’s price to the $100 mark. This zone shift reflects the cryptocurrency market’s dynamic nature and the strategic levels that traders closely monitor.

Recent days have depicted a clear dominance of sellers in price action. Notably, the utilization of Fibonacci retracement levels unveiled a significant insight – the breach of the 78.6% level from the upward movement paved the way for a probable continuation of LTC‘s downward trajectory.

All signs point towards a potential decline to the 23.6% extension level, directing the course southward with a target of $60.23. This intricate analysis underscores the prevailing bearish sentiment surrounding LTC’s market outlook.

On the H4 chart, a notable Fully Visible Gap (FVG) emerged between $65.97 and $72.79, a void left by Litecoin’s swift decline on August 17th. This gap presented an opportunity for a potential rebound towards the $72 mark, aiming to bridge the price disparity.

However, this ascent might have been temporary, as the likelihood remained that prices could resume their downward trajectory after the gap was filled, reaffirming the volatile nature of the cryptocurrency market.

Sidelined Speculators as Funding Rates Remain Negative

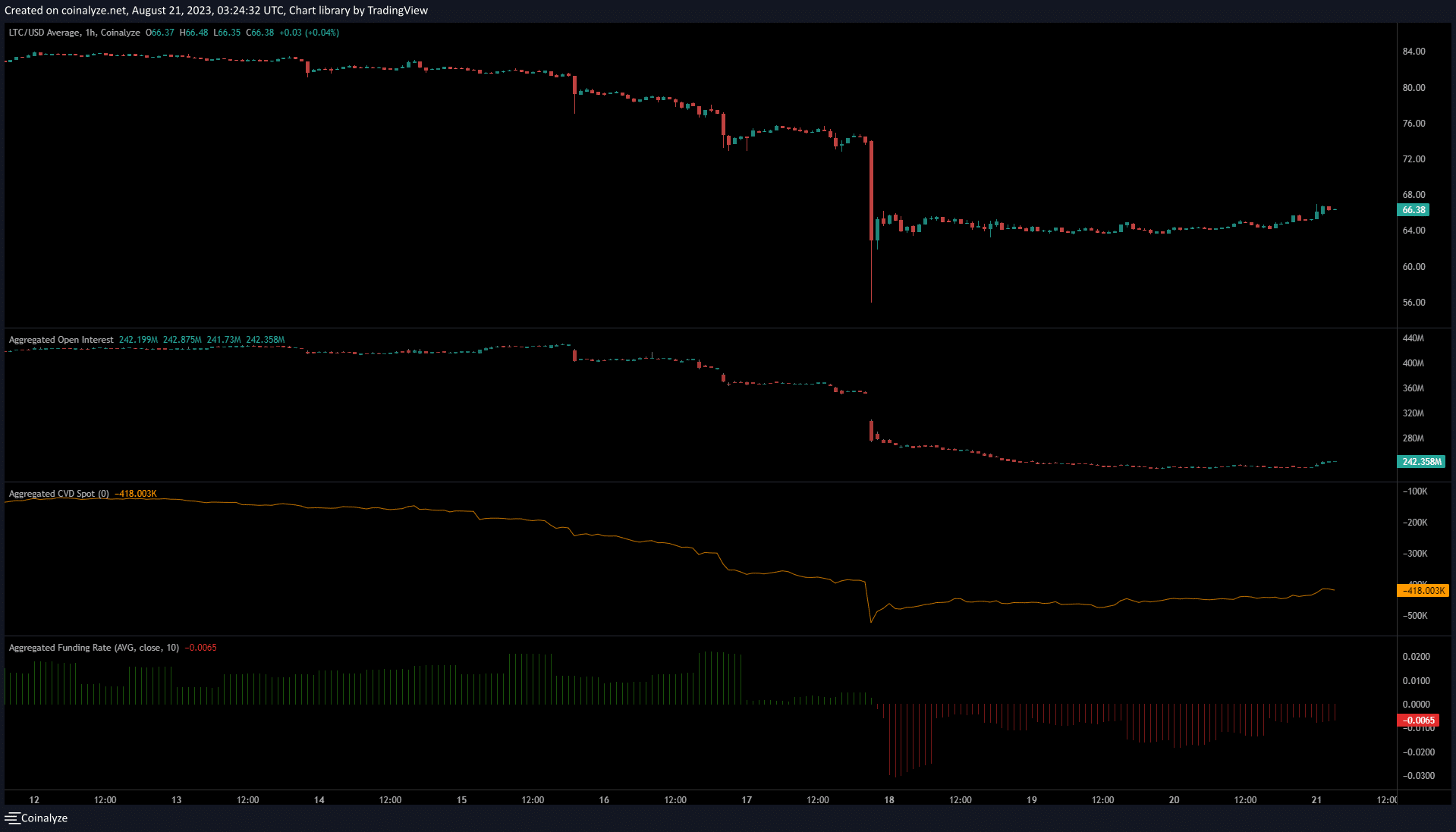

The Litecoin market continues to embrace a bearish sentiment with unwavering conviction. Examining the short-term data provided by Coinalyze over the past few days reveals a persistent trend. Following a sharp decline, the funding rate underwent a notable shift into negative territory, a change that has endured ever since.

This sustained negativity in the funding rate suggests that traders and investors remain cautious, maintaining their skepticism about a rapid recovery. As market sentiment lingers on this bearish spectrum, Litecoin’s trajectory remains uncertain, leaving participants watchful for signs of any potential reversal.

Over the weekend, Litecoin demonstrated a gradual ascent, increasing from $63 to $66.4. Despite this price increase, the Open Interest remained relatively unchanged, failing to reflect a significant upward shift. Recent observations indicate a slight upward movement in the Open Interest over the past few hours, hinting at a minor yet short-term bullish sentiment in the market.

The increasing Open Interest indicates that traders are more willing to hold their Litecoin positions long-term rather than sell at the current price. This suggests that traders believe that Litecoin’s price can increase further shortly, leading to a possible short-term bullish sentiment in the market.

The upward trend of spot CVD indicates increased demand, contributing to a slight influx of capital. However, the combined effect of other factors might fall short of exerting a significant impact capable of disrupting the overall market structure.

Promising Alternative to Litecoin (LTC)

In the dynamic landscape of cryptocurrencies, a swift evolution is underway. Both investors and industry leaders are now shifting their focus toward emerging projects with lower market capitalizations. These ventures, while yet to attain mainstream recognition, offer substantial potential for remarkable returns, enticing those keen to seize the opportunities presented by the evolving market.

Sonik emerges as a rapid-fire meme coin, drawing inspiration from the iconic Sonic the Hedgehog franchise and beckoning with alluring profit prospects. Despite its enticing potential, it’s crucial to note that the SONIK coin is an independent entity, unlinked and unendorsed by the colossal SEGA franchise.

SONIK – The Next Big Meme Coin

In an astonishing feat, the SONIK presale has rocketed past the $260,000 milestone within a mere week of its launch. This remarkable accomplishment serves as a resounding testament to the remarkable enthusiasm that investors have shown for the project. As the broader cryptocurrency market experienced a slight dip, the presale’s remarkable surge emphasizes the coin’s inherent potential for significant performance.

In alignment with the project’s whitepaper, the SONIK team is firmly focused on swiftly attaining a $100 million market cap. The presale of Sonik Coin is amassing funds at a remarkable pace, mirroring the rapid essence of this meme coin.

With a targeted allocation of 50% of the overall supply to backers, an impressive sum of approximately $2.1 million is set to be raised. Consequently, Sonik Coin’s value is $0.000014, presenting a compelling prospect for early investors to seize.

This means that early investors will likely make significant profits due to the low entry cost and the limited supply of Sonik Coin. As the coin gains more traction and popularity, demand will increase, thus driving up the coin’s value. This could potentially result in huge returns for early investors.

This means there is a limited supply of Sonik Coin, which helps drive up its value. As more investors purchase the currency, the demand increases, increasing the coin’s value. This makes it an attractive investment for those who want to get in early and benefit from the potential growth.

SONIK presents a compelling proposition to investors, offering the potential for substantial returns as it gains entry into leading cryptocurrency exchanges. In addition to trading, SONIK introduces a feature that allows users to stake more coins to increase their coin holdings.

By securely locking up their SONIK coins on the stake platform, users unlock the door to rewards and incentives. This dual functionality entices those seeking trading profits and appeals to individuals seeking to grow their cryptocurrency portfolios.

Sonik coin presents a compelling opportunity with its impressive annual percentage yield (APY), aimed at enhancing the ascent of the $SONIK coin’s value. Those who opt to invest can seamlessly engage by staking their coins in the dedicated pool, amplifying their potential earnings.

A substantial 40% of the total coin supply has been allocated to incentivize and reward stakers, a process that will unfold gradually over four years. This strategy promotes active participation and underscores the project’s long-term commitment to its community.

Approximately 90 million $SONIK coins have been successfully staked within the ecosystem, offering stakers an astonishing annual yield potential of up to 26,648%. However, it’s important to note that this enticing rate is poised to gradually decrease as more individuals engage in staking, depositing their coins on the designated savings platform.

To seize this remarkable opportunity, prospective investors are encouraged to explore the project’s official website, where they can conveniently acquire the token using either ETH or USDT, becoming a part of this innovative and potentially lucrative financial venture.

Read More

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage