Join Our Telegram channel to stay up to date on breaking news coverage

The current situation of the cryptocurrency market has been extremely unspeculative. While there are several parties who claim that the price may go up or down, it is evident that the market has been extremely volatile, and has been making unexpected moves in recent days.

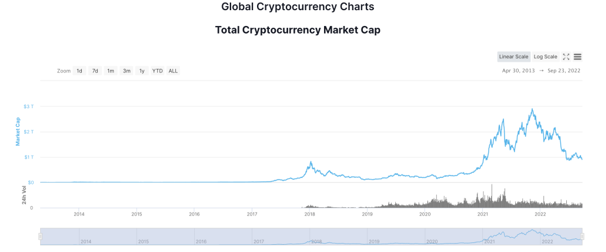

Since the crash last year, BTC, the front-runner cryptocurrency has fallen from its all-time high of around $69,000 to the current trading level of around $19,000. This has not only caused a huge chunk of the investors to pull out their funds and exit the market, but also kill several projects that didn’t promise good fundamentals.

In short, while the major cryptocurrencies or those which boast of actual value have been thriving, many others have been struggling to sustain their ecosystems due to low investor interest leading to liquidity issues. There have been several other factors too, which have acted as a catalyst for the price being on a downtrend.

This, however, hasn’t stunted the growth of cryptocurrency awareness among the people. The industry which was barely recognized as something one could participate in once is now a trillion-dollar sector with a massive community. Amidst all that has been happening in the space, analysis and reports of investors and their behaviour is being tracked by several companies to gather data to speculate prices.

A recent study by Pew Research found that while there has been a slight increase in the number of people who participate in the blockchain sector, many are currently dissatisfied with their returns.

16% of Americans are active investors in the industry

The survey conducted and presented on the website by Michelle Favario and Navid Massarat was published on 23rd August this year. While an overall awareness and sentiment-based view on cryptocurrencies were positive, it was seen that in terms of price and return on investments, many were left unsatisfied.

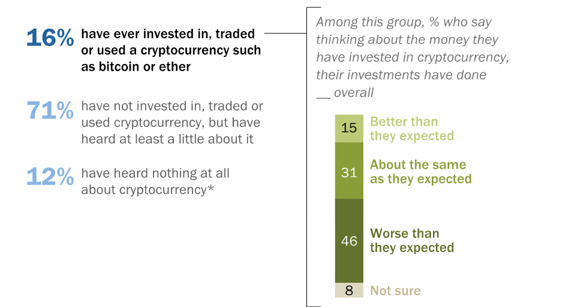

It was found that on average, 16% of American investors invested or traded in cryptocurrencies. While 71% had some sort of awareness about the concept, the remaining 12 were completely unaware of it. The survey was conducted by the research team between 5th and 17th July this year.

It was also seen that of the 16% who invested or participated in cryptocurrencies, 46% had seen their assets perform worse than expected. 15% stated that it performed better, while 31% expected the price to be where it was. The remaining 8% of people weren’t sure about their response.

The study also explored other aspects, like the reason for investing in cryptocurrencies. Among the 16%, most of the people stated that the main reason for them investing in these digital assets was to either ‘explore a different investing option’ or ‘as a good way to make money’. Other responses included ease to invest, confidence in the asset class over others and wanting to become a part of the community.

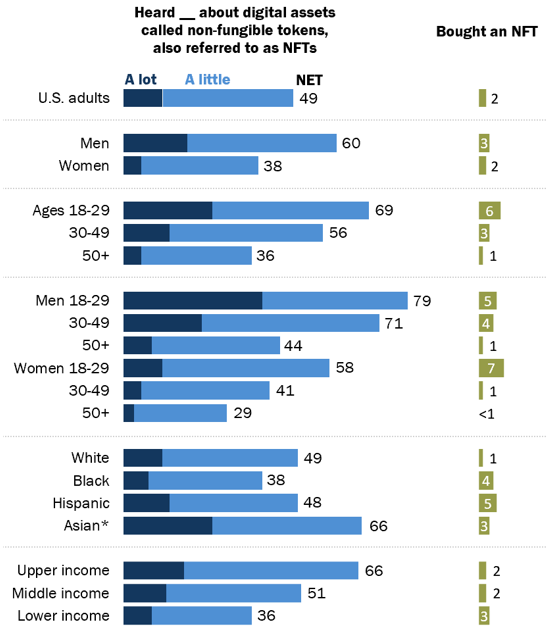

The published article also mentioned data from their 2021 study, which showed that men aged between 18-29 had much more exposure to cryptocurrencies than women of the same range, who stood at around 17%. While there is a disbalance between men and women in terms of participation in the industry, the same can also be said with respect to cultures.

One in five Black, Hispanic, and Asian Americans has invested in, traded, or used a cryptocurrency, compared with 13% of White Americans. However, it was noticed that income didn’t exactly affect participation in the blockchain.

The survey also explored the awareness of NFTs or Non-Fungible Tokens among the general public. Although NFTs were immensely popularised in the past couple of months and were likely advertised on almost every social media platform heavily, the awareness for the same seemed to be very low.

While 49% of the American respondents stated that they had at least heard about the asset, only 2% had actually dealt with them. Only this 2% claimed to have been holding these popular virtual assets.

How can this affect the cryptocurrency industry?

Contrary to belief, it can be seen that the awareness of cryptocurrency; while definitely being propagated is yet to have any actual impact. People who are aware of the asset class too have been refraining from investing in them due to the bearish sentiments.

The data presented in the study shows that there is an inherent interest in the technology. But the age and gender barrier needs to be overcome to pave the way for cryptocurrency to become an asset class that can be invested in by everyone. At this stage, where the entire blockchain sector is still in its infancy, it cannot accurately be speculated as to how long this might take.

This too might eventually happen though, since cryptocurrencies are now being embraced by major institutions as well. Previously, they were only endorsed by celebrities in the entertainment field or similar influential figures. But with major banks and financial institutions joining the sector it is likely that investment opportunities and the number of investors too, will increase considerably in the coming days.

At the time of writing, the cryptocurrency industry has a market cap of around $937 billion, much lower than its all-time high of more than $2.9 trillion back in November 2021.

Read More

Join Our Telegram channel to stay up to date on breaking news coverage